There is a real possibility the world’s biggest economy is heading toward a recession and it is threatening to drag the world’s biggest share market into a crash.

Justin Wolfers, a professor of economics and public policy at the University of Michigan, is concerned US President Donald Trump’s “chaotic” tariff policy is hurting business confidence and creating levels of uncertainty not seen since the pandemic.

“It really has raised the possibility that this very good economy could stop,” he warned.

He’s also worried about mass public sector sackings, as implemented by the new Department of Government Efficiency, or DOGE, led by Elon Musk.

“The argument here is pretty simple, which is if you talk to any CEO right now they don’t know what the business environment will look like in six months, a year, two years or three years,” Professor Wolfers said.

“Given that, there’s a pretty good argument for not investing today.

“If investment were to dry up, and if mums and dads were starting to think that way, spending would dry up, and that would be the spark that could cause a recession.“

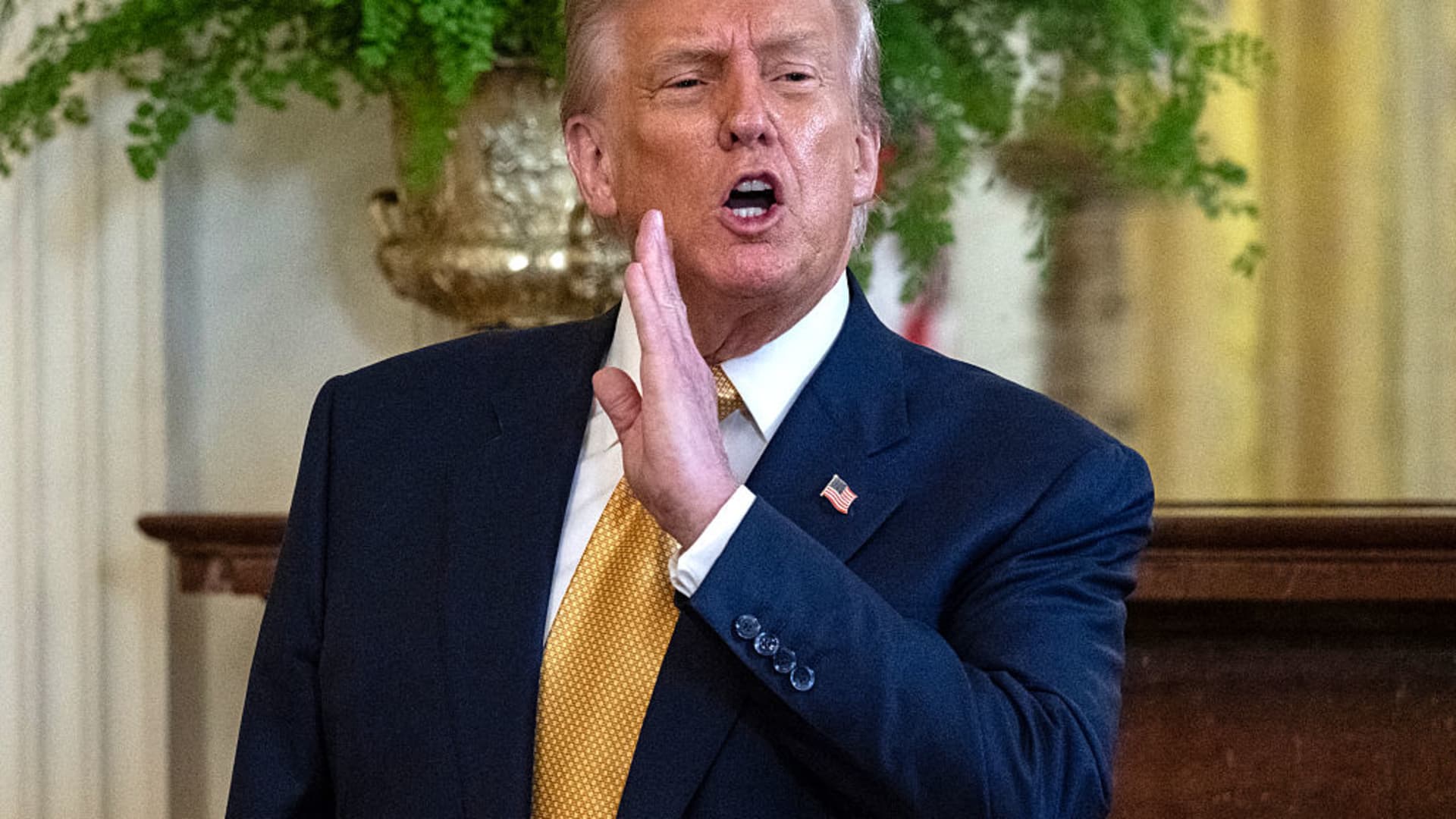

Talk of a US recession is increasing, prompting a reporter to ask Mr Trump directly.

When asked about the possibility of a recession in a Fox News interview that aired on Sunday, Mr Trump acknowledged that the economy was going through “a period of transition”.

And Treasury secretary Scott Bessent told CNBC on Friday that there could be a “detox period” for the economy as the Trump administration slashes federal spending.

Oliver Brown, the chief economist of San Francisco-based Pragmatic Policy Group, said many sectors of the US economy are struggling with the turmoil.

“Businesses here have enormous uncertainty about their inputs coming from Mexico, and Canada, and China, and elsewhere in the world,” he observed.

“And there’s also uncertainty about the strength of US consumer demand given lay-offs, particularly in Washington DC, [which] mean that you have less people who have a pay cheque and less people who can spend down at the local shops.”

Share markets slump on recession talk

A recession is often defined as two consecutive quarters of economic contraction, as measured by GDP (gross domestic product), although in the US recessions are generally declared by the National Bureau of Economic Research (NBER) based on a significant decline in economic activity spread across the economy and lasting more than a few months.

Economic growth is driven by increases in government, business or consumer spending. Positive net exports also contribute to the growth of an economy.

Many economists are now arguing the combination of US fiscal constraint, business uncertainty and thrifty consumers is going to pull the US economy into a recession.

The uncertainty has pushed Wall Street’s VIX, its volatility or “fear” index, sharply higher.

It rose close to 20 per cent overnight to 27.86.

Wall Street sold off heavily as invested head for the exits, with the benchmark S&P 500 index sliding 2.7 per cent to 5,615 and the tech-focused Nasdaq slumping 4 per cent to 17,468 points.

Tesla had the biggest fall on the S&P 500 index, slumping 15.4 per cent to $US222.15, with Microchip Technology and Palantir Technologies both down more than 10 per cent.

Previous market darling Nvidia was down more than 5 per cent to $US106.98, along with big falls for Alphabet, Meta and many other tech names.

But the falls extended beyond tech firms to major banks (Morgan Stanley was down 6.4 per cent and Goldman Sachs 5 per cent), airlines (United was down 6.4 per cent and Delta 5.5 per cent) and some industrial firms (Boeing was down 3.9 per cent).

That skittishness has flowed through to the Australian share market today, albeit at less extreme levels.

The benchmark ASX 200 index was 1.6 per cent lower at 7,839 by 12:40pm AEDT.

It is also affecting broader sentiment on local markets, with Japan’s Nikkei down more than 2 per cent in early trade.

‘Pro-chaos government’

Economists are concerned that the sweeping public sector job cuts implemented by Donald Trump and Elon Musk will slash consumer spending. (Reuters: Kevin Lamarque)

Jamieson Coote founder Angus Coote told the ABC markets are “spooked”.

“Trump not pushing back on the possibility of recession on the back of tariffs is very interesting and has clearly spooked already fragile markets,” he said.

“I think in his mind they [the USA] need to take pain early so that later in his term everything clicks together.

“Hence short-term risks of recessions cannot be ignored and equity markets, which were already at crazy levels, have reacted negatively.”

Justin Wolfers is bracing for more economic and financial markets volatility.

“Governing by chaos and raising uncertainty has made a lot of people nervous,”

he said.

“They had hoped for a pro-business government but, at the moment, this is very a pro-chaos government, not delivering what it was the corporate sector was hoping for.

“To the extent that Trump is trying to deliver for that community, [the financial markets] are a pretty good gauge as to whether they think he’s succeeding or not, and at the moment they think chaos has no pay-off,” Professor Wolfers argued.