NVIDIA Corporation NVDA is set to report its fourth-quarter fiscal 2026 results on Feb. 25, and it would be no surprise if the company reaches another sales milestone and surpasses the $65 billion target. NVDA has been setting new sales records for the past few quarters. In the last reported financial results for the third quarter of fiscal 2026, its revenues reached a new record of $57.01 billion, reflecting a 62% year-over-year increase.

NVIDIA is optimistic that the growth momentum will continue as it again targets record revenues of $65 billion in the fourth quarter. The key driver behind this outlook is its booming data center business, which continues to power the company’s growth amid the global buildout of artificial intelligence (AI) infrastructure. In the third quarter of fiscal 2026, the data center business unit reported $51.22 billion in revenues, up 66% from last year.

The segment reached new highs as demand for accelerated computing, generative AI, and large-scale model training continued to rise across cloud providers and enterprise customers. Much of the momentum came from the rapid adoption of the GB300 platform and wider deployment of NVIDIA’s networking products, including NVLink and Spectrum-X. With hyperscalers racing to expand AI capacity, NVIDIA remained a key beneficiary of record spending on high-performance infrastructure.

The near-term outlook still appears solid, with the company expecting further strength from Blackwell shipments and expanding orders across cloud, sovereign AI and enterprise AI projects. NVIDIA also sees the growing adoption of agentic AI, long-context workloads and advanced inference systems, all of which depend on high-performance graphics processing unit clusters, as key catalysts for long-term growth. The Zacks Consensus Estimate for the data center segment’s fourth-quarter revenues is pegged at $58.72 billion, indicating a year-over-year increase of 65%.

The growing demand for the company’s AI chips used in data centers is likely to continue aiding its overall top-line performance. Analysts’ projections also suggest that the company is expected to surpass the fourth-quarter sales target of $65 billion. The Zacks Consensus Estimate for fourth-quarter fiscal 2026 revenues is currently pegged at $65.56 billion, calling for a year-over-year surge of 66.7%.

NVIDIA’s Competitors in the AI Data Center Space

Advanced Micro Devices, Inc. AMD and Intel Corporation INTC are two major companies that are competing closely with NVIDIA in the AI data center space.

Advanced Micro Devices is gaining traction with its MI300 series accelerators, which are designed to handle training and inference for large AI models. AMD’s chips have attracted interest from major cloud providers seeking diversification beyond NVIDIA’s ecosystem. While Advanced Micro Devices’ software stack is still developing, its performance and pricing advantages make it a credible alternative.

Intel is also reasserting its presence with the Gaudi series of AI accelerators. The company is positioning Gaudi3 as a cost-effective and scalable option for AI data centers, targeting enterprise clients looking for flexibility. Intel’s broad reach in CPUs and server infrastructure helps it integrate AI solutions more easily into existing systems.

NVIDIA’s Price Performance, Valuation and Estimates

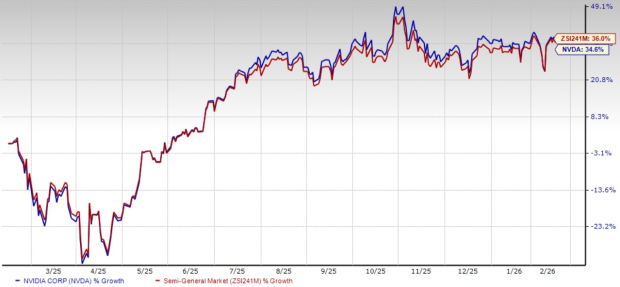

Shares of NVIDIA have risen around 34.6% over the past year compared with the Zacks Semiconductor – General industry’s gain of 36%.

NVIDIA One-Year Price Return Performance

Image Source: Zacks Investment Research

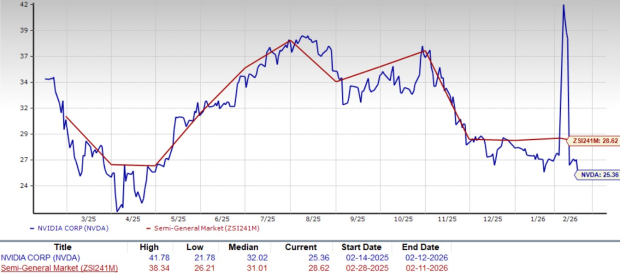

From a valuation standpoint, NVDA trades at a forward price-to-earnings ratio of 25.36, below the industry’s average of 28.62.

NVIDIA Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for NVIDIA’s fiscal 2026 and 2027 earnings implies a year-over-year increase of approximately 55.9% and 57%, respectively. Estimates for fiscal 2026 have remained unchanged at $4.66 per share in the past 60 days. Earnings estimates for fiscal 2027 have been revised upward by 2 cents to $7.32 per share in the past 30 days.

Image Source: Zacks Investment Research

NVIDIA currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the “first wave” of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks’ AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.