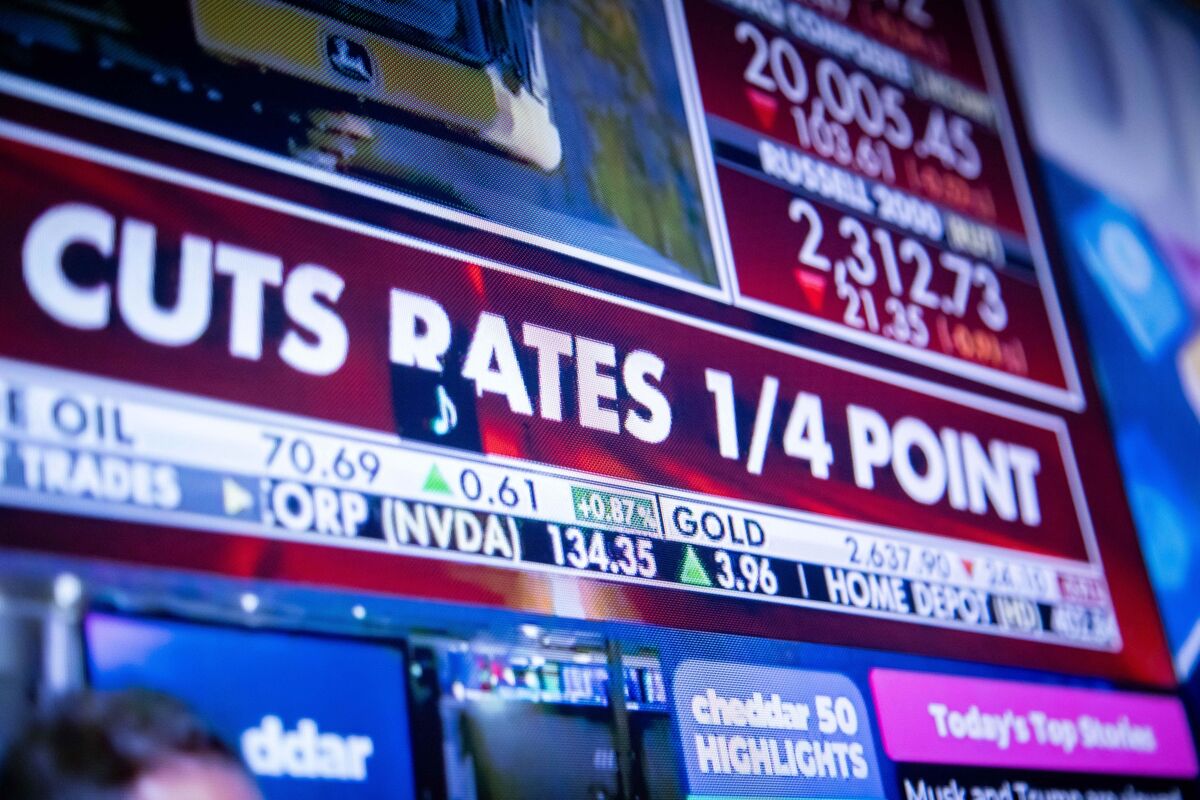

Stocks headed for the basement Wednesday as Wall Street traders pouted over the more cautious tone emanating from the US Federal Reserve. After fulfilling all expectations by cutting rates another quarter point, Fed Chair Jerome Powell made clear the central bank sees its mission now as one where it doesn’t need to be as quick to act. Having lowered their benchmark rate a third consecutive time, officials reined in the number of cuts they expect in 2025. “We have lowered our policy rate by a full percentage point from its peak and our policy stance is now significantly less restrictive,” Powell said following the Fed’s decision. “We can therefore be more cautious as we consider further adjustments.” Indeed, recent price data has raised concerns that inflation may be stalling above the Fed’s 2% target, and the unpredictable nature of the incoming Trump administration also has given officials pause. But apparently that wasn’t what investors wanted to hear, as all of the major US indexes plummeted. Here’s your markets wrap.

Remember the US commercial real estate crisis? It’s possible it slipped your mind these past few months given the presidential campaign, the election and its aftermath—both since Nov. 5 and that yet to come. But don’t worry, it’s still here. The funny thing is that, back in 2022 when rising interest rates turned the sector into a credit desert, optimists told everyone to just hang on until 2025—by then, inflation would be whipped, money would be cheaper and demand would tilt in their favor. Well, 2025 is almost here and the landscape that awaits isn’t so much green trees and rainbows as a densely-packed minefield, one filled with losses that can no longer be put off. “I look at 2025 as a year of reckoning,” says Tim Mooney, head of real estate at Värde Partners. “Lenders and borrowers will acknowledge that lower interest rates aren’t going to save them.”