If you have been eyeing Cisco Systems and wondering whether now is the right time to buy, hold, or trim your position, you are absolutely not alone. The stock has been catching attention for all the right reasons, especially after posting a 14.3% gain year-to-date and an impressive 32.1% climb over the past year. It is the kind of momentum that makes investors perk up, even if the last month was a bit more muted, with shares nudging just 0.3% higher. Over five years, the stock has more than doubled, up 101.0%, which is no small feat in a competitive tech landscape.

Part of what is driving renewed interest are major news stories involving U.S. tech companies like Cisco and their global influence, such as recent reports on tech infrastructure in China. While not always the direct cause, positive headlines and hefty investments in adjacent technology and financial firms can help shift risk perceptions and spark optimism about long-term growth potential.

If you are weighing your next move, it helps to know how Cisco stacks up in terms of valuation. According to six standard valuation checks, Cisco is undervalued in four, giving it a solid value score of 4 out of 6. But as most savvy investors know, not all valuation methods are created equal. Let us break down the usual approaches, and look for an even smarter way to think about Cisco’s true worth later in the article.

Why Cisco Systems is lagging behind its peers

Approach 1: Cisco Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates a company’s intrinsic value by forecasting its future cash flows and then discounting them back to today’s dollars. This helps investors judge whether the current share price reflects the business’s actual financial potential.

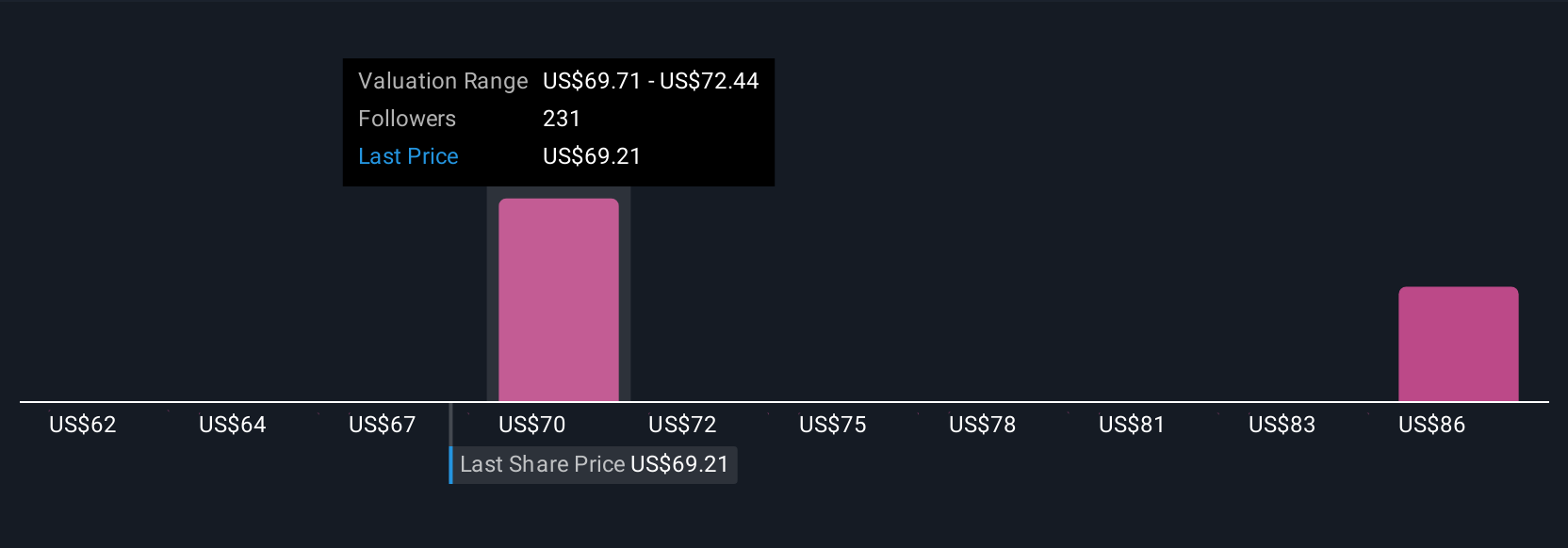

For Cisco Systems, analysts estimate the company will generate Free Cash Flow of $13.37 Billion over the last twelve months, with projections indicating steady growth. By 2030, forecasted free cash flow is expected to reach $17.52 Billion. Analysts provide detailed estimates for the next five years. After 2028, long-term projections are extrapolated, meaning the figures for 2029 and beyond are best interpreted as directional indicators rather than highly precise targets.

Using these projections, the DCF model calculates Cisco’s intrinsic fair value at $70.05 per share. Compared to the current share price, this implies a discount of 3.6%, suggesting the stock is trading just slightly below its estimated true value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Cisco Systems’s valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Cisco Systems Price vs Earnings

For profitable companies like Cisco Systems, the Price-to-Earnings (PE) ratio is one of the most trusted ways to gauge valuation. It works by comparing the company’s current share price to its earnings per share, allowing investors to quickly see how much they’re paying for a dollar of this year’s profits.

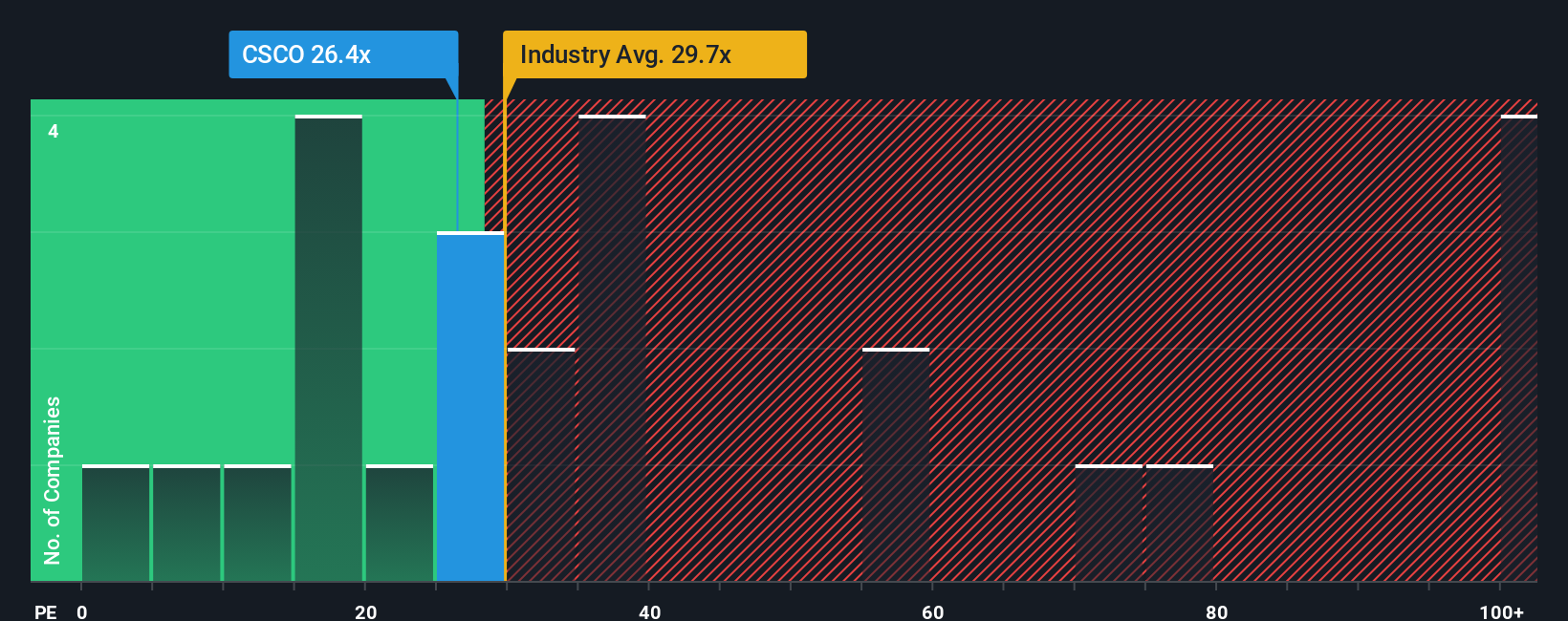

What counts as a “normal” or “fair” PE ratio can swing widely depending on how quickly a company is growing and the perceived risk of those future earnings. Higher growth and stability often justify a higher PE, while significant uncertainty or slow earnings growth can push it lower. For Cisco, the current PE ratio sits at 26.2x. This stacks up against a Communications industry average of 30.3x and a peer average of 44.1x, putting Cisco at a discount to both its direct competitors and the sector as a whole.

To refine that perspective, Simply Wall St calculates a “Fair Ratio” for each stock, reflecting what investors should reasonably pay given a company’s unique growth outlook, profitability, risk profile, market cap, and industry context. By rolling all these factors into a single number, the Fair Ratio offers a truer picture of value than simply comparing to broad averages or individual peers. For Cisco, the Fair Ratio is 29.6x, just a shade above the current 26.2x valuation. This suggests the stock is in line with what long-term fundamentals would support.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cisco Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your story about a company, describing how you personally see its business prospects, which you turn into a fair value by combining your views on future revenue, earnings, and margins. Narratives link this story to a financial forecast, and then to a fair value, creating a bridge between what you believe will happen and what the numbers show.

On Simply Wall St’s Community page, Narratives are an easy, accessible tool used by millions of investors to quickly compare their view of a company’s worth with the market’s price. They make your investment decision more actionable by showing whether your Narrative’s fair value is above or below the current share price, helping you decide when it may be smart to buy or sell.

Best of all, Narratives update dynamically as the latest news or earnings come in, ensuring your view always reflects the newest information. For Cisco Systems, for example, one investor might build a bullish Narrative based on booming AI infrastructure and see a fair value as high as $87.00. Another investor, with concerns about tech competition and slowing growth, might see it as low as $61.00.

Do you think there’s more to the story for Cisco Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com