Tech stocks were taking it on the chin on Thursday, with the impact particularly severe for software shares amid Microsoft’s post-earnings plunge.

The software sector slipped into bear market territory as Microsoft renewed fears that the market’s largest tech firms may be spending too much, too fast on AI without seeing adequate growth in other parts of the business to offset.

While Meta was rewarded after earnings, as robust capex guidance was overshadowed by advertising strength, investors punished Microsoft.

Shares of the software giant dropped 10%. The firm said it spent a record amount on AI, but reported slowing cloud growth and issued soft guidance on profits for the following quarter, leading tech stocks to sell off across the board.

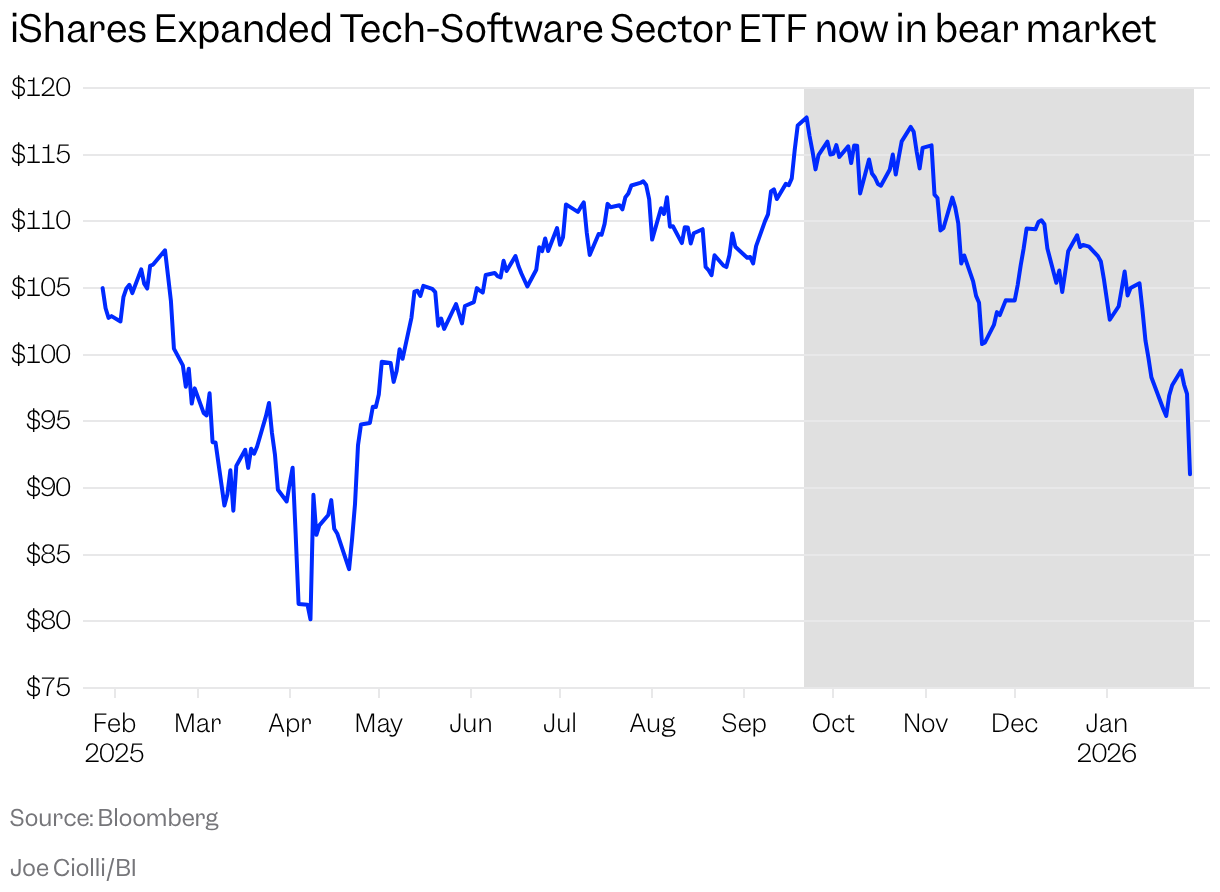

The iShares Expanded Tech-Software Sector ETF is down more than 20% from its high in October.

Here were the notable moves in the tech sector:

“Microsoft (MSFT) was the black sheep with losses,” Joee Mazzola, the head trading and derivatives strategist at Charles Schwab, wrote on Thursday, referring to more upbeat results from Magnificent Seven peers Tesla and Meta.

Major indexes were dragged lower. The S&P 500 dropped more than 1%, retreating further from the 7,000 mark, which it briefly topped for the first time on Wednesday, while the Nasdaq Composite dropped 2%.

Here’s where US indexes stood at the 4 p.m. market close on Thursday:

Capex spend: a warning, or time to buy?

Investors have been particularly sensitive to signs that demand for AI may not be as robust as markets originally anticipated. Capex spending among tech giants has been a particular worry, given the uncertainty over monetization plans and when the market will see returns from AI spend.

Microsoft’s earnings likely “reinforced fears that a return on AI investment may be slow in coming,” David Morrison, a senior market analyst at Trade Nation, wrote in a note Thursday morning.

The company likely needs to “prove” that it’s making good investments into its AI endeavors, analysts at UBS wrote earlier this week.

“Microsoft has elected to increase the allocation of new GPU compute to its 1P efforts, effectively throttling Azure growth, because of its confidence in monetizing Copilot,” the bank said. “The challenge for the stock is that many investors don’t buy into that trade-off.”

Still, several analysts noted that Thursday’s stock plunge might have been an overreaction.

“We believe that any weakness this morning post print represents strong buying opportunities for long-term investors,” Wedbush Securities analysts wrote.

The analysts, led by tech bull Dan Ives, added: “2026 remains the true inflection year of AI growth for Microsoft as the company continues to see growth head in the right direction while aggressively investing in capturing this massive opportunity.”

Analysts at William Blair said they continue to see Microsoft “expanding its enterprise footprint.” They said they see growing opportunity for the firm in AI copilots and agents.

Mizuho analyst Gregg Moskowitz wrote that the IT giant expects its capex spend — the factor unsettling investors — to go down sequentially.

“We remain ever-confident that MSFT’s revenue growth opportunities over the medium-term and beyond are greater than many realize, and we remain very bullish on its tangible AI adoption and monetization levers,” Moskowitz wrote.

All three firms maintain an “outperform” rating on the stock.