Xpeng (HKG: 9868) has surpassed Li Auto (HKG: 2015) in market capitalization as the two companies have demonstrated starkly different growth trajectories this year.

At press time, Xpeng rose 3.07 percent to HK$87.3 per share in Hong Kong, with a market cap of HK$166.3 billion.

Li Auto, however, fell 2.03 percent to HK$81.9 per share, with a market cap of HK$165.3 billion.

Nio Inc (HKG: 9866) remains the smallest by market cap among China’s EV trio, valued at HK$135 billion.

For most of the past two years, Li Auto held the highest market cap among the three companies due to its strongest vehicle deliveries and financial performance.

However, this year has seen significant changes.

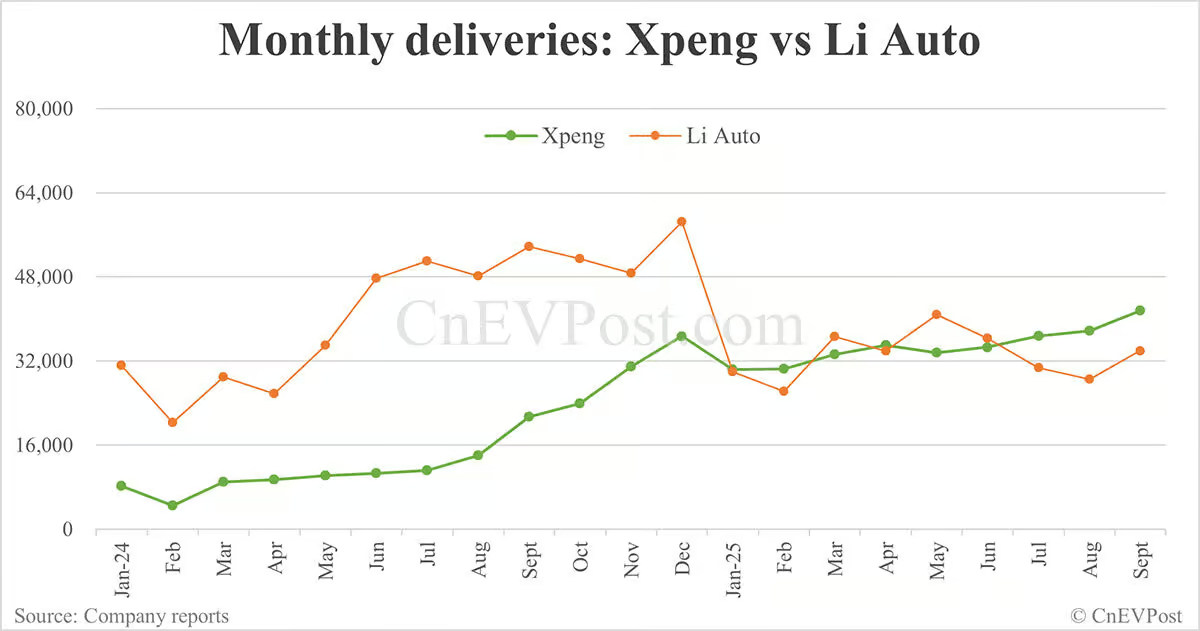

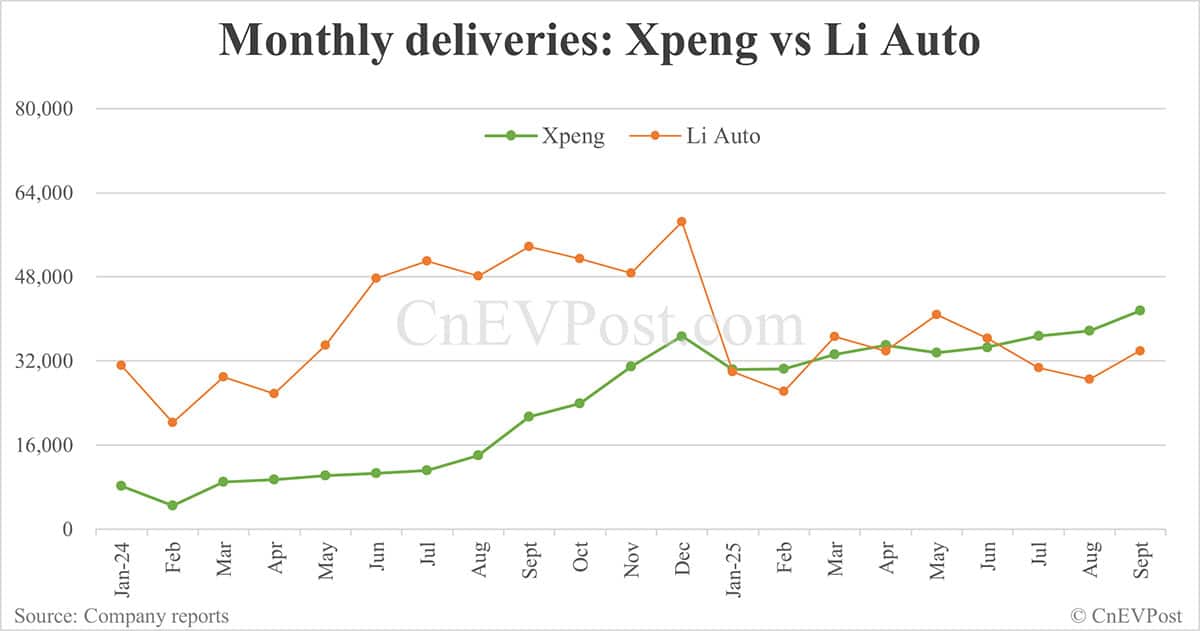

Li Auto’s deliveries have continued to show weakness, with its main L-series extended-range electric vehicle (EREV) models experiencing sustained sharp declines. Meanwhile, its new Li i8 and Li i6 models are still in the production ramp-up phase.

The company delivered 33,951 vehicles in September, a 36.79 percent year-on-year decline, marking the fourth consecutive month of year-on-year contraction.

Xpeng has maintained robust growth this year, delivering 41,581 vehicles in September — its third consecutive record-high monthly figure.

From January to September, Li Auto delivered 297,149 vehicles, down 13.07 percent year-on-year, while Xpeng delivered 313,196 vehicles during the same period, surging 217.77 percent year-on-year.

Nio’s performance was tepid in the first half of this year, but began seeing robust growth following the July 31 launch of its sub-brand Onvo’s flagship SUV, the L90, and the September 20 launch of the third-generation Nio ES8.

The company delivered 34,749 vehicles in September, marking its second consecutive record month with a 64.06 percent year-on-year increase and an 11.00 percent rise from August.

From January to September, Nio Inc delivered 201,221 vehicles, up 34.79 percent year-on-year.

Last week, Nio Inc delivered 10,300 vehicles, exceeding 10,000 units for the second consecutive week.