Bloomberg’s Evening Briefing Asia will resume publication on Dec. 27.

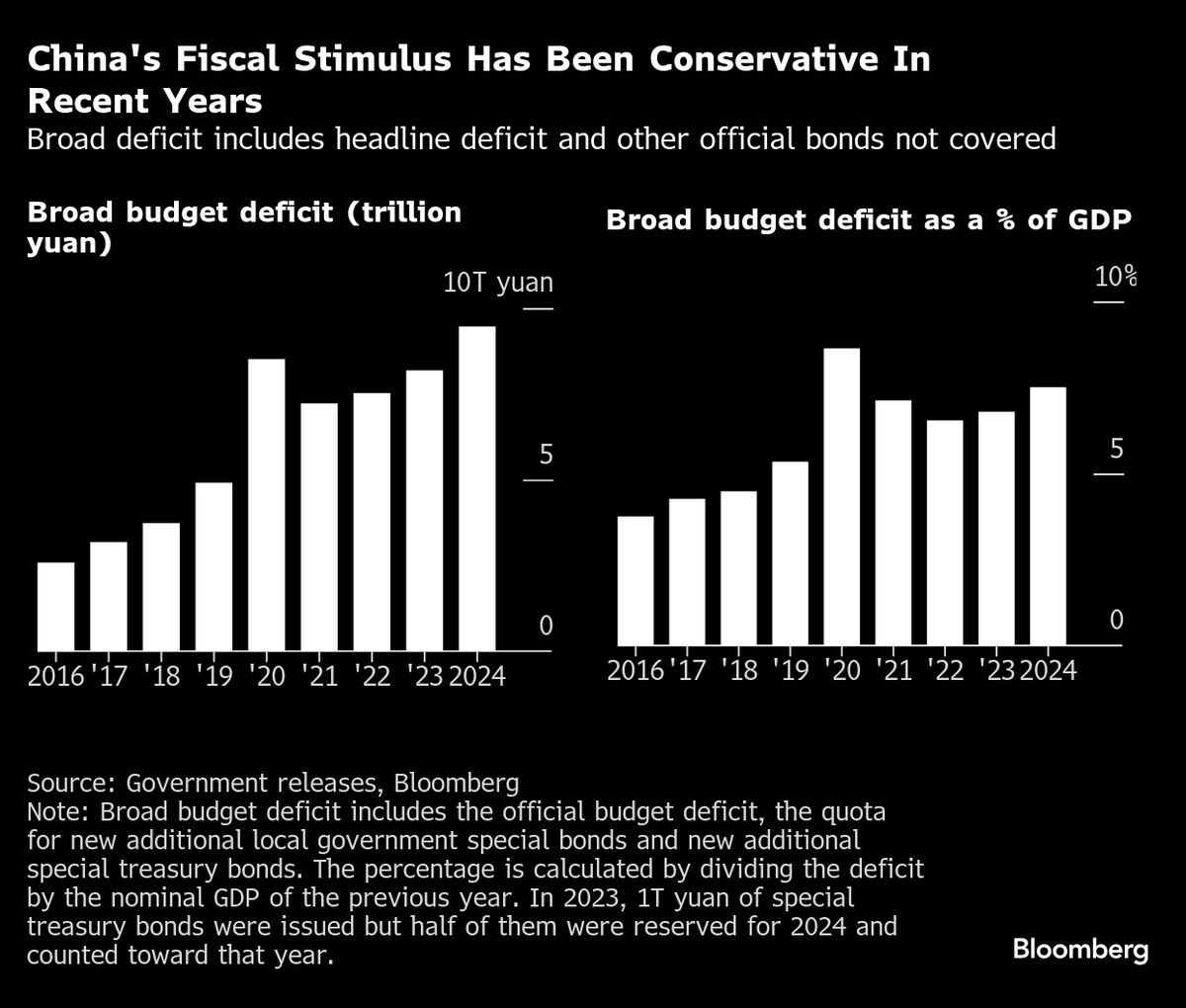

The story that has dominated Asian financial and economic news in 2024 remains the hot topic for market watchers as we head into the new year. China’s finance ministry reaffirmed it will increase public spending with a greater focus on boosting consumption to support the economy next year, ahead of growth headwinds from looming US tariffs. This came in a statement published Tuesday following a two-day national conference held by the Ministry of Finance on fiscal work in 2025. Hopes for greater fiscal stimulus to shore up the world’s No. 2 economy got a further boost with a report that policymakers plan to sell a record 3 trillion yuan ($411 billion) of special treasury bonds in 2025. Funds raised from the bonds will be used to support consumption subsidies, business equipment upgrades as well as investments in key technology and advanced manufacturing sectors, according to Reuters, which cited unnamed sources. Some of the proceeds will also be used to inject capital into large state banks, it said.

Until the promised stimulus arrives, China’s real estate woes look set to get worse before they get better, raising the prospect of a miserable year for property shares despite a recent bounce. Developers in the country are still suffering from a yearslong slump that has sapped the confidence of potential buyers, caused a sharp decline in house prices and left millions of homes unfinished. Economists think both home prices and sales in the country will fall next year. The best they can say: The decline may be slower than it was in 2024. On the flip side, China’s wild markets have sent trading of derivatives in Hong Kong to a third record year.