Key Highlights

- USD/JPY started a fresh increase above 156.00.

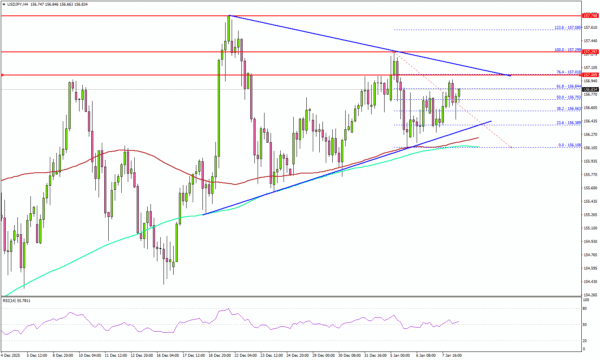

- A major contracting triangle is forming with support at 156.35 on the 4-hour chart.

- EUR/USD could extend losses if it breaks the 1.1650 support.

- The US nonfarm payrolls could change by 60K in December 2025.

USD/JPY Technical Analysis

The US Dollar stayed above 155.50 and started a fresh increase against the Japanese Yen. USD/JPY settled above 156.00 to avoid a downside break.

Looking at the 4-hour chart, the pair slowly moved higher above 156.50 and now faces many hurdles. Immediate resistance sits near 157.10. The first key hurdle is seen near 157.30. A close above 157.30 could open the doors for a move toward 157.75.

Any more gains could set the pace for a steady increase toward 158.00. If there is no break above 157.10, there could be a bearish reaction.

On the downside, immediate support is near the 156.40 level. There is also a major contracting triangle forming with support at 156.35. The first major area for the bulls might be near 156.10, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour).

A close below 156.10 might spark heavy bearish moves. The next support could be 155.50, below which the bears might aim for a move toward 155.00.

Looking at EUR/USD, the bears remain in action, and they could soon aim for a sustained move below 1.1650.

Upcoming Key Economic Events:

- US nonfarm payrolls for Dec 2025 – Forecast 60K, versus 64K previous.

- US Unemployment Rate for Dec 2025 – Forecast 4.5%, versus 4.6% previous.