A slew of mainland-listed Chinese technology companies are speeding up fundraising plans in Hong Kong to capitalise on the upbeat market sentiment.

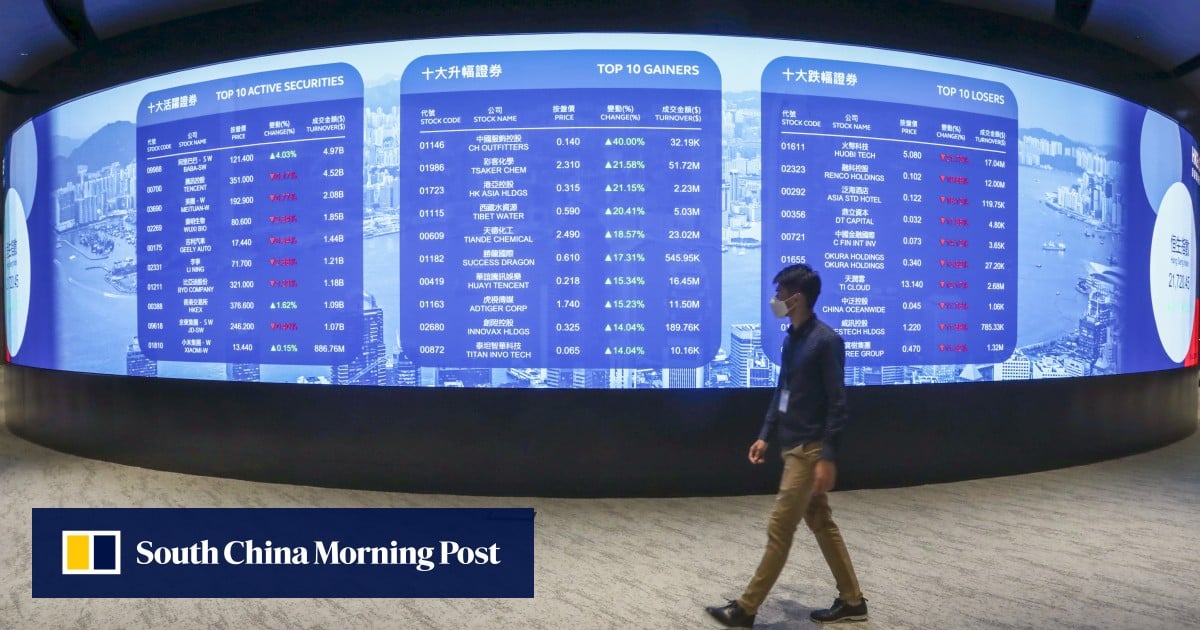

Hong Kong’s equity market has been buoyed by mainland investors’ record buying of HK$731.2 billion (US$93.1 billion) of stocks in the first half of the year, according to Hong Kong Exchanges and Clearing (HKEX) data and Bloomberg on Monday.

The buying spree, driven by attractive valuations and a re-rating of China’s technology sector, has led to a growing number of A-share companies seeking dual listings in Hong Kong.

From electric vehicle battery maker Sunwoda Electric Vehicle Battery to biopharmaceutical maker Changchun High-Tech Industry Group and smart-city solutions provider PCI Technology Group, companies are keen to take advantage of the city’s deep liquidity pool, international investor base and favourable valuations to accelerate their global expansion, diversify their funding sources and enhance their international profiles.

Improved investor sentiment in Hong Kong’s secondary market and a rebound in companies’ valuations have made the city a more attractive listing destination for A-share companies, said Kenny Ng Lai-yin, a strategist at Everbright Securities International.