The Lead:

Global trade order split into two distinct paths: deep bilateral integration among non-US powers, and aggressive “tariff-as-ultimatum” tactics from Washington. The signing of the EU-India Free Trade Agreement represented a landmark achievement in “de-risking” for Europe, effectively creating a massive economic counterweight to both Chinese and American protectionism. However, this progress was overshadowed by the US threat of a 100% tariff on Canadian goods, a move that fundamentally challenged the stability of the North American trade bloc. As gold prices surpassed $5,000/oz and the WTO struggled to find a unified voice at Davos, the week concluded with global markets bracing for a year defined by extreme policy volatility and the breakdown of traditional regional alliances.

This Week’s Ocean, Air & Freight Markets

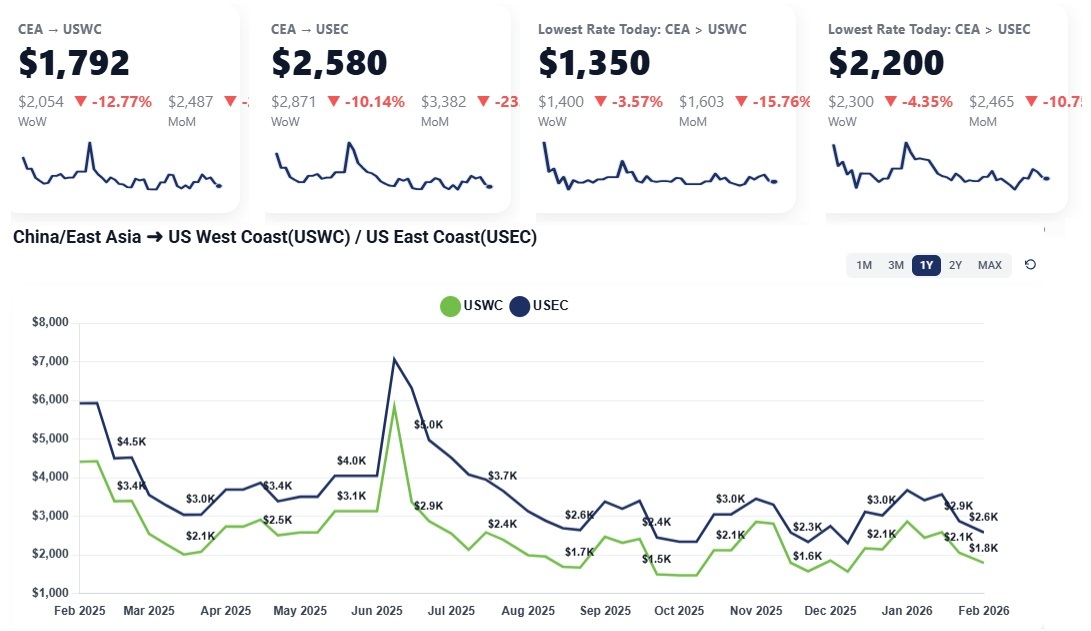

China-US Ocean Freight Market:

The transpacific shipping corridor continues to see a significant downward trend in rates as the market approaches the Lunar New Year holiday. Current spot pricing has retreated to levels not seen since late last year, signaling a near-total erosion of earlier rate hikes.

CEA to USWC: Rates have dropped further than anticipated, currently sitting between $1,600 and $1,650 per container. This represents a significant decline and places pricing at levels reminiscent of November 2025.

CEA to USEC: Rates for the East Coast have followed a similar trajectory, falling to approximately $2,400. Carriers are now operating on thin margins, with pricing approaching the breakeven point where space is being sold nearly at cost.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

This Week Explained:

-

Unexpected Rate Erosion: Despite previous expectations that rates would hold steady until the end of February, they have continued to drop as carriers struggle to secure volume.

-

Operational at Cost: Carriers are barely maintaining profitability at these levels, with some likely selling space at cost just to fill vessels before the holiday shutdown.

-

Volume Exhaustion: The “pre-holiday rush” has largely concluded, leaving only minimal shipments, described as “breadcrumbs”, remaining in the system.

-

Market Sentiment: Importers appear to have front-loaded or paused shipments in response to earlier geopolitical and tariff uncertainties, leading to a premature softening of demand.

Looking Ahead:

The immediate outlook suggests a market that is essentially “done” for the pre-CNY period. While rates may stay at these low levels or see minor adjustments for the remainder of this week and next, a complete standstill is expected by the end of next week as factories in China close.

Predictions for February indicate a dormant period with virtually nothing left to move as the holiday takes full effect. Shippers can expect a quiet month followed by a potential post-holiday reset in March, though any recovery will depend heavily on the evolution of US consumer demand and the clarification of tariff policies.

China-US Air Freight Market:

The air freight market has entered its peak volatility phase as the industry nears the Chinese New Year (CNY) shutdown. Rates have seen a sharp week-over-week increase as capacity tightens and shippers scramble to clear inventory before factory closures.

CEA to USWC: Rates for West Coast destinations like LAX have surged significantly from the previous week’s lows. In Week3, high-density cargo was priced as low as $2.07/kg, but Week4 data shows these rates have jumped to $3.40–$5.18/kg. This represents a week-over-week increase of approximately $1.30–$1.50/kg for standard shipments.

CEA to USEC: Rates to the East Coast, including JFK, have also climbed steadily. After hovering around $4.59–$4.89/kg in Week3, prices have now pushed into the $5.18–$5.48/kg range. This reflects a more moderate but consistent increase of roughly $0.60/kg compared to the prior week.

This Week Explained:

-

The Final Pre-CNY Rush: With Chinese New Year holidays imminent, factories are pushing all remaining inventory out of their warehouses to avoid holding stock during the month-long shutdown.

-

Space Compression by “Big Fish”: Large enterprise entities like Tesla and major e-commerce players took up a massive amount of available aircraft space early in the month. This has left smaller and medium-sized shippers fighting for the remaining high-cost “spot” capacity in the final weeks.

-

Manufacturer Prioritization: Chinese manufacturers are prioritizing their largest clients (like Tesla) to ensure their high-volume orders are fulfilled and shipped before the holiday, often at the expense of smaller shippers’ timelines.

-

Geopolitical and Tariff Caution: Recent threats of 50% tariffs on goods entering the U.S. have created a sense of urgency for some importers to land their products before any potential policy shifts occur.

-

Lack of Organic US Demand: While rates are climbing due to seasonal capacity constraints, they remain below historical “sky-high” levels (such as $7.00–$8.00/kg) because overall U.S. consumer demand is still relatively weak.

Looking Ahead:

The high-rate environment is expected to persist until the formal start of the holiday period around February 2nd, which aligns with the current validity of many airline quotes. Space will likely remain at a premium through the second week of February as the final backlogs are cleared.

Once factories close, the market is predicted to enter a “dead” period for 2-3 weeks where booking activity will be non-existent. The long-term outlook for March suggests a potential for rate reductions if volume does not rebound significantly after the holiday. Shippers should be prepared for a quiet Q1 as the market settles and geopolitical uncertainties regarding new tariffs become clearer.

In the News:

Reuters: New trade map takes shape in Davos as world adjusts to Trump tariffs

https://www.reuters.com/world/americas/new-trade-map-takes-shape-davos-world-adjusts-trump-tariffs-2026-01-22/

BBC: Trump raises US tariffs on South Korea imports to 25%

https://www.bbc.com/news/articles/cwyw3ynwe37o

Global Trade Magazine: US–Canada Trade Rift Deepens as Trump Warns of 100% Tariff Over China Deal

https://www.globaltrademag.com/u-s-canada-trade-rift-deepens-as-trump-warns-of-100-tariff-over-china-deal/

Financial Times: The WTO needs an overhaul

https://www.ft.com/content/2ff1d4ce-4d63-4776-8e8c-ace6b3509f24

CNBC: South Korea scrambles to pass U.S. investment bill after Trump threatens higher tariffs

https://www.cnbc.com/2026/01/27/south-krea-scrambles-to-pass-us-investment-bill-after-trump-threatens-higher-tariffs.html