NVIDIA Corporation NVDA is scheduled to report fourth-quarter fiscal 2026 results on Feb. 25, after market close.

The company expects revenues of $65 billion (+/-2%) for the quarter. The Zacks Consensus Estimate is pegged at $65.56 billion, which indicates a whopping 66.7% increase from the year-ago reported figure.

The Zacks Consensus Estimate for quarterly earnings has been revised a penny upward over the past 60 days to $1.52. This suggests year-over-year growth of 70.8% from the year-ago quarter’s earnings of 89 cents per share.

Image Source: Zacks Investment Research

Earnings of the graphics chip maker surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed in one, delivering an average surprise of 2.8%.

NVIDIA Corporation Price and EPS Surprise

NVIDIA Corporation price-eps-surprise | NVIDIA Corporation Quote

Earnings Whispers for NVIDIA

Our proven model does not conclusively predict an earnings beat for NVIDIA this season. The combination of a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Though NVDA carries a Zacks Rank #2, it has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Factors Likely to Influence NVIDIA’s Q4 Results

NVIDIA’s fourth-quarter top line is likely to have benefited from the continued strength in its Data Center business. The increasing adoption of cloud-based solutions amid the growing hybrid working trend is anticipated to have boosted demand for its chips across the Data Center end market. An increase in hyperscale demand and growing adoption in the inference market are likely to have acted as tailwinds in the to-be-reported quarter.

The Data Center end-market business should have benefited from the growing demand for generative AI and large language models using GPUs based on NVIDIA Blackwell architectures. The strong demand for its chips from large cloud service and consumer Internet companies is anticipated to have aided the segment’s top-line growth in the to-be-reported quarter. The Zacks Consensus Estimate for the Data Center end market’s fourth-quarter revenues is pegged at $58.72 billion.

NVIDIA’s fourth-quarter performance is also likely to have benefited from the continued momentum across its Gaming and Professional Visualization end markets. The Gaming end market’s results have improved year over year in eight out of the last 10 quarters, as inventory levels with channel partners have returned to normal. The company also registered strong demand across most regions for its gaming products. The consensus mark for the Gaming end market’s fourth-quarter revenues is pegged at $4.26 billion.

NVIDIA’s Professional Visualization segment’s performance also reflected recovery, with revenues increasing in nine consecutive quarters. The trend is likely to have continued in the fourth quarter. The Zacks Consensus Estimate for the Professional Visualization end market’s fourth-quarter revenues is pegged at $757.6 million.

The company’s Automotive segment demonstrated an improvement in trends over the preceding seven quarters. The positive trend is likely to have continued in the fiscal fourth quarter due to increasing investments in self-driving and AI cockpit solutions. The consensus mark for the Automotive end market’s fourth-quarter revenues is pegged at $662.7 million.

NVIDIA Stock Price Performance & Valuation

Shares of NVIDIA have remained highly volatile over the past year. NVDA stock has gained 39.8% over the past year, outperforming the Zacks Semiconductor – General industry’s rise of 37.3%. However, the stock has underperformed major semiconductor stocks, including Advanced Micro Devices AMD, Intel INTC and Broadcom AVGO. Shares of Advanced Micro Devices, Intel and Broadcom have surged 83.5%, 79.4% and 52.7%, respectively.

NVIDIA One-Year Price Return Performance

Image Source: Zacks Investment Research

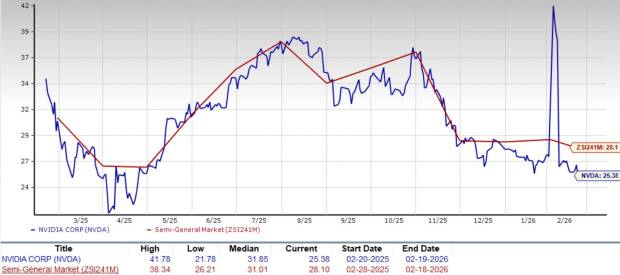

Now, let’s look at the value NVIDIA offers investors at the current levels. NVIDIA is trading at a discount with a forward 12-month price-to-earnings (P/E) of 25.38X compared with the sector’s 28.1X, reflecting an attractive valuation.

NVIDIA Forward 12-Month P/E Multiple

Image Source: Zacks Investment Research

Compared with other chip giants, NVDA trades at a lower multiple against Intel, Advanced Micro Devices and Broadcom. Currently, Intel, Advanced Micro Devices and Broadcom trade at a forward P/E of 81.97X, 28.35X and 29.29X, respectively.

Investment Consideration for NVIDIA

Over the past year, NVIDIA’s revenue growth has been driven by robust demand for chips required for the development of generative AI models. NVIDIA dominates the market for generative AI chips, which have already proven useful across multiple industries, including marketing, advertising, customer service, education, content creation, healthcare, automotive, energy & utilities and video game development.

The growing demand to modernize the workflow across industries is expected to drive the demand for generative AI applications. The global generative AI market size is anticipated to reach $1,260.15 billion by 2034, according to a new report by Fortune Business Insights. The market is expected to witness a CAGR of 29.3% from 2026 to 2034.

The complexity of generative AI requires vast knowledge and immense computational power. This means that enterprises will need to significantly upgrade their network infrastructures. NVIDIA’s AI chips, including the A100, H100, B100, B200, B300, GB200 and GB300, are the top choices for building and running these powerful AI applications, positioning the company as a leader in this space. As the generative AI revolution unfolds, we expect NVIDIA’s advanced chips to drive substantial growth in its revenues and market presence.

Final Thoughts: Buy NVDA Stock Now

As a leading player in the semiconductor industry, NVIDIA has benefited from its dominance in GPUs and strategic expansion into AI, data centers and autonomous vehicles. The company’s strong product portfolio, leadership in AI and relentless innovation present a compelling investment opportunity. A lower valuation multiple than the industry also suggests that NVIDIA is a good investment option right now.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market’s next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don’t build. It’s just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.