Rivian is hoping to break into the mass market for electric vehicles in 2026.

Electric cars have had a difficult run during the past few years. According to Cox Automotive, although 2024 was the best year ever for electric vehicle (EV) sales in the U.S. market, with 1.3 million EVs sold, the pace of sales growth has slowed and stagnated since 2023.

Federal government-backed EV sales tax incentives were removed in October 2025. This led total EV sales to plummet in the fourth quarter, down 46% compared to the third quarter and down 36% year over year. In 2025, electric vehicles had 7.8% market share of total U.S. vehicle sales, down from 8.1% in 2024.

Image source: Rivian.

Even if you love electric vehicles and believe that gasoline-free is the future of the auto industry, it’s clear that EVs are hitting some major speed bumps. These challenges can be seen in the share price of Rivian Automotive (RIVN 7.16%). This U.S. electric vehicle company’s stock has lost 86% of its value since debuting on the public markets in November 2021.

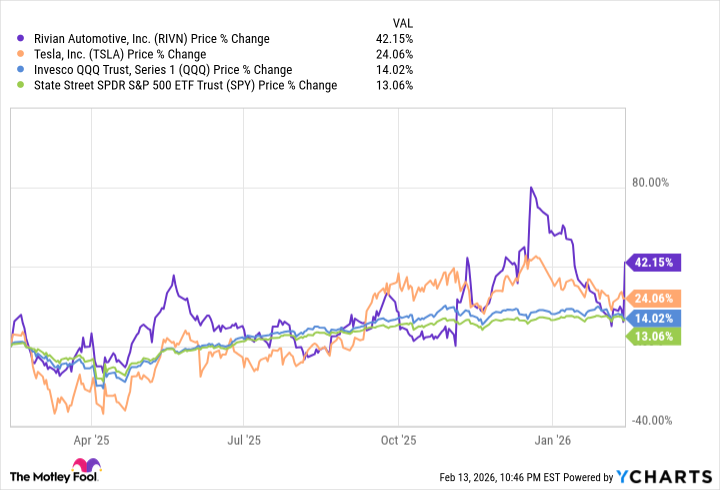

Rivian makes premium-priced all-electric SUVs and trucks. It’s a small player in the auto market compared to Tesla, its much-larger competitor. But Rivian’s share price has been making a comeback. The stock has outperformed Tesla, the tech-heavy Nasdaq-100 index, and the S&P 500 index in the past year.

And Rivian’s earnings report for the fourth quarter of 2025 gave the stock a big surge of momentum. Rivian shares were up by about 26% the day after the company’s Feb. 12 earnings call. If you believe in the prospect of an EV stock recovery in 2026, here are a few reasons to keep an eye on Rivian.

Rivian forecasts up to 59% increase in deliveries

Rivian’s stock jumped on Feb. 13 for several reasons. The company reported an 8% increase in annual revenue and a $1.3 billion improvement in its gross profits year over year. Although its automotive revenue was down 15% in 2025 compared to 2024, Rivian’s revenue from software and services skyrocketed by 222%, largely due to its partnership with Volkswagen Group.

But an even bigger story might be Rivian’s plans to increase deliveries. In 2025, the company delivered 42,247 vehicles to customers. For 2026, the company is forecasting 62,000-67,000 vehicles delivered. Reaching the high end of that range would mean a 59% increase in Rivian vehicles rolling off the assembly line.

Today’s Change

(-7.16%) $-1.27

Current Price

$16.46

Key Data Points

Market Cap

$20B

Day’s Range

$16.39 – $17.64

52wk Range

$10.36 – $22.69

Volume

798

Avg Vol

38M

Gross Margin

-276.59%

The company is ready to expand into mass market EVs

Rivian vehicles aren’t known for their affordability. The company’s R1T truck has a starting price of $72,990 and its R1S sport utility vehicle starts at $76,990. But on March 12, Rivian will announce the launch of its new mass market electric vehicle, the R2. Exact details on Rivian R2 pricing haven’t been announced yet. But the company says the R2 will offer more than 650 horsepower and over 300 miles of range. The vehicle is getting “extremely positive” preproduction reviews.

Rivian is still facing some significant risks and high costs of doing business. The company guided an adjusted loss before interest, taxes, depreciation and amortization of $1.8 billion to $2.1 billion for 2026. But Rivian might have turned a corner toward profitability, especially if the R2 gets rave reviews from consumers.

If you want to invest in a high-potential electric vehicle company with a strong comeback story, you might want to buy Rivian stock in 2026.