On January 14, 2026, the “Jetta Automotive Technology Co., Ltd. Kickoff Conference” was held in Chengdu. According to the company, the move marks Jetta’s shift from a product brand to a technology company spanning the full value chain — from R&D and manufacturing to supply and sales.

Image source: FAW-Volkswagen

What stands out is its proposed “government–enterprise coordination, China–foreign integration” joint-venture model — both a proactive answer to the smart-electrification wave and a fresh, differentiated template for JVs transforming in China. Still, with the market splitting and domestic brands gaining ground, the real impact of this upgrade will take time to show.

NEV push: targeting growth — and wading into a red‑ocean fight

One of the core aims of creating the tech company is to bet on the NEV track and close the electrification gap that has plagued many joint ventures.

Fresh data from the China Association of Automobile Manufacturers show that in 2025, China’s NEV production and sales reached 16.626 million and 16.49 million, up 29% and 28.2% year on year. NEVs accounted for 47.9% of new-car sales — 7 percentage points higher than a year earlier. Yet joint ventures contributed little to that growth curve, with delayed electrification now a central reason for their shrinking share.

Jetta’s upgrade is, in essence, a bid to carve out new room for joint ventures as the industry’s structure is being rebuilt.

The pivot rests on three-way resource synergy. Under a new JV framework — clearer local positioning, deeper co‑creation and faster decisions — provincial, municipal and district governments will provide Jetta Automotive Technology with systematic support, from strategic guidance and factor assurance to ecosystem building.

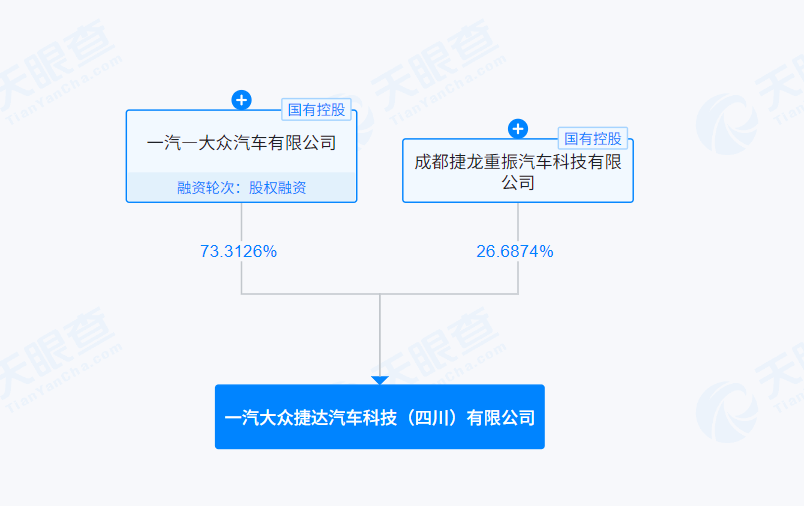

Image source: Tianyancha

China FAW, as an industry leader and major shareholder, will inject capabilities across R&D, intelligent manufacturing, supply chains and market development. Volkswagen Group, for its part, will act as a core strategic shareholder and technology partner, opening its global R&D network, providing advanced electrification platforms, and enabling Jetta’s overseas expansion.

Crucially, Jetta Automotive Technology has been granted greater market‑facing R&D and rapid decision rights — able to spearhead smart EVs tailored to local needs while tapping Volkswagen’s global technology and China FAW’s supply chain.

Even so, the deeper tensions of the traditional JV model aren’t fully resolved. How far technology licensing extends, and how decision‑making power is apportioned between China and Germany, could still quietly cap the pace of change.

On technology and product, Jetta has mapped a path. Riding the intelligent‑EV wave, it will focus on new platforms and architectures, driver‑assistance and smart cabins, strengthening local R&D and speeding commercialization and iteration. On the product side, Jetta plans to launch 5 all‑new models by 2028, 4 of them NEVs, building a lineup that covers mainstream segments.

Local industry ecosystems will help. Chengdu ranks among the top cities nationwide for vehicle ownership and boasts a complete NEV supply chain, while Sichuan is targeting more than 4 million NEVs on the road by 2027.

Jetta Automotive Technology will align with China’s Western Development strategy, acting as a “chain leader” to push regional auto clusters toward higher‑end, smarter manufacturing and help Sichuan build a 100 billion yuan automotive ecosystem. That brings policy tailwinds and localized supply‑chain support that cut transition costs — but also a question: how to keep market decisions independent while leaning on local resources.

Overseas expansion: leveraging shareholder resources, with coordination speed the swing factor

Going abroad is Jetta’s bid to step out of the domestic red ocean — and a second pillar of this strategic upgrade.

China has led global auto exports for consecutive years, with “Made‑in‑China” increasingly recognized overseas. Jetta combines Sino‑German JV tech roots with the cost advantages of localized manufacturing, giving it a base for expansion; making it a tech company elevates overseas business to a group‑level priority.

FAW‑Volkswagen Party Secretary and General Manager Dong Xiuhui said the creation of Jetta Automotive Technology is the latest outcome of China FAW and Volkswagen Group responding to China’s high‑level opening and deepening their JV. “Through establishing an independently operated new Jetta company and introducing strategic support from local government, we aim to build a more agile, deeply localized operating entity. This will help us fuse Chinese and German technological advantages, accelerate the electrification transition, and establish a new development pattern of ‘deeply rooted at home, heading overseas.'”

Shareholder resources will be Jetta’s biggest lever abroad: Volkswagen offers global channels, unified quality control and brand backing, while China FAW brings footprints and accumulated resources in Southeast Asia, the Middle East and other markets.

“Globalized technology + localized operations” is the core of Jetta’s overseas pitch. Agile structures can adapt quickly to local regulations and consumer habits, while Volkswagen’s technology underpins compliance and quality — a combination that can play well in emerging markets.

Even so, the road overseas is not straightforward. Jetta must contend with the rapid rise of BYD and other Chinese brands, as well as local incumbents; beyond price‑performance, brand awareness and reputation‑building will matter.

From this new starting line, Jetta Automotive Technology will follow a “rooted in Sichuan, radiating nationwide, going overseas” path, targeting mid‑term annual production and sales of 400,000–500,000 units.

Seen in full, Jetta’s upgrade is a proactive reset of the JV model. The three‑party, dual‑track approach deserves credit, yet balancing technology voice, aligning shareholder execution and carving out real market differentiation will be the tests ahead. For the industry, the attempt offers valuable reference — and its outcome will matter for joint ventures grappling with transition anxiety.