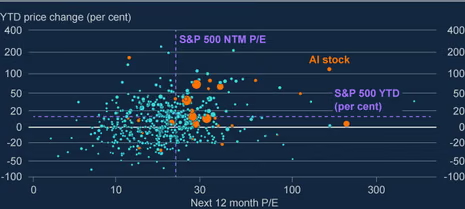

Chart: Why Bank of England is worried about AI valuations and debt splurge

The Bank of England has also produced a neat chart to show how AI stocks have driven the high valuation and growth of the US stock market, as investors have piled in on the expectation of high future earnings growth.

The chart, in today’s financial stability report, shows the year-to-date price change of S&P 500 stocks (y-axis), and the next 12 month price-to-earnings ratio for each stock (x-axis).

(b) The size of dots corresponds to the market capitalisation of firms as of 24 November 2025.

(c) ‘AI stocks’ are those which appear in the JPAIM equity basket. Photograph: Bank of England

As you can see, many AI stocks are trading at a higher price-to-earnings ratio than the rest of Wall Street, a sign that much higher profits are expected in future years.

As the Bank explains:

The share prices of many AI companies are partly underpinned by high expected future earnings growth over several years, contributing to those companies – and subsequently the equity indices which they comprise a significant part of – appearing historically expensive in valuation metrics which consider past, current or only near-term future earnings [see chart above].

The US excess cyclically-adjusted price-to-earnings (CAPE) yield – a measure of equity risk premia (ERP) which considers past earnings – is close to its lowest level since the dot-com bubble. CAPE is a backward-looking measure, but even ERP calculated from the excess yield of three-year forward earnings expectations is at its most compressed level in 20 years. Whether these earnings will be realised, or even prove underestimates, is uncertain.

As flagged in the introduction, the Bank is also concerned about the growing role of debt financing in the AI sector, pointing out that this has increased through the second half of 2025.

This poses financial stability risks, it cautions:

Deeper links between AI firms and credit markets, and increasing interconnections between those firms, mean that, should an asset price correction occur, losses on lending could increase financial stability risks.

AI infrastructure spending over the next five years could exceed $5tn, according to some forecasts, implying that these links could deepen further.

So far, the bond market has bought the splurge of AI debt without complaint.

But… the BoE fears this situation may not last, and points out that the cost of insuring Oracle’s debt against default has risen since the summer.

It says:

The bond market has absorbed this issuance so far – US IG corporate bond spreads remain near their lowest level over the past 15 years.

But debt securities and credit derivatives associated with AI companies can quickly reprice in response to changes in outstanding debt volumes and/or future earnings expectations.

For example, the five-year credit default swap spreads of Oracle – an AI company which has lower free cash flow margins than some other larger hyperscalers and has issued a large amount of debt this year to finance AI infrastructure spending – has widened from less than 40 basis points to around 120 basis points since end-July (by contrast, the credit default swap spreads of US IG corporates more broadly – as proxied by the CDX North American IG five-year index – are broadly unchanged over the same period).

Key events

Bailey denies Bank of England is ‘sowing the seeds’ for the next crisis

The Bank of England are now fielding questions from the press – and the first homes in on today’s decision to ease capital rules for high street banks for the first time in a decade.

Q: Are today’s cuts to bank capital ratios sowing the seeds for the next financial crisis?

Governor Andrew Bailey says the decision was taken in the light of the evolution of the banking system, and the economic conditions today.

He insists it is a “sensible reflection of conditions”, and also “a sensible reflection of the health of the banking system”.

Playing down concerns about the decision, Bailey says:

“I don’t have any concerns about this in terms of where it takes the regulatory system to. I think it’s a sensible thing do to.”

Q: Can you stop the banks simply using this cut to boost their dividends?

Bailey says it’s not up to the Bank of England to tell banks how to run their busineses.

But there is a “two-way” relationship here, he adds: if the banks support the economy by lending, that will strengthen the economy, and the banks will benefit.

Andrew Bailey then confirms that UK banks passed this year’s stress tests, showing they could keep functioning without needing new capital if there was a sharp economic downturn that leads to deep recessions across countries, a rise in inflation, and higher interest rates.

The most important thing the Bank of England can do to support economic growth is to maintain financial stability, insists governor Andrew Bailey.

That focus is more important than ever in the current geopolical environment, he says.

But in response to a request from chancellor Rachel Reeves last year, the Bank’s financial policy committee has assessed and identified areas where the financial sector could contribute further to supporting sustainable growth through higher productivity growth, investment and innovation.

Governor Andrew Bailey cites three areas:

-

barriers faced by pension funds and insurers when supporting long-term capital investment

-

challenges high-growth firms face in accessing domestic finance, particularly when scaling up

-

Issues relating to responsible adoption of innovative technology.

Given the deeper links between AI and credit markets and increasing interconnections between firms, a sharp asset price correction could lead to losses on lending, which could disrupt financial stability, BoE governor Andrew Bailey then tells reporters in London.

Watch Bank of England press conference here

The Bank of England are holding a press conference now to present their financial stability report, plus their work on helping create sustainable economic growth, and the results of their bank stress tests.

You can watch it here:

Andrew Bailey begins by apologising for the state of his voice, which is sounding a little croaky….

He begins by explaining that overall risks to financial stability have increased during 2025 (as flagged in the introduction to this blog).

Bailey says:

Key sources of risk include geopolitical tensions, fragmentation of trade and financial markets, and pressures on sovereign debt markets, which could stack to amplify the risk of these risks crystalising.

He adds that as governments face rising spending pressures, they may have less capacity to respond to shocks in the future.

Elevated geopolitical tensions increase the risk of cyber-attacks and other disruption, he warns.

He then turns to concerns about AI valuations, another key theme in today’s report, saying:

On some measures, equity valuations in the US are approaching levels not seen since the dot-com bubble, and in the EU and UK since the global financial crisis (GFC).

The AI sector is a particular hotspot, and somewhere where the role of debt financing is increasing quickly as firms seek large-scale infrastructure investment.

The Bank of England is not alone in warning about private markets creating risks.

Former Reserve Bank of India Governor Raghuram Rajan today warned about excess liquidity building up in private credit globally, Bloomberg reports.

Rajan, a finance professor at the University of Chicago, is concerned that private sector profitability and a wave of AI success stories have created a sense in the market that the lending boom will continue for a long time.

Speaking at the Clifford Capital Investor Day event in Singapore on Tuesday, he explained:

“We are in a period where there’s ample credit, and the Fed is cutting.

“That is the time when the risks build up more. So this is a time to be really more careful.”

UK consumer confidence drops as job security fears rise

UK consumer confidence declined in the run-up to last month’s budget, as people grew more worried that they might lose their jobs.

The YouGov/Centre for Economic and Business Research consumer confidence index, released this morning, has dipped by 1.2 points to 108.0 (where any reading over 100 shows positive setiment).

The index shows falls in perceptions of job security (to the lowest since May 2023), home values and outlook for household finances last month.

People’s perceptions of their job security over the past thirty days also fell 1.3 points to 94.4, meaning that measure remains in negative territory (as it’s below 100).

Sam Miley, Cebr’s head of forecasting and thought leadership, says:

“Uncertainty in the run-up to the Autumn Budget likely drove the dip in consumer confidence in November. Other economic developments may have compounded the decline. For instance, the simultaneous falls in the home value indices may have been the result of the Bank of England’s decision to hold interest rates early in the month.

Meanwhile, the unemployment rate recently reached a four-year high, weakening perceptions of current and future job security.”

Bank shares higher after stress test results

Today’s stress test results show the UK banks are in “robust health,” says Matt Britzman, senior equity analyst at Hargreaves Lansdown:

The UK’s seven biggest banks sailed through the latest stress test, reaffirming their resilience and earning a regulatory nod to ease capital buffers. Most banks already hold capital well above the minimum by choice, so any shift in strategy may take time – but in theory, it frees up extra capital for lending or capital returns.

However they use the new freedom, this is another clear signal that the UK banking sector is in robust health. This was largely expected, but the confirmation should still be taken well, especially after dodging tax hikes in last week’s Budget. UK banks have been on a tear over the past two years from deeply depressed levels – valuations aren’t as cheap anymore, but there are still some solid catalysts in play and the potential for strong shareholder returns ahead.

Shares in UK banks are a little higher this morning, led by Lloyds Banking Group (+1%), Barclays (+0.95%) and HSBC (+0.7%).

The London stock market is calm this morning, with the FTSE 100 gaining 10 points or 0.11% to 9713 points in early trading.

The Bank of England’s financial stability report does not seem to have alarmed the City.

Kathleen Brooks, research director at XTB, explains:

There are residual concerns about an AI bubble, the FT is reporting that British pension funds have been reducing their equity allocations to the US and moving into other regions as fears grow about an AI bubble and concentration risk. The trend is to increase allocations to UK and Asian markets, and this could be a big theme in 2026.

When the institutional money makes a move, it is worth noting, since they tend to be juggernauts that take a while to change direction. If UK pension funds are turning away from the US and looking globally for returns, this could signal that the valuation gap between the US and elsewhere might start to narrow. This is a theme that has been around for a while, but it might start bearing fruit.

The Bank of England is also getting in on the act, and in its latest Financial Stability Report, released this morning, it once again flagged the risks from high valuations, specifically from AI stocks and it said that ‘global risks remain elevated.’ However, trading financial markets are all about managing risk, and we do not think that these comments will dramatically alter the outlook for stocks in the near term.

UK house prices up in November

UK house prices rose last month despite uncertainty before the budget, according to new data from Nationwide.

The UK’s biggest building society said the average house price rose 0.3% month on month in November, higher than a 0.1% increase predicted by economists polled by Reuters. The average price of a home was £272,998, up from £272,226 in October.

But on an annual basis, house price inflation slowed to 1.8% in November, down from 2.4% in the year to October.

Robert Gardner, Nationwide’s chief economist, has predicted that the newly announced “mansion tax” would have a limited impact on the housing market.

“The changes to property taxes announced in the Budget are unlikely to have a significant impact on the housing market. The high value council tax surcharge, which is not being introduced until April 2028, will apply to less than 1% of properties in England and around 3% in London.

More here:

Karim Haji, global and UK head of financial services at KPMG, has welcomed the decision to ease the capital requirements on UK banks:

“UK Financial Services firms have proved resilient time and again both by regulatory stress tests and real life shocks. But global risks persist. The Financial Stability Report rightly points to continued structural risks from issues like cyber and the private client market.

The past year has shown that risks aren’t confined to traditional economic shocks and when an event happens the impacts are felt immediately due to the interconnectedness of the financial system and technology.

“Regulations need to be robust but proportionate and UK banks have huge pools of capital. The recommendation to update the CET1 benchmark is a helpful step towards maintaining the UK’s resilience whilst also being supportive of growth.”