Silver has historically been viewed as both a monetary metal and an industrial commodity. In recent years, structural changes in global debt, currency debasement, and industrial demand have led some analysts to project an extreme upside scenario for silver, with long-term targets as high as $250 per ounce. This article examines the macroeconomic, supply-demand, and historical factors behind this thesis. Monetary Inflation and Currency Debasement support higher prices due to the dramatic expansion since 2008, and even worse since 2020. Structural Supply Deficits are becoming more favorable to higher Silver prices. The Silver mining output has stagnated due to declining ore grades, rising production costs, and limited new discoveries. Also, the Industrial Demand explosion is a factor; Solar Panels and Electric vehicles are increasing the demand for the metal.

From a technical perspective, Silver (XAGUSD) is currently displaying a three-wave structure within the Super Cycle degree, according to Elliott Wave Theory. Such a structure is inherently bullish, as it implies either a Wave IV correction within an ongoing impulse or a nested impulsive structure (nest) preparing for a powerful Wave V advance. As always, Elliott Wave Theory allows for more than one valid path; however, we apply a probability-based system that assigns weight to each scenario.

At this stage, we believe Silver completed its prior cycle in March 2020, leaving two primary scenarios in play:

- A Wave IV correction within the Grand Super Cycle

- A nested impulsive structure within the Grand Super Cycle

This article explains both scenarios and outlines the technical reasons for supporting or rejecting each.

Scenario 1: Wave IV within the Grand Super Cycle

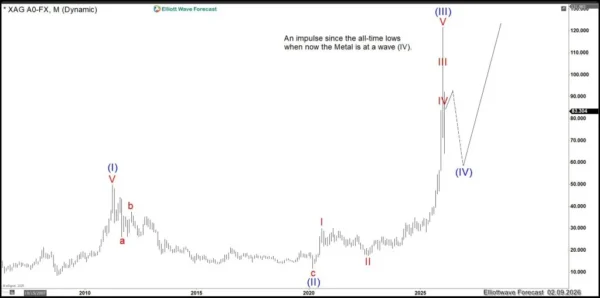

Under the traditional Elliott Wave framework, Silver can be interpreted as trading within Wave IV of the Grand Super Cycle impulse, as shown in the following chart.

XAGUSD (Silver) Monthly Elliott Wave Chart

Technical Support for Wave IV

The presence of three completed waves within the Grand Super Cycle aligns well with classical Elliott Wave requirements.

There is a clear extension between proposed Wave I and Wave II, which strongly supports the impulsive nature of the advance.

As the first leg of the Grand Super Cycle, the structure has the potential to evolve into a leading diagonal, which would permit price overlap with the 2011 highs, a feature allowed in diagonal formations.

From a pure Elliott Wave standpoint, this interpretation is valid and technically sound.

Why We Reject the Wave IV Scenario

Despite its theoretical validity, the Wave IV count loses credibility when intermarket correlation is applied—specifically the relationship between Silver and Hecla Mining Corporation (HL).

Here is a chart showing the correclation between $XAGUSD (Silver) and HL (Hecla Mining Corporation).

Overlay of Hecla and Silver (XAGUSD) Chart

HL has completed a structure that cannot be counted as a Wave IV correction.

The historical correlation between Silver and HL is exceptionally strong.

If Silver were truly in a Wave IV, HL would need to exhibit a comparable corrective structure, which it does not.

Because Elliott Wave analysis must remain consistent across correlated markets, it becomes very difficult to justify a Wave IV count in Silver while HL structurally denies it.

Conclusion on Wave IV:

While technically possible, Wave IV is not the most likely scenario.

Scenario 2: Nested Impulse within the Grand Super Cycle (Preferred View)

The second and preferred interpretation is that Silver is forming a nest within the Grand Super Cycle—a bullish configuration where multiple impulsive waves build upon one another before an explosive advance, as shown in the following chart.

XAGUSD (Silver) Weekly Elliott Wave Chart

Technical Support for the Nest

Silver has completed three waves and has since traded in a corrective manner, consistent with nest development.

The nest interpretation aligns Silver and HL structurally, maintaining intermarket consistency.

Because Silver cannot complete a Wave V without confirmation from its mining equities, the nest scenario becomes the higher-probability path.

Price Implications and Targets

Under our analysis, Silver is positioned for a major bullish phase, with two potential outcomes:

Wave V scenario: Target near $150.00

Nested impulse scenario: Target extending to $250.00

While these targets may sound extreme, history provides context. We have remained bullish on Silver since 2014, when sentiment was overwhelmingly negative. At that time, members at Elliott Wave Forecast were advised to accumulate Silver ahead of a major advance—well before the broader market recognized the opportunity.

Today, sentiment once again reflects fear and hesitation. Although lower prices remain possible in the short term, depending on strategy and risk tolerance, the broader technical path is clear.

Conclusion

Silver is not a market suited for long-term selling. Whether it completes a Wave V or launches from a nested structure, the dominant trend remains higher prices. The Elliott Wave structure, supported by intermarket correlation with HL, points toward a historic advance that could carry Silver well beyond $250.00.

Buying Silver is a long-term investment decision.