First Solar Company Overview

Zacks Rank #3 (Hold) stock First Solar (FSLR) is the world’s largest thin-film photovoltaic (PV) solar module manufacturer. First Solar’s competitive edge in the solar industry stems from its cadmium telluride (CdTe) semiconductors technology, which release less carbon, are more efficient, and have a more rapid energy payback time. Meanwhile, production of First Solar’s unique solar panels requires less water, material, and energy than the competition. The Arizona-based company’s technology is focused on solar power plants and commercial utility projects.

Solar Will Become the Dominant Energy Source

Tesla (TSLA) CEO Elon Musk, the godfather of clean energy, believes that solar will soon become the dominant energy source. Musk cites solar power advantages such as the sun’s vast and limitless power, economic viability, and scalability.

Worldwide Electricity Demand is Soaring

A recent study by the National Electrical Manufacturers Association (NEMA) suggests that U.S. electricity demand will increase 2% annually and 50% over the next 25 years. The electric vehicle revolution, robotics, and energy-hungry data centers will drive electricity growth.

Image Source: NEMA

With soaring energy demand, and an aging grid, many large-scale companies will need to rely on solar for their energy needs.

First Solar: Expanding Manufacturing Capacity as Demand Soars

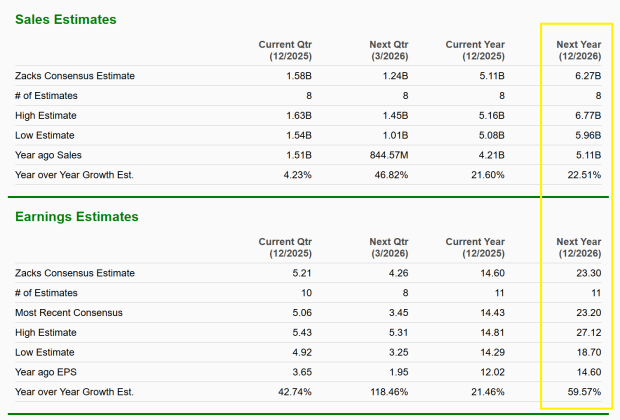

First Solar’s latest earnings report illustrates the rapid growth in the solar industry. First Solar’s year-over-year earnings-per-share grew 46% while revenue jumped 80%. Meanwhile, Zacks Consensus Estimates suggest that the rapid, double-digit top-and-bottom line growth will continue into 2026.

Image Source: Zacks Investment Research

To address soaring solar demand, First Solar is proactively investing in manufacturing capacity. The company projects that it will bring on line a new 3.7-gigawatt (GW) manufacturing facility in late 2026 that will help it to meet demand.

First Solar’s Groundbreaking Technology

Although First Solar already has the most advanced technology in its industry, it is expected to unveil even better technology next year. FSLR’s new CuRe technology modules enhance semiconductor performance by replacing copper with other elements, enabling grater energy output.

The FSLR Pullback is Buyable

After a robust uptrend for most of 2025, FSLR shares are retreating to the rising 10-week moving average, offering investors a low-risk buy zone.

Image Source: TradingView

Bottom Line

As global electricity demand accelerates and grid constraints intensify, large-scale solar is becoming a critical piece of the energy mix. First Solar’s differentiated technology gives the company momentum into 2026.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.