Market snapshot at midday

- ASX 200: -0.4% to 8,812 points

- Australian dollar: -0.2% to 66.0 US cents

- Nikkei: -1.1% to 44,430 points

- S&P 500: +0.4% to 6,688 points

- Nasdaq: +0.3% to 22,660 points

- FTSE: +0.5% to 9,350 points

- EuroStoxx: +0.5% to 558 points

- Spot gold: +0.2% to $US3,866/ounce

- Brent crude: +0.1% to $US66.18/barrel

- Iron ore: +0.1% to $US103.85/tonne

- Bitcoin: -0.2% to $US114,463

Prices current around 12:22pm AEST.

Live updates on the major ASX indices:

Midday market update

The local share market is still slightly down in the middle of the trading day.

The ASX200 is down -0.3% to 8,820 points, while the broader All Ordinaries index is down -0.27% to 9,111 points (as at 12:43pm AEST).

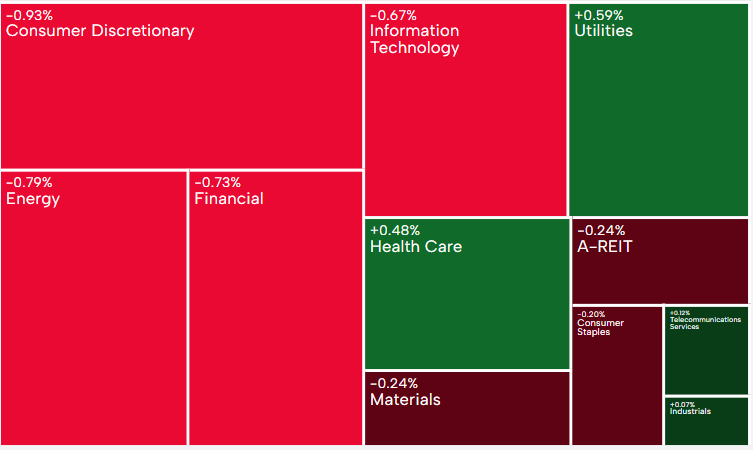

7 of the 11 sectors are lower today, with utilities currently the top performing sector, rebounding from its recent decline.

Consumer discretionary, energy, and financials are dragging the market down today.

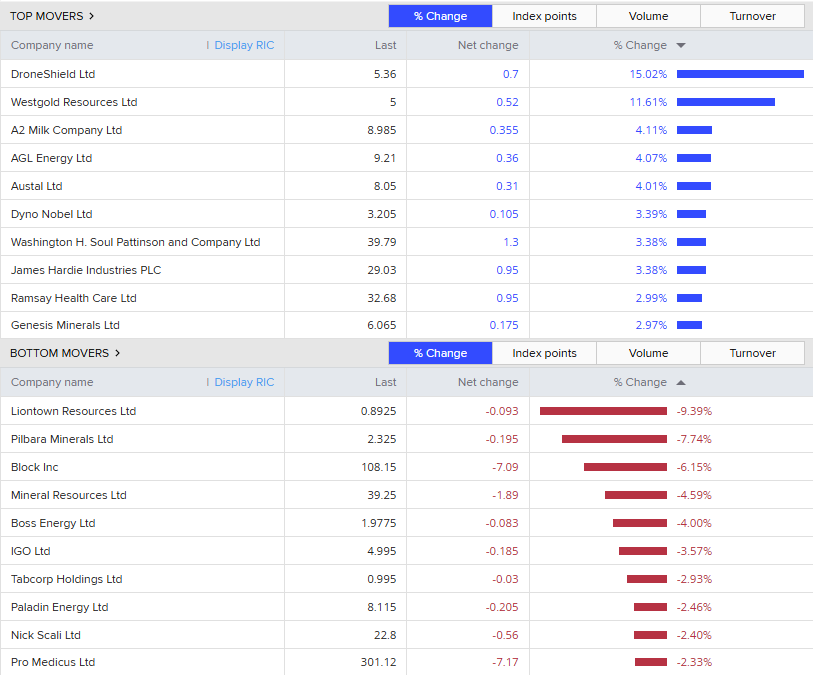

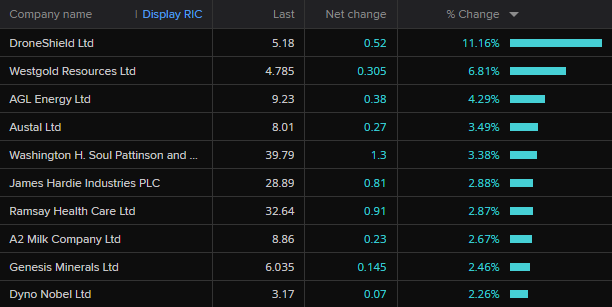

DroneShield continues its winning streak this week, up 15%.

Followed by Westgold Resources, up 11.6%.

The worst performing stocks are Liontown Resources (-9%) and Pilbara minerals (-7.7%).

The Australian dollar is also lower, buying 65.95 US cents.

Gas supply outlook eases in 2026

Gas supply on Australia’s east coast is expected to ease in the first quarter of 2026, according to the latest gas inquiry report by the ACCC.

It’s an improvement from the June outlook, which predicted a shortfall in gas by the end of this year.

A gas supply surplus of between 2 -24 petajoules is expected for the east coast.

However, the outlook still depends on how much uncontracted gas LNG producers decide to export.

The total amount of gas secured under long-term supply contracts remains below pre- 2022 levels.

The Australian government is currently conducting a Gas Market Review which will examine current regulations.

Beijing is exerting control over private companies

Beijing has been trying to exert more power on the way iron ore is managed, says Director of Iron Ore Research Philip Kirchlechner.

He says it’s led to increased tension between private companies and Beijing in recent months,

“Since Xi Jinping came to power, he would like to increase the power the central government has over the economy and in particular its industries. Whether these industries are private or not, he likes to exert control.

“But people need to realise that doing deals with countries that have a very restrictive political system, there’s always a risk.”

He said it isn’t just BHP that is affected by threats.

“It’s clear that tensions have risen, but in the end, China needs the iron ore.”

“No other country is even near China in the size of its steel industry and its requirement for iron ore.

It’s currently a national holiday in China, and he said most of the purchases were done before the steel mills go on break.

But Mr Kirchlechner expects the “cat and mouse game” to resume after the holidays.

When it comes to business, size does matter

Governments should focus their support on new businesses, regardless of their size, rather than subsidising small businesses, a new report finds.

The research, released by the e61 Institute, has said that young firms — operating for five years or less — have been Australia’s dominant positive economic contributors over the past 15 years.

New firms in their first year of business activity generate 22% of new jobs, with just over 5% of employment.

My colleague Yiying Li has more on this story.

A reminder of who’s in control: analyst

After slumping at the open of trade, shares in BHP Group have stabilised a little.

At 11:30 AEST the stock is still down 1.4% though.

Henry Jennings is a senior portfolio manager with Marcus Today.

He’s told the business blog the markets decided this is a negotiating tactic and nothing more.

“This is temporary and clearly a negotiating tactic.”

“China just want to remind them who drives the price,” he said.

Australia’s first free trade agreement with the Middle East

Australia’s free trade agreement with the United Arab Emirates has come into effect today.

It’s the first free trade agreement Australia has signed in the Middle East.

“The UAE represents an important trading destination for our exporters and importers as it rates in the top 20 of our trading partners,” said the Australian Chamber of Commerce and Industry’s CEO Andrew McKellar.

“It is an important regional and global hub for transport and logistics, the services sector and goods trade.”

Mr McKellar says it creates new opportunities for Australian business to expand trade and investment linkages.

Cup Day cash rate cut a drifting favourite?

Bendigo Bank has joined the chorus of economists who are questioning the timing of the next interest rate cut.

It follows the Reserve Bank’s decision to keep interest rates on hold yesterday at 3.6%.

“Our forecasts are unchanged for a ‘shallow’ RBA easing cycle back to a more neutral rate around 3.25%, but the timing of the next cut is under question,” said chief economist David Robertson.

The monthly August inflation figures plus sharp rises in other key categories has sent mixed signals, meaning a cup Day cut on November 4 remains a popular but drifting favourite, he says.

“The full quarterly CPI numbers out on October 29 will the key event to verify this timing,” he said.

“So barring a significant jump in core inflation, the easing cycle should continue. But it’s a complex environment.”

Rio Tinto’s Gladstone power station to retire early

Mining giant Rio Tinto will close Queensland’s largest and oldest coal-fired power station six years earlier than expected.

The Gladstone Power Station was set to close in 2035, but now could close as early as 2029.

Workers at the station were notified this morning.

The announcement is drawing mixed reactions from industry, politicians and the community.

Rio Tinto shares are up slightly by +0.3% in early trade.

Live blog

ABC proof reading is diabolically bad these days, i.e.:

BHP shares dripped in London overnight– Nicky

Hi Nicky, thanks for the feedback, we’ll fix that.

But just so you know, this is a live blog, so the posts are not proof read before publication.

If we did that it would be a 15-minute delayed blog, not a live one!

This is a pretty good impression of me this morning trying to cover the markets and BHP news while sitting through editorial meetings.

Loading

Market snapshot

- ASX 200: +0.1% to 8,856 points

- Australian dollar: -0.1% to 66.05 US cents

- Nikkei: -0.7% to 44,636 points

- S&P 500: +0.4% to 6,688 points

- Nasdaq: +0.3% to 22,660 points

- FTSE: +0.5% to 9,350 points

- EuroStoxx: +0.5% to 558 points

- Spot gold: +0.1% to $US3,862/ounce

- Brent crude: -0.1% to $US65.99/barrel

- Iron ore: +0.1% to $US103.85/tonne

- Bitcoin: -0.4% to $US114,243

Prices current around 10:55am AEST.

Live updates on the major ASX indices:

Australian government appears to confirm some sort of Chinese ban on BHP iron ore

Along with the Prime Minister, Treasurer Jim Chalmers has also weighed into the China-BHP issue, calling the reports of the ban “concerning”.

It would be unusual to see such strong statements from the government if there was absolutely no problem with BHP’s current iron ore contract negotiations with Chinese buyers.

Mr Chalmers said he would set up a conversation with BHP chief executive Mike Henry about the issue.

“Ultimately though, they are about the commercial arrangements between two companies and so in one respect, it’s a matter for the company to work through,” he said.

“I’ll have discussions with Mike Henry about that in due course when we can set that up.”

The ABC’s Canberra-based foreign affairs correspondent Stephen Dziedzic has more.

ASX flat as BHP weighs

The Australian share market is lower in early trade, dragged down by a moderate fall for mining giant BHP.

The company’s iron ore has reportedly been temporarily banned by China’s state-controlled purchaser amid a pricing stand-off during contract negotiations, although there are conflicting reports.

The Australian mining giant said it does not comment on contract negotiations, however the Australian Prime Minister and Treasurer have both said the reports are concerning and they want to see any dispute resolved quickly.

BHP shares were down 1.7% to $41.83 by 10:28am AEST.

Fortescue shares were up a similar amount, amid hopes it could benefit from any stand-off between Chinese steel mills and BHP, while Rio Tinto was up 0.2%.

Elsewhere on the market, three of the big four banks and Macquarie were down, but CBA was up 0.2%.

Overall, 106 of the top 200 companies were trading down, while 83 were higher.

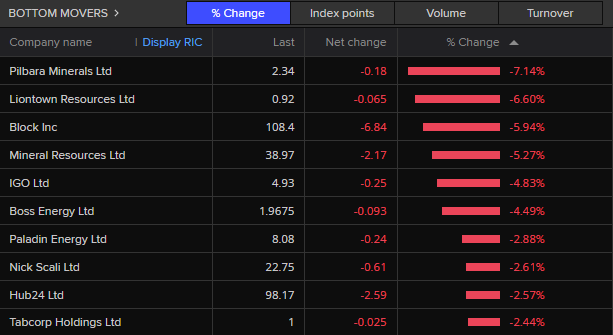

A couple of lithium miners were leading the losers.

While DroneShield continued its boom this year, amid numerous security incidents in Europe that are boosting interest in its defence systems.

Overall, the ASX 200 index was flat at 8,849 points by 10:35am AEST.

The Australian dollar was down 0.1% at 66.03 US cents.

BHP share price falls deepen

BHP shares are down 1.9% to $41.72 after 20 minutes of trade.

That’s a bit over $4 billion wiped off the market value of the company this morning amid reports Chinese steel mills have been told to temporarily stop buying BHP iron ore.

If the reports are correct, then Chinese steel mills will be looking for extra supply from elsewhere.

Rio Tinto shares are up 0.3% and Fortescue up 1.7%.

BHP iron ore supply ‘irreplaceable’ for China

I’ve just received a very interesting analyst note from Kaan Peker at RBC Capital Markets.

He isn’t too worried about the apparent temporary ban on BHP iron ore purchases, suggesting that China is very vulnerable to that supply being cut off for any extended period.

“While headlines read negative, we view this as a neutral event,” he notes.

“We view this ‘ban’ as more of a negotiating tactic, most likely an effort to secure lower long-term prices.

“On government instructions steel mills could try to offset BHP volumes via Fortescue, RIO, Vale, domestic ores, or stockpiles, but in aggregate it would be at higher cost and efficiency loss and this would be at the margin (competitors could currently only absorb a very small portion of BHP’s volumes).

“The ban would likely increase pricing power of other competitors (Vale, Rio Tinto, Fortescue), as they know steel mills are desperate for feed. Iron ore prices are already elevated (+$US100/t) as the market is tight (despite seasonally weak Chinese construction demand), which would likely see competitor products trade at a premium (particularly for Vale and Rio to offset BHP high-grade blends).”

Mr Peker says BHP’s output is simply too crucial for Chinese steel production to be sidelined.

“BHP’s ore (Jimblebar, Newman and MAC) is good quality and balance sinter chemistry. Chinese steel mills would lose blending flexibility, resulting in lower feed grades, higher impurities leading to productivity losses and higher coke rates,” he explains.

“This means that Chinese steel mills must accept higher costs and lower steel margins.

“Ultimately, if prolonged, the ban risks squeezing steel margins or forcing selective output cuts (& higher steel prices with ripple effects into construction costs, autos and infra), but China cannot realistically walk away from BHP supply altogether. 55-65% of BHP’s iron ore sales are to China (RBCe 290Mt in FY26), this equates to roughly 160-190Mt of iron ore to China (~16% of Chinese imports). This would suggest 11% of China’s steel output would be at risk (or 110-115Mt). Hence, we view BHP’s iron ore supply as structurally irreplaceable.”

BHP shares fall 1.1% at the open on reports of China iron ore ban

BHP shares dropped 1.1% to $42.05 at the open of trade on the ASX amid reports that China has temporarily banned imports of its iron ore.

These reports appeared to receive some confirmation from the Australian prime minister when he told reporters that he hoped the contract pricing dispute would be resolved quickly.

Australian prime minister says any Chinese ban on BHP iron ore ‘disappointing’

While doing a press conference on housing, Prime Minister Anthony Albanese was asked about reports that China’s state-controlled iron ore buyer had issued a directive for steel mills temporarily not to buy from BHP, amid a stalemate in contract negotiations.

“I am concerned about that and what we want to make sure is that markets operate properly,” he responded.

“Of course, we have seen those issues in the past. I want to see Australian iron ore to be able to be exported to China without hindrance. That is important, makes a major contribution to China’s economy but also to Australia’s.”

Mr Albanese went on to say:

“These measures are always disappointing.

“Let’s hope, certainly, that they are very much short-term.

“Sometimes when people are negotiating over price, sometimes these things will occur. I want to see this resolved quickly.”

Voting on US government funding bill continues

As Michael reported earlier, we’re mere hours away from a US government shutdown, as the 2pm AEST (midnight local time) deadline looms.

In an update out of Washington DC, Reuters reports that the Republican bill to keep the government funded beyond today, which passed the House of Representatives earlier this month, is currently falling short of the votes needed to pass the Senate.

Voting continues.

Despite this uncertainty, Westpac senior economist Mantas Vanagas notes markets remain relatively calm.

“Despite ongoing risks, US equities finished the quarter on a positive note, with the S&P 500 up 0.4%, extending its rally for a third consecutive day,” he wrote.

Meanwhile the Australian dollar remained higher overnight, around 66 US cents, after yesterday’s Reserve Bank meeting.

“The RBA’s statement and the Governor’s press conference were hawkish,” wrote CBA head of international economics and foreign exchange Joseph Capurso.

“With the RBA’s meeting out of the way, the trend in the USD will determine AUD/USD for the rest of the week, particularly the likely shutdown of parts of the US government.

“The risk is skewed to further modest gains in AUD/USD…”

Mr Capurso noted the US dollar had eased ahead of the potential shutdown.

“The USD will resume its fall today if the political discourse suggests an extended shutdown.

“Government shutdowns are not uncommon in the US: there have been 21 shutdowns in the past five decades.

“The US government was shut down for 35 days in President Trump’s first term. As a consequence, non‑farm payrolls may not be released on Friday.”

‘No comment’ from BHP on China iron ore ban reports

As promised, we have been chasing more info about these reports of a Chinese ban on BHP iron ore purchases.

A spokesperson from BHP had the following response:

“We do not comment on commercial negotiations.”

This was the report that BHP is declining to comment on:

House prices post strongest monthly gain in nearly 2 years

National dwelling values climbed 0.8 per cent in September — the strongest monthly gain since October 2023 — marking the eighth consecutive rise, according to property research firm Cotality.

Over the September quarter, values rose 2.2 per cent, adding an average of $18,215 to the cost of a home.

The national median home value is now $857,280.

Here’s how areas around the country fared: