Donald Trump came into office threatening tariffs on Chinese goods, but few observers predicted that he would raise them as high as he has. In early April, he slapped a minimum fifty-four-per-cent tariff rate on imports from the country; less than two weeks later, he raised the rate to more than a hundred per cent, causing Chinese President Xi Jinping’s government to reciprocate by levying similar tariffs on American goods. Although Trump had gone back and forth about whether certain products, such as smartphones and computers, will be exempt, the markets have been consistent in responding negatively to his moves, and economists have raised the risk of a recession significantly since the beginning of the year. No one knows exactly what Trump will do next, or whether the tariffs represent a long-term policy or a bargaining position, but the uncertainty—in addition to spooking businesses around the world—has raised questions about how China is likely to respond in the medium and the long term to the U.S.

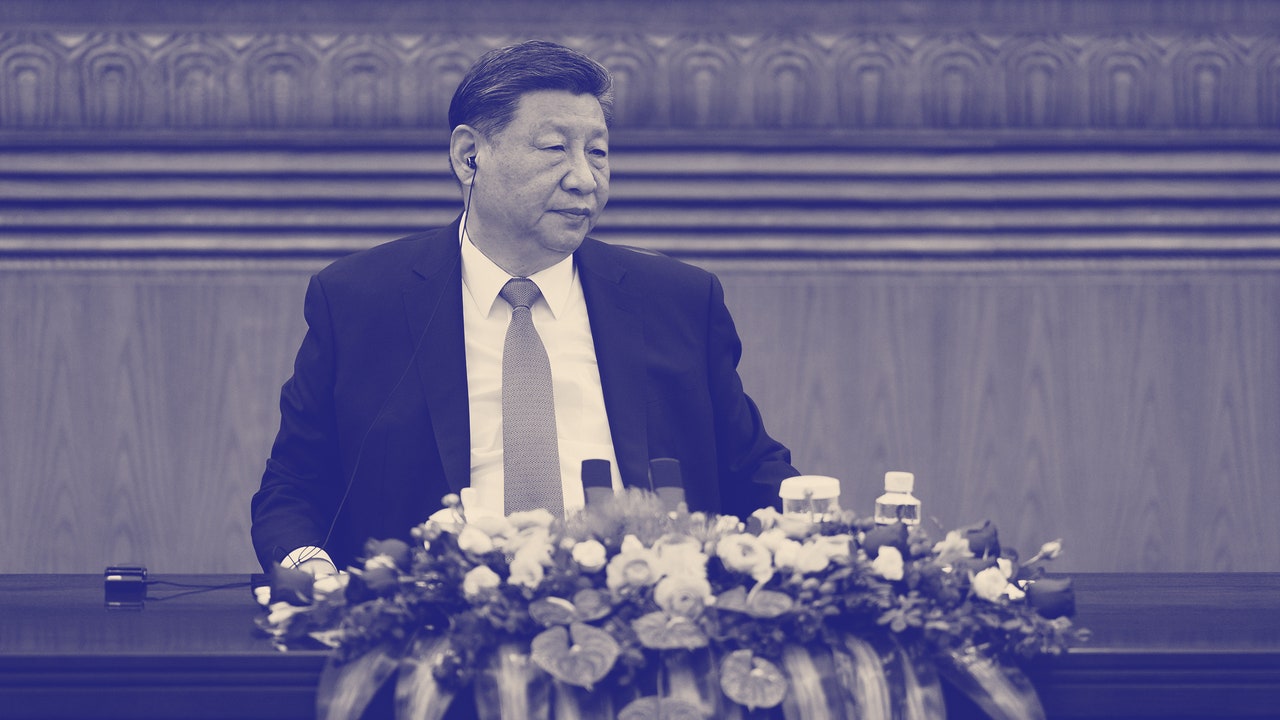

I recently spoke by phone with the economist Yasheng Huang, an expert on China who teaches at M.I.T.’s Sloan School of Management. During our conversation, which has been edited for length and clarity, we discussed the ways in which tariffs provide an opportunity for Xi to reform his country’s economy, how the tariff war is likely to play out, and why disappointing economic growth figures have not caused any weakening of the Chinese Communist Party’s grip on power.

What do you think is the central goal for Xi Jinping and the Chinese Communist Party (C.C.P.) in terms of how to deal with the American Administration under Trump on tariffs? What are they hoping to achieve?

I think it’s clear they don’t want a trade war. Their economy is struggling, and the export sector has been one of its few bright spots. Last year, they had almost a trillion-dollar trade surplus. The property sector is not doing well. The technology sector is doing well, but it’s not really adding that much to G.D.P. growth. So this was purely a trade war that was initiated by the United States, and not by China.

I don’t think they want to cave in. That would make the Chinese leadership look very bad. And, moreover, I don’t think they trust the Trump Administration. Even if they were to give concessions this time around, I don’t think they believe that the concessions would hold. So there are multiple motivations on their part not to quickly come to an agreement if that agreement requires significant concessions.

Even if they do not want to make significant concessions to the Trump Administration, do you think that they believe the economic relationship between China and the United States in the medium term has to change in some way? And what would that look like for China?

Well, in terms of the bigger-term picture, the thing that they have been really, really serious about is technology. Trade is important in terms of G.D.P. growth. But, from their point of view, the long-term issue with the United States is that the U.S. controls key technologies that China needs for its national security and for its economic growth. I disagree with that view, but that’s the view that they have. And since 2018—the first Trump trade war and tariffs—they have moved substantially toward technological self-sufficiency, and they have achieved quite a bit of success. But that movement toward technological self-sufficiency has also exposed them to trade shocks and to the volatilities of the external economy. So that’s the dilemma that they have. They are able to reduce technological dependency on the United States, but arguably they have not reduced the economic dependency on the external sector.

Why would becoming more self-sufficient also open them up to trade shocks?

When I say self-sufficiency, I mean technological self-sufficiency. Technologies are extremely costly, and they require significant up-front investments—and the returns happen in the future, if they happen at all. There is no evidence that the kind of technological investment China has made has created a real economic payoff. If you look at the G.D.P. data, it’s very clear that, as they have achieved technological successes, the G.D.P. growth rate has trended down rather than up. And the most direct measure of the economic implications of this significant up-front investment is that productivity is actually slowing down. In the short term, you need to generate G.D.P. growth, and you need to create employment.

And those aspects of the Chinese economy—productivity, G.D.P., employment—require a robust export performance, simply because the real-estate sector, which was almost thirty per cent of the Chinese economy, is struggling. Consumer sentiment is fairly low after the COVID pandemic. Unemployment is problematic. The export sector is one sector that has been doing well. And now they are faced with this trade shock. But that doesn’t mean that they are going to cave in, because this discussion is really about politics, not about economics.

What specifically are you talking about when you say technology?

Electric vehicles, wind turbines, other energy-transition industries, and, more recently, A.I. If you look at those energy-transition sectors where China is clearly emerging as a leader, they have a major overcapacity, meaning that the domestic economy is not generating sufficient demand for the products that are being produced. Whenever you have a gap between supply and demand, that gap has to be absorbed somewhere else. So that’s why the European Union is very concerned about Chinese products coming their way. And the United States has always been concerned about Chinese exports coming to this country. And even other developing countries are concerned about Chinese products flooding into their regions. So, essentially, the technological successes that they have achieved have not been about creating demand but about creating supply. And when you have that gap between supply and demand, that forces the Chinese economy to depend even more on the external economy than it would otherwise.

You said that you disagreed with the way that the C.C.P. thinks about the need to be independent. What specifically do you disagree with and why?

For an economy at the level of the Chinese economy, the most important driver of efficiency is capital allocation—efficient capital allocation, rather than adding technology. I’m not saying technologies are bad for productivity; it is just that relative to capital efficiency, technologies are less important. But here’s the problem. In the past ten years, what we have seen is a bigger role of the state sector, which is not as efficient as the private sector. They’re using a lot of capital to generate output, and they’re using a lot of capital as compared with the private sector, while not generating as much employment. And so this is where the gap is. Huge capital allocation has not created productivity gains, employment growth, or income opportunities for the Chinese population.

So what would the alternative be?

The essence of the argument is that the way they can really protect themselves from another four years of Trump—policy volatility, protectionism—is to expand the domestic markets and tap into their potential. The ratio of private consumption to G.D.P. is only thirty-nine per cent. Here it is about seventy per cent. India is more than sixty per cent. And the consumption ratio is very low because of two things. One is that the savings rate is very high. And the reason that the savings rate is high is because Chinese households are concerned about their future pension liabilities, medical liabilities, old-age liabilities, because the government doesn’t provide enough social protection. This is a government that has invested tremendously in technologies, in infrastructure, in urban building, urban construction, but has invested relatively little in people and social protection, pensions and things like that, so they have to save all of their own income against these future liabilities.

The other reason, which I think is actually a bigger reason, is that, relative to the G.D.P. growth rate, the personal-income growth rate has been comparatively low. You work at The New Yorker; I work for M.I.T. You and I, at the personal level, care more about the paychecks that we get than the G.D.P. So, China has had an incredibly high G.D.P. growth rate. But, relative to that high G.D.P. growth rate, the personal-income growth rate of the average Chinese person, and we are talking about 1.4 billion people, has actually been quite modest. So if you look at the income share of Chinese G.D.P., it’s really on the lower end of major economies in the world. And, if you combine these factors, then the consumption rate relative to G.D.P. is low. So I would argue that they should really focus on that problem, rather than continue with the overcapacity model that they have.