A little over half of Americans (56%) have less than $2,000 in savings, according to a 2024 Forbes survey. One in five Americans (20%) doesn’t have savings at all.

Read Next: The No. 1 Key To Wealth, According To Wahei Takeda, the ‘Warren Buffett of Japan’

Learn More: 10 Genius Things Warren Buffett Says To Do With Your Money

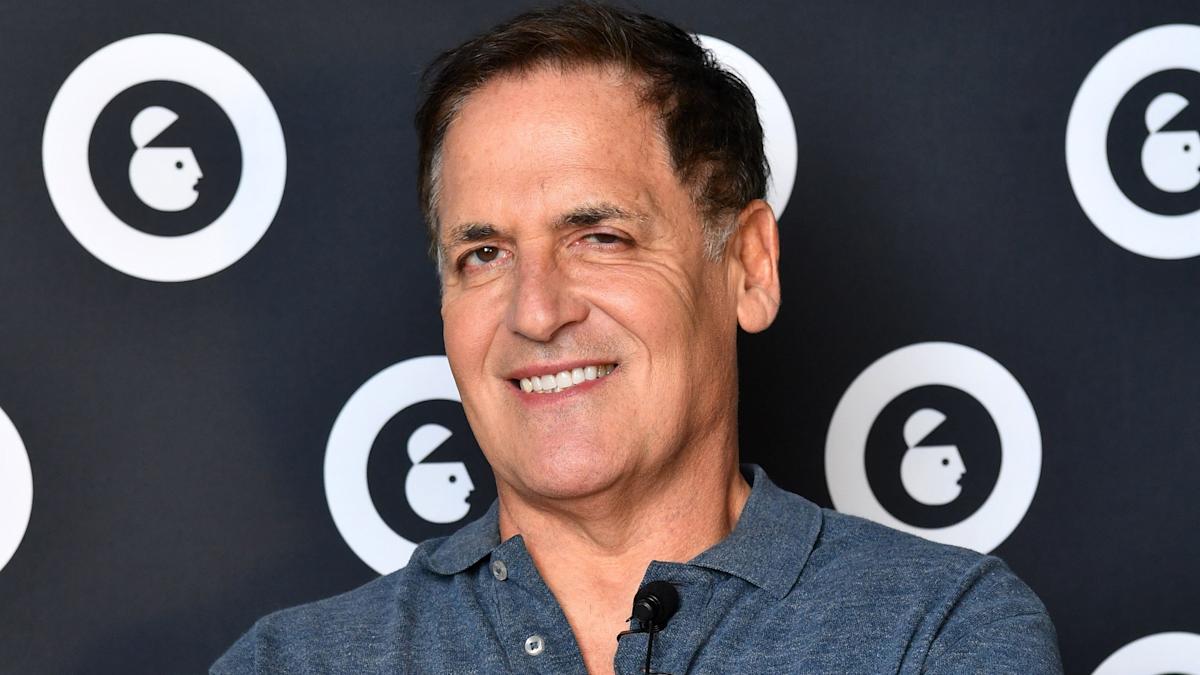

While saving is important, it’s not the only way to build wealth. In fact, billionaire Mark Cuban argues that you shouldn’t just save — you should invest instead. GOBankingRates broke down Cuban’s advice on prioritizing investing your money over saving it.

According to Mark Cuban, saving isn’t the best way to make your money work for you. The top 1% doesn’t just save. They aggressively invest in things like real estate and alternative assets (like gold IRAs).

A 2025 CAIS-Mercer study supports this idea. Of the financial advisors surveyed, 92% said they allocate their funds to alternative investments. Nearly all of them (91%) said they intend to increase allocations in the future.

Leaving your money in a savings account, even one with higher-than-normal yields, might not be the best idea. After all, those yields may not even keep up with inflation. This means the value of your savings might fall rather than rise (depending on the account and how much you’re contributing).

But you might still want to have a little saved for emergencies.

“Every individual should have [three to six] months of lifestyle expenses in savings — a checking account and a high-yield money market account. Once they have this money in savings, they should start investing,” said Richard Craft, CEO of Wealth Advisory Group.

You can save money for short-term goals — anything that takes under a year. But if you have long-term goals — anything over a year — investing is generally smarter.

For You: I’m Retiring a Multimillionaire: Here’s What I Wish I Knew in My 30s

Say you have a savings account with 4.00% APY and a $50,000 balance. After one year, you’d have roughly $52,000. In 10 years, you’d have around $74,000. This assumes nothing changes in that account — no withdrawals, deposits or changes in yield.

Now, say you invest $50,000 in the stock market instead. According to Investors.com, the stock market has seen an average annual return of 10.8% over the past decade. Assuming average returns and no additional contributions, you’d have nearly $140,000 after 10 years.

That’s nearly double — all because you invested. When you think even longer term, you could potentially be losing out on a lot more than that.