Key Points

CoreWeave (NASDAQ: CRWV) has had a tremendous start to 2026. Its stock is up over 30% this year, and if its growth rates continue as they have in the past, this could be just the start of an even bigger run. CoreWeave is in a perfect position to capitalize on all of the AI spending as it provides a way that AI hyperscalers can access computing power without needing to build it themselves.

CoreWeave’s growth rates have been off the charts, but I think it is just getting started despite some worries investors have.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

CoreWeave’s platform has several big-name clients

CoreWeave operates data centers that are filled with cutting-edge chips primarily from Nvidia (NASDAQ: NVDA). Customers can then rent this computing power to train and run AI models. This is essentially the same business model used in cloud computing — a successful and proven approach. Companies don’t always have the resources (whether monetary or computing) necessary to do everything they need, so contracting computing power from CoreWeave is a smart idea.

Among CoreWeave’s client list are hyperscalers like Meta Platforms (NASDAQ: META), Microsoft (NASDAQ: MSFT), and OpenAI. These are some heavy hitters, but all three of these companies are building data centers of their own to facilitate the AI compute they need, so why do they need to rent computing power from CoreWeave?

There are a couple of reasons why these hyperscalers are using CoreWeave in addition to their own facilities. First, the hyperscalers don’t have all of the computing power they want up and running right now. Second, by offloading some of the workload to a different provider, they can easily scale up or down their usage based on demand, while internal resources handle the primary workload. Lastly, the computing units inside data centers are depreciating assets that can burn out quickly and are often outdated months after installation. By spreading out this risk to a supplier, these companies are decreasing their risk.

CoreWeave has become a popular solution, with revenue in Q3 2025 rising 134% year over year. The party could be just getting started, as Wall Street analysts project 83% revenue growth for 2026. Demand for CoreWeave’s computing power is massive and growing, but there’s one problem to the story.

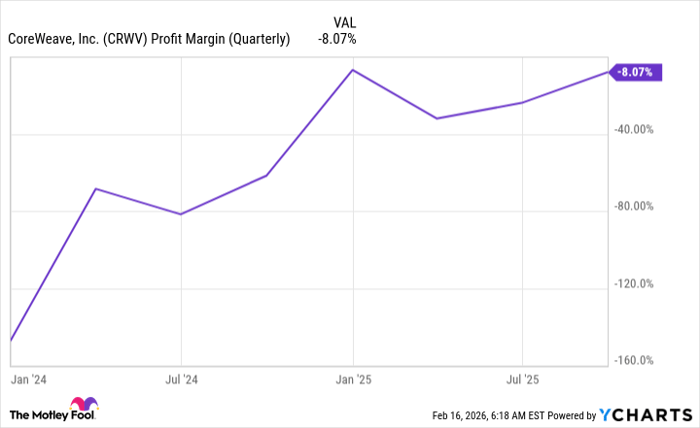

CoreWeave isn’t anywhere near posting profits and has losses each quarter, although this is getting better.

CRWV Profit Margin (Quarterly) data by YCharts

If CoreWeave can produce a profit throughout 2026, don’t be surprised if the stock soars. If it fails to make a profit, investors may be a bit wary, and the stock could go in reverse. Time will tell what happens, but with massive AI demand and limited computing hardware, I think CoreWeave has great odds to be a successful investment this year.

Should you buy stock in CoreWeave right now?

Before you buy stock in CoreWeave, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CoreWeave wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 18, 2026.

Keithen Drury has positions in Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.