Key Points

Nvidia (NASDAQ: NVDA) has been a top stock to own over the past few years, but its climb has slowed recently. Since Aug. 1, 2025, it has risen by a mere 5% compared to the S&P 500‘s (SNPINDEX: ^GSPC) gains of about 10%. Moreover, if you look at what’s going on in the artificial intelligence (AI) realm, that weak performance may be a bit baffling.

Nvidia has posted excellent results twice since then and has given jaw-dropping projections regarding the future of the AI buildout. I think that the market has grown a bit weary of the GPU giant, even though all signals point to it continuing to be an excellent investment. Nvidia has given investors more than 3 trillion good reasons to like the stock since August, and I’d suggest loading up on it before the rest of the market regains its optimism.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Image source: Nvidia.

The AI buildout is just getting started

Recently, much of the talk in the AI world has been focused on the capital expenditure guidance given by Amazon, Alphabet, and Meta Platforms for this year. These three companies alone expect to lay out at least $500 billion in capital expenditures during 2026. That’s a massive increase from 2025’s levels, and Nvidia will be one of the primary beneficiaries of that spending. However, the stock hasn’t budged.

Another bullish indicator for Nvidia is the expected growth in global data center capital expenditures. By 2030, the chipmaker is forecasting that global data center capital expenditures will reach $3 trillion to $4 trillion annually. That’s huge growth, and if Nvidia can maintain its market share, it will deliver huge revenue growth over that period.

In 2025, the company estimated that this spending would be around $600 billion. Wall Street analysts expect to hear that Nvidia generated $213 billion in revenue during its fiscal 2026, which ended in January. That means Nvidia was the recipient of about a third of all data center capital expenditures, based on its current share of the AI accelerator market. If it can maintain that market share and the market grows in line with the company’s estimates, it could be looking at $1 trillion in high-margin revenue.

That alone would be reason to invest, yet Nvidia’s stock has barely moved in the past six months.

Another catalyst that’s coming is the resumption of sales to China. With a framework in place that will allow Nvidia to export graphics processing units (GPUs) to China again, it has regained access to the second-largest AI market in the world.

Given that the stock has barely moved in response to all these business tailwinds, it’s time for investors to take advantage. Nvidia rarely trades at levels this cheap, and you’ll be kicking yourself months from now for not buying more.

Nvidia’s stock is cheap for its growth

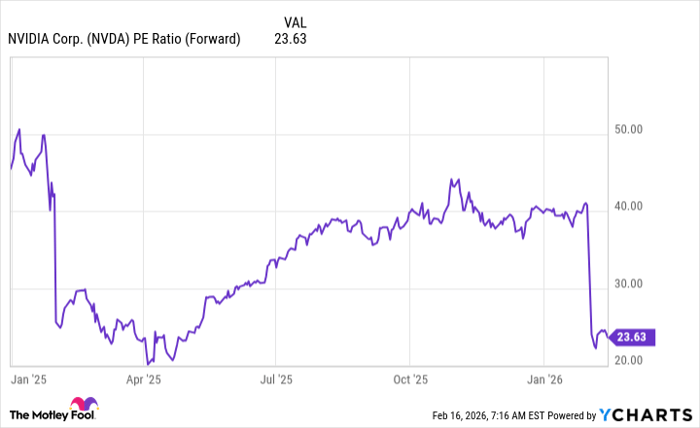

At less than 24 times forward earnings, the stock looks like a bargain relative to the growth the company expects to deliver over the next five years.

NVDA PE Ratio (Forward) data by YCharts.

For reference, the S&P 500 trades at about 21.9 times forward earnings, so Nvidia’s premium is minor. Deals like this don’t come around often, and with all the spending coming down the pipeline, the reasons to expect an upward trajectory for Nvidia’s stock couldn’t be clearer.

As a result, I think investors should load up on Nvidia stock. The company will report its fiscal 2026 Q4 results after the close of trading on Feb. 25, and I think the session that follows could be a huge one for the stock. Buying before then makes a ton of sense. If you wait until after, you’ll regret it.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 19, 2026.

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.