Key Points

-

ASML is the world’s sole provider of EUV lithography machines, which are vital to advanced semiconductor production.

-

The company had consistent and large revenue growth over the past decade.

-

The entire tech industry is reliant on semiconductors and therefore on ASML.

- 10 stocks we like better than ASML ›

In all the talk about artificial intelligence (AI) and semiconductors, there’s one company that I don’t see mentioned often despite the fact that the entire technology industry is reliant upon its products.

It’s called ASML Holding N.V. (NASDAQ: ASML) and it’s one of the only companies that can be described accurately as a monopoly.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

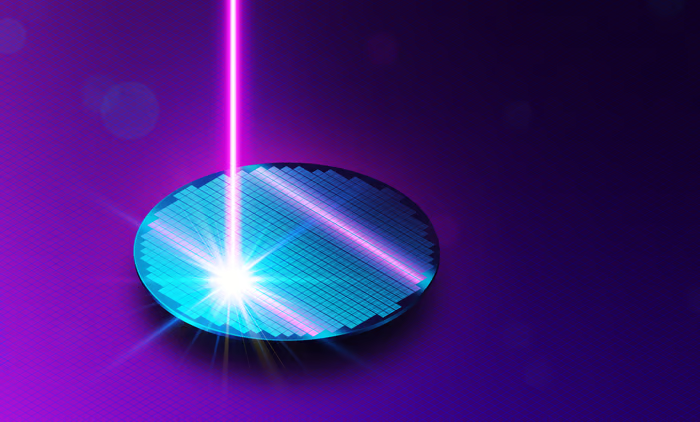

All modern technology is reliant on semiconductors, not just AI. And ASML stands alone as the world’s only producer of the advanced lithography machines needed to produce the best semiconductor chips.

Image source: Getty Images.

One of a kind

Perhaps the most surprising thing about ASML is that it’s based in the relatively small town of Veldhoven in the Netherlands. And despite its humble home base, ASML effectively has a monopoly on the equipment needed to make advanced semiconductor chips.

Everyone from Nvidia (NASDAQ: NVDA) to Taiwan Semiconductor Manufacturing (NYSE: TSM) to Microsoft (NASDAQ: MSFT) is directly or indirectly reliant on this singular company in the Netherlands.

ASML is the sole provider of extreme ultraviolet (EUV) lithography machines. And you need an EUV lithography machine if you want to make the most advanced semiconductor chips that all the cellphones, computers, data centers, weapons systems, and electric vehicles rely on.

There are competitors in the broader lithography market but they can only compete with ASML in the less advanced deep ultraviolet (DUV) type of lithography machines, which cannot manufacture as sophisticated chips as the EUV machines.

And in case you were thinking of opening your own semiconductor factory, each EUV lithography machine is roughly the size of a bus and can cost as much as $400 million.

So, what does the balance sheet of an effective monopoly look like? It’s pretty impressive.

The quiet monopoly

ASML, despite seeing a slight dip in sales for Q3 2025, is still up 97% since August of 2025 and is up just over 30% this year because everyone needs its machines. So a single quarter of down revenue isn’t likely to break its momentum. Plus, it still beat earnings for that quarter.

Besides, in the long term, ASML is an incredibly consistent revenue growth machine. Over the past decade, its revenue has grown at a compound annual growth rate of 17.6%. And being the only game in town for a technology everybody needs is also incredibly profitable. ASML has a gross margin of 52.7% and a net margin of 29.38%.

The company also holds cash reserves of just over 6 billion euros, which is almost more than twice its 3.16 billion euros in debt. And that means it has plenty of cash to continue paying and raising its dividend.

Admittedly, the dividend doesn’t yield that much because of ASML’s 1,400% return over the past decade. That’s a bull run that shows no signs of stopping. It only yields 0.54% but ASML has grown its dividend for 10 years running and over the past five years, it has grown it at a rate of 22.92%.

It goes without saying that with a return of 81.9% in the past 12 months, ASML has positively trounced the return of the S&P 500 just as it has done for several years now. And I think it will continue to outperform.

That makes it worth a look.

Should you buy stock in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 31, 2026.

James Hires has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.