The crude oil markets continue to be a very volatile place to trade, as there are multitudes of concerns at the moment. The most obvious one, of course, is going to be any potential military strikes against the Iranian regime, but at the same time, it’s probably worth noting that the market had bounced from a massive support level in the form of $55. Supplies still outstrip demand, so unless there is some type of military action, crude oil will likely struggle to hang on to gains in any significant manner. Keep in mind that Monday is Martin Luther King Jr. Day in the United States, limiting trading hours.

Gold markets continue to be very strong, as we have pierced the $4600 level over the past week. This will remain a very bullish market from everything I see with central banks around the world accumulating gold, many central banks being either dovish or flat, and of course, the massive amount of debt that the world currently has, all of which will contribute to buying pressures. Short-term dips should continue to remain buying opportunities as we are likely to eventually see $5000 an ounce this year.

The euro has continued to slump over the past week, initially trying to rally, but it has given back quite a bit of the gains. The 1.16 level seems to be offering a little bit of support, but when you look at the longer-term chart, it becomes very obvious that we are still in the middle of the larger consolidation area, with the 1.14 level underneath being a massive floor. Currently, I believe that the 1.14 level should hold as support, but if it were to give way, the US dollar will strengthen quite drastically.

The British Pound continues to be very noisy, but this last week has seen a bit more downward pressure, suggesting that the 1.35 level is going to continue to act as a bit of a barrier. The US dollar is starting to strengthen against multiple other currencies, although it’s probably worth noting that the British pound has been stronger than many other currencies against the US dollar over the course of the last couple of years, meaning that even when it falls, it falls a lot less rapidly than many other currencies. Whether or not that is changing remains to be seen, but I still favor the US dollar overall.

The Australian dollar initially rallied this week but has given back gains to show signs of hesitation yet again. While I do believe that the Reserve Bank of Australia is a little bit of an outlier in the sense that it will probably raise rates, the reality is that the US dollar is really fighting back against most currencies. With that being the case, it would not surprise me to see this market breakdown, but the Aussie will probably remain more or less choppy in the face of US dollar strength, not necessarily falling apart.

The US dollar fell rather significantly against the Mexican peso during the week, as we are now well below the 18 MXN level. I do believe that we will work our way down to the 17.5 MXN level sooner or later, but the emphasis might be on the word “sooner.” Overall, this is a pair that I like shorting as it pays a positive swap at the end of every day, and I also look at the 18 MXN level now as offering resistance. With Banxico recently reiterating its intention to keep the interest rate at 7%, Mexico continues to be an outlier when it comes to trading against the US dollar.

Silver continues to see massive inflows, breaking above the $90 level during the previous week. It is worth noting that there is a little bit of pushback at the moment, but quite frankly, that could just be gravity at this point. Short-term pullbacks continue to attract buyers from everything I see here, and in the short term, I would anticipate that the $80 level ends up being a floor. I do think that silver traders are trying to do everything they can to get the $100 level.

Bitcoin has been bullish enough to break above the crucial $95,000 level during the week, but has struggled at the 50 Week EMA. Nonetheless, this is a market that I think will eventually break out to the upside as we have been building a bit of an accumulation pattern as of late, and any “risk on” type of catalyst will send this thing higher. I expect Bitcoin to go looking to the $107,000 level before it’s all said and done, but it may take some time to get there. Regardless, it looks like the buyers have stepped up, and that is something worth paying attention to.

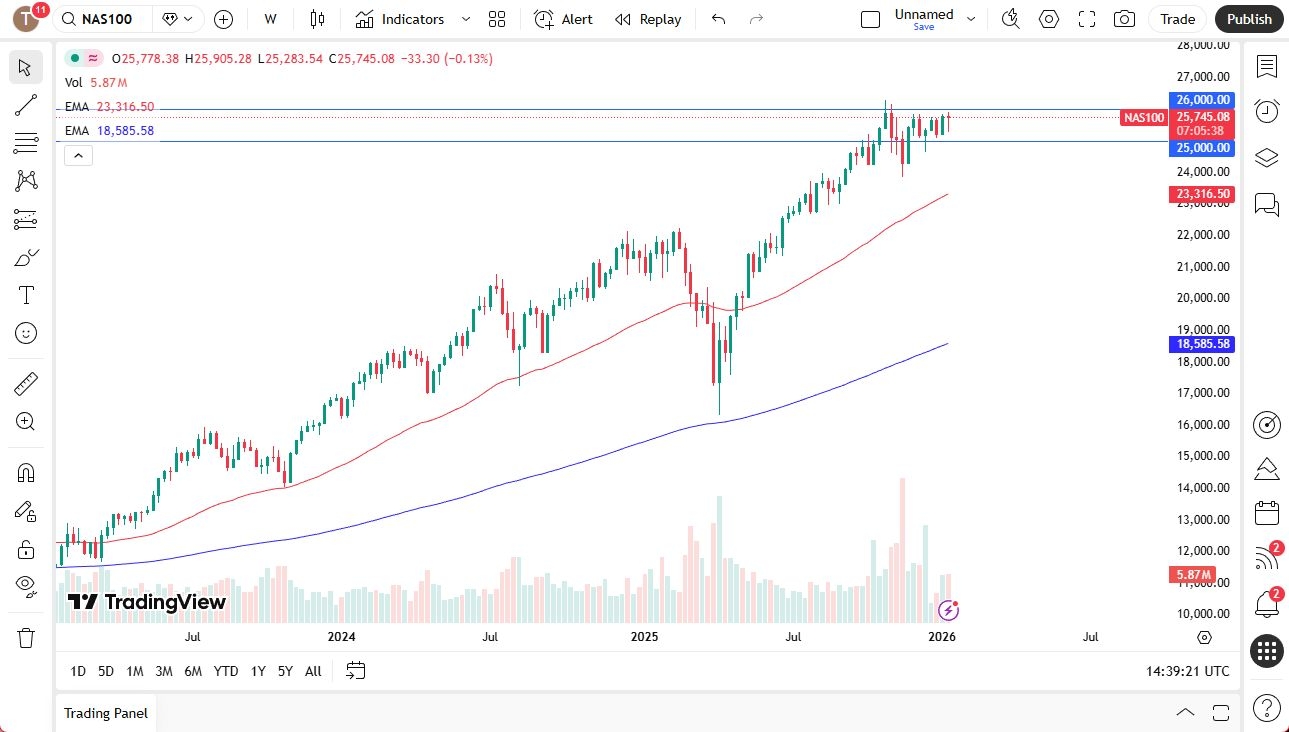

There isn’t much to say about the NASDAQ 100 other than it remains in consolidation. Nonetheless, if we can break above the crucial 26,000 level, then it’s likely that traders will continue to see this as an opportunity to go long at the moment. Short-term pullbacks will continue to attract a lot of attention, offering an opportunity to find value. I remain bullish and recognize that the earnings season coming in the next week or 2 for most of the major players will be a huge factor here.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.