Key Points

Nvidia (NASDAQ: NVDA) has been among the best performers in the stock market over the past few years, but it hasn’t had a great 2026 so far. Its stock is essentially flat, as is the S&P 500. All of that could change after it reports Q4 earnings on Feb. 25, as those results could ignite the stock to its usual form.

I think 2026 could be a huge year for Nvidia stock for several reasons, but the ultimate question is, what will Nvidia’s stock price be by the end of the year? The answer may shock some investors, as I think Nvidia’s stock has a huge runway.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Image source: Nvidia.

Nvidia has a few bullish catalysts emerging

Nvidia makes graphics processing units (GPUs) primarily used in artificial intelligence (AI) applications. As we’ve heard from some of the biggest names in the AI world, capital expenditures are expected to be massive in 2026. Amazon expects to spend $200 billion, Alphabet anywhere from $175 billion and $185 billion, while Meta Platforms intends to spend $115 billion to $135 billion. Those are massive projections, and don’t include any numbers from some players like OpenAI or Microsoft. It’s clear that 2026 will be a monster year for AI spending, and Nvidia is one of the primary companies that’s set to cash in.

Another growth driver in 2026 will be the return of sales to China. In April 2025, President Donald Trump and his administration barred Nvidia and its peers from exporting computing units to China. This was a problem, as Nvidia specifically developed a GPU to meet export restrictions that it was now stuck with.

However, it appears that Chinese sales have been approved once again, though Nvidia will have to pay an export tax. China is a massive AI market, and the impact will be felt in Nvidia’s fiscal year (FY) 2027 results, ending January 2027.

All of this adds up to what’s expected to be a far better year, and the projections back it up. Wall Street analysts project that Nvidia’s growth rate will be 65% in FY 2027, up from 57% in FY 2026. On the earnings per share (EPS) side, they expect Nvidia’s to increase from $4.69 to $7.74.

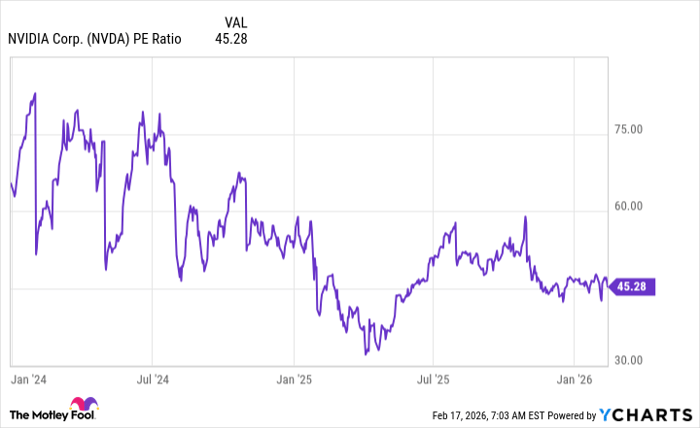

That $7.74 in earnings per share is what we’ll base our valuation on. Nvidia’s price-to-earnings (P/E) ratio decreased in 2025 to average about 45 times trailing earnings.

NVDA PE Ratio data by YCharts

To bake a bit of conservatism into this projection, I’ll set an end price of 40 times earnings for Nvidia’s stock. If it does that and meets analyst EPS projections, then Nvidia’s stock price would be $309.60. That’s a massive jump from today’s $185 share price, and if Nvidia beats EPS estimates, like it has consistently done over the past few years, and trades for a higher multiple, that price could be even greater.

Nvidia stock is a no-brainer buy right now, and I could see it crossing over $300 per share before 2026 is over.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $420,595!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,152,356!*

Now, it’s worth noting Stock Advisor’s total average return is 899% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 20, 2026.

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.