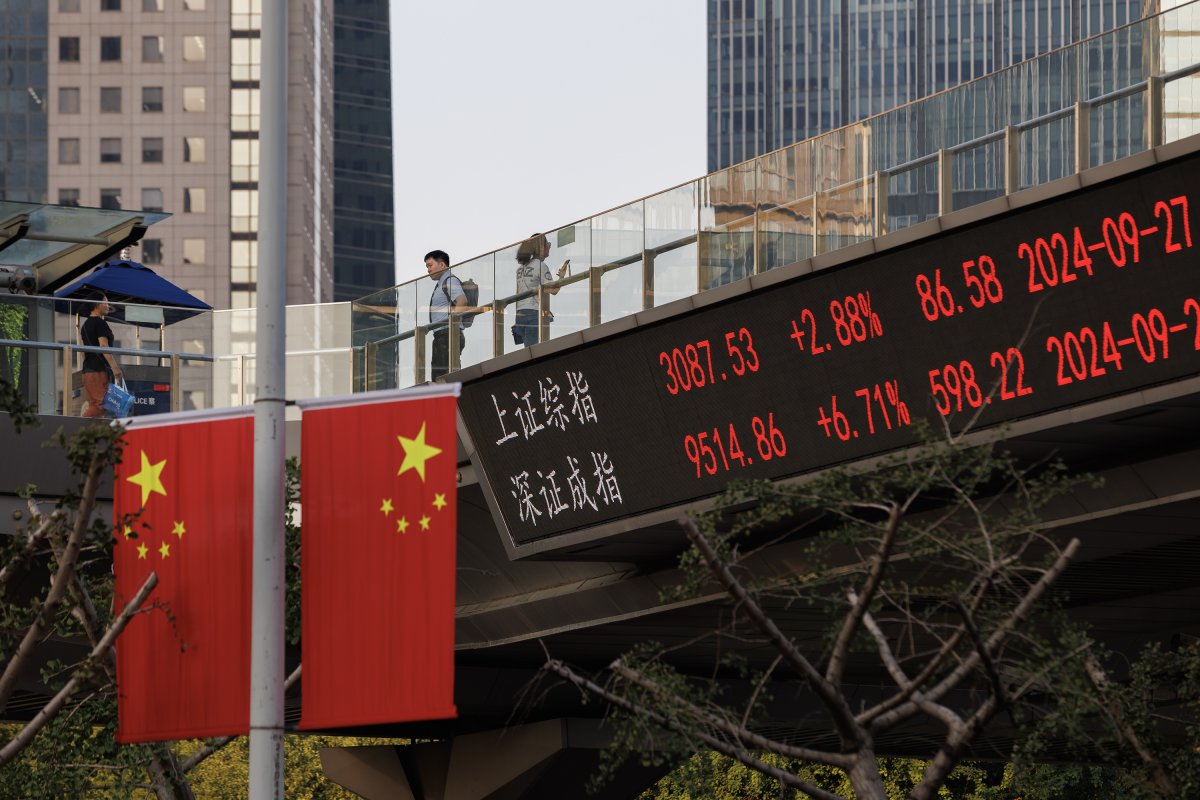

Shanghai stocks plummeted 6.6 percent on Wednesday, marking their worst single-day drop since February 2020.

The steep decline came as investors grew frustrated with the Chinese government’s failure to deliver more robust economic stimulus.

Shanghai Composite’s fall, compounded by an 8.6 percent slump in Shenzhen stocks, followed a brief surge earlier in the week driven by stimulus hopes after a national holiday.

A lack of specifics from the National Development and Reform Commission’s Tuesday briefing left markets disappointed.

The Hang Seng Index also dropped 1.4 percent, adding to Tuesday’s 9 percent plunge.

The sell-off came amid growing concerns about China’s economic health, with the government targeting 5 percent annual growth but missing the mark last quarter with just 4.7 percent.

Economists have been revising their expectations downward due to weaker-than-expected consumer and business activity, further dampening sentiment.

Michael M. Santiago/Getty Images

In contrast, U.S. markets showed resilience despite the turmoil in China.

The S&P 500 rose 0.6 percent in afternoon trading, with the Dow Jones Industrial Average gaining 387 points, or 0.9 percent, and the Nasdaq composite up 0.4 percent.

The strength in U.S. markets was partly driven by gains in the travel sector, with Norwegian Cruise Line surging 10.5 percent on analyst optimism about future growth. Carnival and Royal Caribbean also saw gains of 7.2 percent and 4.7 percent, respectively.

The gains helped offset losses from major U.S. companies.

Boeing slipped 2.5 percent after halting contract negotiations with striking workers, while Alphabet fell 2.1 percent amid ongoing antitrust concerns.

Globally, markets displayed mixed reactions—Japan’s Nikkei and Germany’s DAX both rose close to 1 percent, while European stocks were relatively stable despite the volatility in Chinese markets.

Oil prices eased, with Brent crude falling 1.6 percent to $75.96 per barrel. The yield on 10-year U.S. Treasuries rose slightly to 4.07 percent, amid continued speculation about Federal Reserve policy.

Hugo Hu/Getty Images

Traders awaited the Fed’s September meeting minutes for clues on the central bank’s evolving strategy amid robust U.S. economic indicators.

While Treasury yields climbed, investors balanced expectations around the Federal Reserve’s upcoming decisions.

These bond movements occurred as markets adjusted to China’s stock sell-off, signaling a broader apprehension over how China’s financial instability might influence global economic momentum and U.S. market conditions

Recent data, including strong job market figures, have led to recalibrated expectations for rate cuts, signaling that the Fed may adopt a more cautious approach to lowering interest rates.

This has prompted market participants to closely monitor the Fed’s outlook on balancing economic growth with inflation control.

Meanwhile, in China, hopes for stimulus remain high, with attention turning to the Finance Ministry’s upcoming briefing for potential new measures.

This article includes reporting from The Associated Press.