Gates is more interested in stalwart, boring businesses than high-flying tech.

Bill Gates built his fortune through Microsoft, one of the world’s largest tech companies. He and co-founder Paul Allen got in on the ground floor of the personal computing revolution and amassed fortunes as their company’s value rose in tandem with the boom in PCs in the 1980s and 1990s. Gates became the world’s first centibillionaire (a net worth of $100 billion) in 1999, nearly two decades before anyone else would reach that level of wealth.

Today, Gates is still worth about $100 billion, despite Microsoft’s value skyrocketing about sixfold from its peak in 1999. That’s because he’s turned his attention to his foundation, where he plans to give away 99% of his remaining wealth over the next 20 years.

Gates has historically donated his Microsoft shares to the foundation, but the foundation trust’s portfolio has sold off those shares while remaining heavily invested in some noticeably non-tech names. In fact, about 60% of the trust’s portfolio is invested in three mostly low-tech companies, following the investment managers’ sale of about two-thirds of its Microsoft shares last quarter. Here’s where the Gates Foundation is investing today.

Image source: Getty Images.

1. Berkshire Hathaway (29.3% of portfolio value)

Berkshire Hathaway‘s (BRK.A 0.06%) (BRK.B 0.17%) CEO Warren Buffett is a longtime donor to the Gates Foundation. Every year, he donates Class B shares of the stock to the foundation, along with several other charitable organizations. This year, he gave just over 9.4 million shares of the stock to the foundation at the end of June.

Berkshire has produced solid results from its insurance business in 2025, despite setbacks from the California wildfires at the start of the year. Third-quarter results were particularly impressive, with underwriting earnings rising to $3.2 billion from $1 billion in Q3 2024. That more than offset the drop in earnings through the first half of the year.

Today’s Change

(-0.17%) $-0.88

Current Price

$503.39

Key Data Points

Market Cap

$1.1T

Day’s Range

$501.01 – $505.43

52wk Range

$440.10 – $542.07

Volume

3.6M

Avg Vol

4.7M

Gross Margin

24.85%

Meanwhile, Berkshire’s massive investment portfolio continues to produce gains. However, Buffett and his investment team have struggled to find significant opportunities to invest Berkshire’s growing cash pile. That pile’s made bigger as Berkshire sells more equities than it buys every quarter.

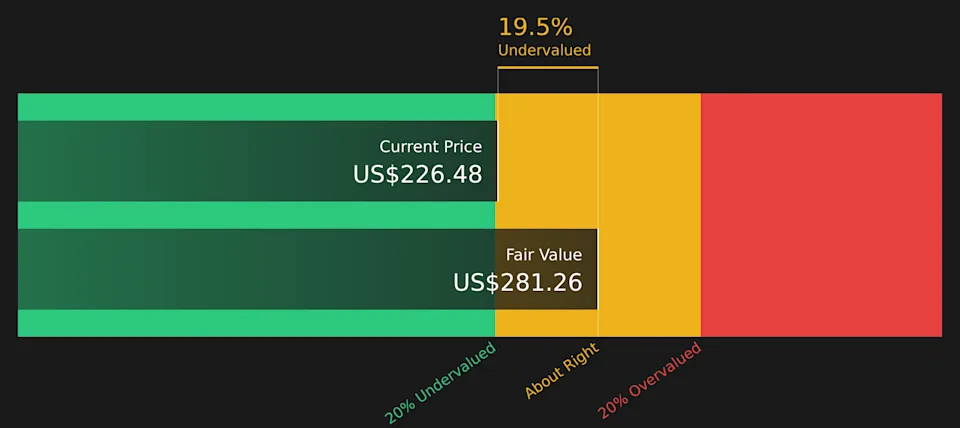

Shares of the conglomerate now trade for about 1.55 times book value. While that’s above the stock’s historic average, it’s down from the high price investors were paying early in 2025. With Buffett’s retirement announcement taking some air out of the stock, it’s now trading closer to fair value at today’s price, based on the assets held in its portfolio and its core operating results from insurance.

2. Waste Management (17.1%)

Waste Management (WM 0.66%) is one of the longest-held securities in the Gates Foundation trust. There’s a good reason for that. It’s a recession-resistant business with a huge competitive advantage.

Waste Management’s main waste-hauling business benefits from its scale and its dominant landfill ownership position. With its scale, the company is able to build a more efficient network of collection routes and transfer stations, benefiting its operating margin. Meanwhile, Waste Management’s 262 active landfills put it in an enviable position among other waste haulers, as regulations make it extremely costly to obtain approval and build new landfills. As a result, the company has been able to raise prices every year due to the growing scarcity of landfills, while charging third-party waste haulers fees to use its facilities.

The business generated a 32% adjusted operating margin last quarter, continuing to demonstrate room for improvement as it exercises pricing power and scales.

Today’s Change

(-0.66%) $-1.45

Current Price

$218.32

Key Data Points

Market Cap

$89B

Day’s Range

$217.92 – $220.53

52wk Range

$194.11 – $242.58

Volume

1.5M

Avg Vol

1.9M

Gross Margin

28.92%

Dividend Yield

1.50%

Additionally, Waste Management now operates a medical waste disposal business following its acquisition of Stericycle, which it rebranded as WM Health Solutions. Management sees room for synergies to cut costs for the business, but it expects the market for Health Solutions to climb quickly over the next decade due to the aging U.S. population. For now, the business accounts for less than 10% of revenue.

It’s no wonder that the trust has rarely sold shares of the stock, which has grown considerably over the last 25 years. Even with the company trading at an enterprise value of around 15 times its expected EBITDA over the next 12 months, it appears to be a good value. Strong earnings improvements for Health Solutions, combined with steady growth for the main waste-hauling business, should enable the stock to keep climbing from here.

3. Canadian National Railway (13.6%)

Canadian National Railway (CNI +2.27%) (CNR +2.13%) connects Canada’s east and west coasts with the Midwest United States and the Gulf Coast. Railroads remain an important method of hauling freight across dry land as massive scale drives overall costs lower. Better fuel efficiency than trucks, and the ability of trains to haul massive amounts, make them more economical for long-hauling. That said, it’s a very slow-growing industry.

On the plus side, there are significant barriers to entry. It’s practically impossible for a new company to compete with the big ones, as it takes thousands of freight contracts to generate the scale needed to operate profitably. Instead, the industry has consolidated over the years, as businesses look to take advantage of the benefits of scale. To that end, Canadian National has been able to raise prices steadily while growing contract volume. That’s pushed its operating margin higher. It reached 38.6% last quarter.

Canadian National Railway

Today’s Change

(2.27%) $2.21

Current Price

$99.58

Key Data Points

Market Cap

$60B

Day’s Range

$97.68 – $100.24

52wk Range

$90.74 – $108.75

Volume

2M

Avg Vol

1.5M

Gross Margin

44.23%

Dividend Yield

2.62%

Many feared that tariffs would negatively affect the railroad’s international freight business from Canada through the middle of the U.S. While management has seen a drop in volume for metals, minerals, and forest products due to the tariffs, it has seen increases in petroleum and chemicals, grain, coal, and fertilizers.

Despite slow revenue growth, management has been able to increase its operating results while reducing its capital expenditures. As a result, free cash flow growth climbed 14% through the first nine months of the year. Management expects further improvements in free cash flow in 2026, driven by additional reductions in capital expenditures. It returns that excess cash flow to shareholders through dividends and share repurchases, the latter supporting mid-single-digit earnings-per-share growth.

With the company’s enterprise value roughly 12 times analysts’ EBITDA expectations, it appears to be a great value relative to its peers, trading closer to a 14-times multiple. Considering the barriers protecting the business, it’s not surprising that the Gates Foundation continues to hold a massive position in the railroad.