Vertiv VRT shares have lost 4.8% since it reported fourth-quarter 2025 results on Wednesday. The decline can be attributed to weak market conditions in APAC, particularly in China, and softness in the EMEA region.

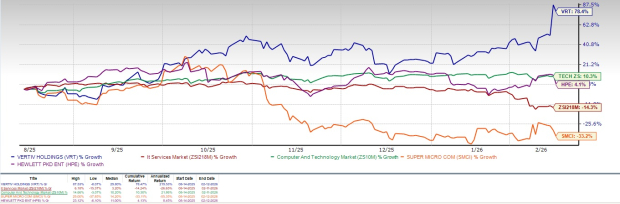

However, VRT’s shares have surged 78.4% in the trailing six-month period, outperforming the broader Zacks Computer and Technology sector’s increase of 10.3%. The Zacks Computers – IT Services industry declined 14.3% in the same time frame.

The company has also outperformed its closest peers, Super Micro Computer SMCI and Hewlett-Packard Enterprise HPE. Both Super Micro Computer and Hewlett-Packard Enterprise are expanding their capabilities in the AI infrastructure market. While Hewlett Packard Enterprise shares have rallied 4.1%, Super Micro Computer shares have plunged 33.2% over the trailing 12-month period.

The outperformance of VRT stock can be attributed to its extensive product portfolio, which spans thermal systems, liquid cooling, UPS, switchgear, busbars, and modular solutions. In the trailing 12 months, organic orders grew approximately 81%, with a book-to-bill of 2.9 times for the fourth quarter of 2025, indicating a strong prospect.

VRT Stock’s Performance

Image Source: Zacks Investment Research

In the fourth quarter of 2025, organic orders rose approximately 252% year over year, with the backlog increasing to $15.0 billion, up 109% compared with the fourth quarter of 2024 and up 57% sequentially from the third quarter of 2025. This growth is primarily driven by the rapid adoption of AI and the increasing need for data centers to support the digital transformation.

VRT Benefits From Expanding Portfolio

Vertiv’s expanding portfolio has been noteworthy. The company recently announced Vertiv Next Predict, an AI-powered managed service that uses predictive analytics and anomaly detection to transform data center maintenance by proactively optimizing power, cooling, and IT infrastructure performance.

The company is focusing on innovative solutions that cater to the growing demand for AI-driven infrastructure and advanced cooling technologies. With products like OneCore and SmartRun, Vertiv is delivering end-to-end data center solutions that simplify operations, enhance scalability, and reduce deployment time for customers. These offerings demonstrate Vertiv’s commitment to addressing the evolving needs of the industry.

Acquisitions have played an important role in expanding Vertiv’s portfolio. In December 2025, Vertiv finished its $1.0 billion purchase of PurgeRite. This move strengthens its leadership in next-generation liquid cooling and thermal management services. The agreement improves system performance and reliability for High-Performance Computing and AI data centers by combining Vertiv’s thermal knowledge with PurgeRite’s flushing, purging and filtration abilities.

The global acceleration of AI adoption is driving significant demand for data center infrastructure. Vertiv is capitalizing on this trend, particularly in the Americas, which saw a 46% organic sales growth in the fourth quarter of 2025.

Vertiv Benefits From Expanding Partner Base

Vertiv’s rich partner base, which includes NVIDIA NVDA, Caterpillar, Ballard Power Systems, Compass Datacenters, Oklo, Intel, ZincFive, and Tecogen, has been noteworthy.

In October 2025, Vertiv announced the launch of its gigawatt-scale reference architectures for the NVIDIA Omniverse DSX Blueprint, enabling faster, more flexible, and scalable deployment of next-generation AI factories. The company also announced the progress of its collaboration with NVIDIA, advancing 800 VDC power architectures to engineering readiness for next-generation AI factories.

VRT Initiates Positive 1Q26 Guidance

Vertiv is benefiting from its strong portfolio and rich partner base, which will continue to benefit the company’s top-line growth.

For first-quarter 2026, revenues are expected to be between $2.5 billion and $2.7 billion. Organic net sales are expected to increase in the 18% to 26% range. The Zacks Consensus Estimate for Vertiv’s first-quarter 2026 revenues is pegged at $2.61 billion, suggesting growth of 28.07% year over year.

VRT expects first-quarter 2026 non-GAAP earnings per share between 95 cents and $1.01. The Zacks Consensus Estimate for first-quarter 2026 earnings is currently pegged at 99 cents per share, increased by a penny over the past 30 days. The figure indicates a year-over-year increase of 54.69%.

Vertiv Holdings Co. Price and Consensus

Vertiv Holdings Co. price-consensus-chart | Vertiv Holdings Co. Quote

Vertiv Stock Is Trading at a Premium

Vertiv is currently overvalued, as suggested by a Value Score of D.

In terms of the trailing 12-month Price/Book, Vertiv is currently trading at 25.77X compared with the broader Computer and Technology sector’s 10.58X.

VRT’s Valuation

Image Source: Zacks Investment Research

Conclusion

Vertiv is benefiting from its strong portfolio and rich partner base, which are driving order growth. These factors justify the company’s premium valuation.

Vertiv stock currently carries a Zacks Rank #2 (Buy) and has a Growth Score of A, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the “first wave” of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks’ AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.