Follow us today…

The global automotive landscape has reached its “Rubicon” moment. For decades, the industry operated under the assumption that Western engineering and Japanese efficiency would forever dictate the terms of global mobility. That era officially ended this week. The International Energy Agency (IEA) released its definitive 2026 report, confirming a statistic that has sent shockwaves through boardrooms from Dearborn to Wolfsburg: China now produces 70% of all electric vehicles sold globally.

This is no longer a “emerging trend” or a “competitive threat.” It is a fundamental restructuring of the world’s largest manufacturing sector. The IEA data shows that the Chinese industrial machine has transitioned from a fast-follower to a global hegemon, leaving Western legacy automakers in a defensive crouch, shielded only by thinning layers of protective tariffs and brand nostalgia.

The 70% Reality: More Than Just Subsidies

The IEA’s confirmation that China has reached a 70% share of global EV production is the result of a twenty-year master plan. While the West debated the viability of hydrogen and the longevity of the internal combustion engine, Beijing secured the entire “dirt-to-dashboard” pipeline.

By controlling the refining of 80% of the world’s battery minerals and 60% of battery component manufacturing, China created a cost advantage that is now insurmountable through traditional means. Companies like BYD and Xiaomi are not just benefitting from state support; they are benefiting from an integrated vertical supply chain that allows them to iterate three times faster than Ford or Volkswagen. In early 2026, we are seeing Chinese brands launch new models every 12 to 18 months, while Western “Gen 3” platforms are still mired in four-year development cycles.

What Western Carmakers Must Do to Survive

To prevent being entirely forced out of the market, Western manufacturers cannot rely on the 100% tariffs currently imposed by the U.S. or the steep price floors set by the EU. Protectionism is a bridge, not a destination. To survive the next decade, Detroit and Europe must execute three radical shifts:

1. Abandoning the “Legacy Premium” Strategy For too long, Western makers have treated EVs as luxury items with high price tags to protect their ICE margins. They must now embrace “Cost Radicalization.” This means adopting Lithium Iron Phosphate (LFP) chemistry—a space China currently dominates—and redesigning vehicles for extreme manufacturing simplicity. If they cannot produce a $25,000 EV that is profitable, they will lose the middle class entirely.

2. Software-Defined Everything The current battleground isn’t horsepower; it’s the Software-Defined Vehicle (SDV). Chinese EVs are increasingly viewed as mobile living spaces with seamless digital ecosystems. Western makers are still struggling with buggy infotainment and fractured over-the-air (OTA) update capabilities. They must stop being “car companies that use software” and become “software companies that build cars.”

3. Supply Chain Sovereignity The West must decouple its battery reliance from China. This requires massive investment in solid-state battery technology and domestic mineral processing. Without a non-Chinese supply chain, Western makers are essentially just “white-labeling” Chinese innovation.

Will the West Actually Make These Changes?

The likelihood of a successful Western pivot is, frankly, a coin toss. While companies like Stellantis have begun aggressive cost-cutting measures and BMW is betting heavily on its Neue Klasse architecture, the cultural inertia of legacy auto is a powerful anchor.

Western carmakers are currently caught in a “Death Loop”: they need ICE profits to fund the EV transition, but as EV prices drop due to Chinese volume, the resale value of ICE cars is plummeting, eroding the very capital needed for the shift. Furthermore, the labor costs in the U.S. and Europe, while socially vital, make it nearly impossible to compete on price with a Chinese workforce that is increasingly automated and vertically integrated. We are likely to see a “Great Consolidation,” where only two or three major Western brands survive as high-volume players, while the rest pivot to niche luxury or vanish entirely.

The Timeline: When Does China “Own” the World?

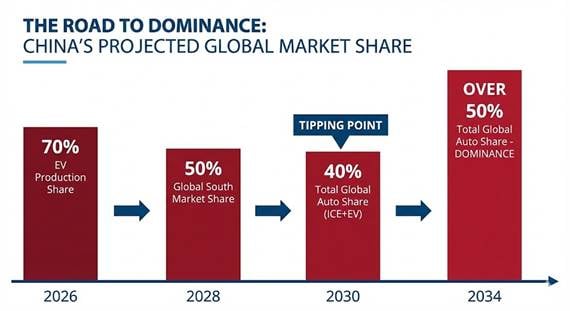

If the IEA’s 70% production figure is the milestone for 2026, the timeline for total market ownership is shorter than most analysts predicted. “Owning” the market doesn’t mean every car is a Chinese brand; it means China dictates the price, the technology standards, and the supply chain for the entire industry.

- 2027-2029: The Global South Pivot. While the U.S. and EU use tariffs to block Chinese cars, China will capture 80% of the market in Southeast Asia, Latin America, and Africa. By 2028, Chinese brands will likely account for 50% of all new car sales in these high-growth regions.

- 2030: The Tipping Point. By 2030, as global EV adoption is expected to hit 45-50%, China’s manufacturing lead will translate to a 40% share of the total global automotive market (ICE and EV combined).

- 2034: Total Dominance. Within the next eight years, if Western innovation does not leapfrog current battery tech, China will effectively “own” the world automotive market. At this point, even Western cars will likely be built on Chinese platforms or powered by Chinese “Black Box” software and batteries.

The Ecosystem Gap

The most significant advantage China holds in 2026 isn’t the battery; it’s the ecosystem. As Xiaomi targets 550,000 deliveries this year, they are proving that a smartphone manufacturer can build a better “smart car” than a traditional automaker.

Their vehicles are fully integrated with the user’s home, office, and personal devices. In contrast, Western automakers are still fighting to keep Apple CarPlay and Android Auto as the primary interface because their own software suites are insufficient. This digital gap is the “silent killer” of the Western auto industry. Consumers under 30 prioritize digital integration over “driving dynamics,” a shift that plays directly into China’s hands.

Wrapping Up

The IEA report confirming China’s 70% production share is a final warning for the Western automotive establishment. The era of “business as usual” is dead. To avoid being marginalized, Western carmakers must stop relying on government protection and start out-innovating their Eastern rivals in software, battery chemistry, and manufacturing efficiency. The window for this transition is closing rapidly. If Detroit and Stuttgart cannot bridge the “value gap” by 2030, the global automotive crown will not just be shared with China—it will be permanently surrendered.

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.

Follow us today…