Key Points

-

Marginal increases in demand can exert significant upward pressure on commodity prices, particularly during periods of weak supply growth.

-

High prices may be causing demand destruction for silver, so the current sell-off is not unusual.

-

The coming data center demand (powered by Nvidia architecture) is probably structural and lasting.

- 10 stocks we like better than Nvidia ›

Commodities like silver can experience large price spikes in response to what often seem like relatively small changes in supply and demand. That’s one key reason the price of silver has soared over the last few years. It’s also why a new source of demand, driven by a new generation of data centers using Nvidia (NASDAQ: NVDA) architecture, could create a second wind of demand for silver. Here’s why.

The demand for silver

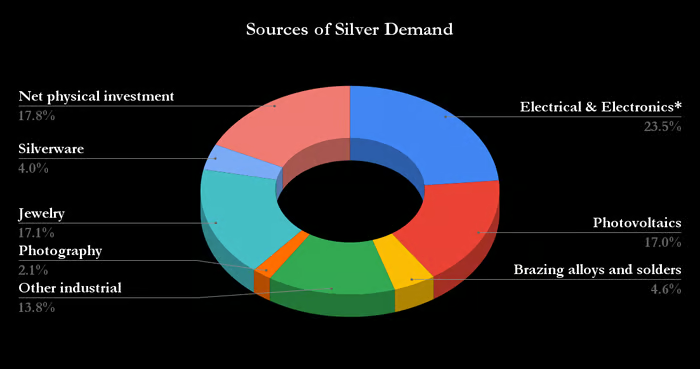

Silver’s use in jewelry and silverware is high profile, but actually, industrial demand (most notably in photovoltaic cells in the solar industry) is far more critical. The chart breaks out the estimated source of silver demand in 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Data source: The Silver Institute.*Does not include photovoltaics

As with any commodity, a surging price will cause some demand destruction, and the Silver Institute is forecasting a 1% decline in demand in 2025. Silver demand is expected to stay consistent in 2026, and supply is expected to increase by 1.5%. In normal circumstances, that’s usually bearish for silver prices, but the Silver Institute’s estimates for 2026 still leave the market undersupplied — a bullish indicator.

Image source: Getty Images.

Nvidia and a nonnegotiable source of demand

The technology company’s architecture is driving the introduction of new 800V high-voltage direct current (HVDC) data centers, set to launch in 2027. It’s something that strengthens the investment case for Nvidia. In addition, the data centers offer significant efficiency and lower maintenance costs, and one way they do this is by using relatively more silver. The metal’s higher thermal conductivity and better oxidation resistance give it several advantages over copper, particularly at high voltages.

Data centers are already a key source of silver demand, but the new 800V HVDC data centers are likely to contain relatively more silver.

In addition, given the critical importance of these new data centers in meeting surging market demand driven by artificial intelligence (AI) applications, demand for silver in the new data centers is likely to be what economists call relatively price-inelastic. In other words, it will take a significant increase in silver prices to curb demand for the commodity. That’s bullish for silver, as it implies strong underlying demand, and, as noted, a relatively small increase in demand can affect prices.

Image source: Getty Images.

Where next for silver?

It’s essential to take a balanced view, and as the chart shows, net physical investment (primarily investors buying silver) plays a massive role in demand. It grew in 2025 while industrial demand overall was flat, with some demand destruction in jewelry and silverware in response to surging prices.

As such, don’t be surprised if there’s a correction in silver prices, as is occurring now. That said, the fundamentals (photovoltaic, electric vehicle, and data center demand) remain positive, and coming demand for silver in new data centers, driven by Nvidia technology, suggests investors should be biased toward buying the dip in silver prices this year.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 17, 2026.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.