Key Points

Nvidia (NASDAQ: NVDA) has been one of the best stocks to own since 2023. It outperformed the market every year over that period, but 2026 could present some new challenges. The narrative around the artificial intelligence (AI) infrastructure buildout and Nvidia’s dominance in the AI-accelerator chip niche is changing, which could have implications for its stock performance next year.

Many investors who have held the stock for a while are sitting on monster gains. But is it time for folks to take those profits and move on from Nvidia, or is it just getting started?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

All indications point toward more growth

Nvidia makes graphics processing units (GPUs) and other hardware and software to support them. It has been the leading maker of such chips by far for many years, which made it the top dog in the AI accelerator space when demand for such hardware skyrocketed. However, some rivals are stepping up their challenges.

Fellow GPU maker AMD recently announced a partnership with OpenAI to provide it with 6 gigawatts of computing power. (For reference, Nvidia’s deal with OpenAI is for 10 gigawatts). Meanwhile, Broadcom has been making headway by collaborating with several hyperscalers to design custom AI accelerators for more narrowly defined purposes. Among these application-specific integrated circuits (ASICs) are Alphabet‘s Tensor Processing Units, which it has been installing exclusively in its own data centers. However, according to recent news articles, Alphabet is allegedly in talks to sell some TPUs to Meta Platforms — one of Nvidia’s largest customers.

All of this has some investors worried that Nvidia may be losing its dominance in AI. However, I don’t think that’s happening. CEO and founder Jensen Huang noted during the Q3 earnings announcement that it is “sold out” of cloud GPUs. Some AI hyperscalers may be sending some business to alternative computing providers simply because they can’t get all the computing power they need from Nvidia.

So, the narrative shouldn’t be that Nvidia is losing its dominance; it’s that Nvidia is avoiding overextending itself. This should be welcomed, as its shareholders were previously burned when the company overextended itself twice during cryptocurrency bull markets. (GPUs are also well suited for mining proof-of-work cryptos, and were in high demand for that purpose.)

The overall market for artificial intelligence computing devices is massive, and it’s OK if Nvidia doesn’t capture all of it. After all, it expects global data center capital expenditures to rise to a range of $3 trillion to $4 trillion annually by 2030.

But will all of this add up to a stock that outperforms the market in 2026?

The AI buildout continues

All of the AI hyperscalers have informed their investors that they should expect record-setting capital expenditures again in 2026. Wall Street analysts have built those forecasts into their expectations for Nvidia: The average analyst projects 48% sales growth in its fiscal 2027, which will end in January 2027. It would be hard for a stock to underperform the market while posting results like that, unless it was previously drastically overvalued.

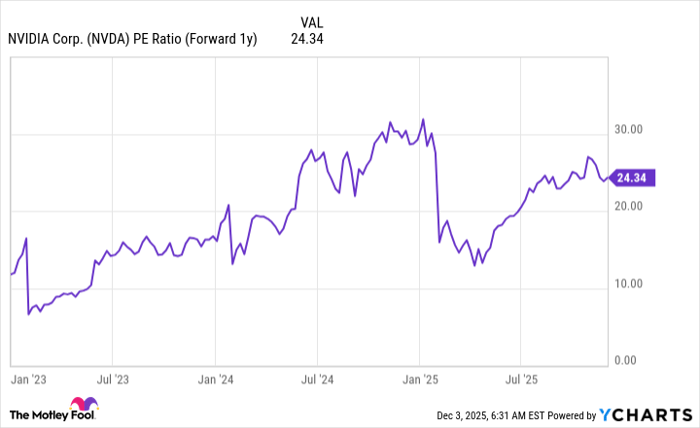

Nvidia’s stock trades for 24 times next year’s earnings. That isn’t necessarily cheap, but it’s not terribly expensive either.

NVDA PE Ratio (Forward 1y) data by YCharts.

Compared to AMD and Broadcom, which trade for 33 and 30 times next year’s earnings, respectively, Nvidia does look cheap. It’s also the second-cheapest “Magnificent Seven” stock by this metric.

Unless something drastic happens that changes the spending plans of data center operators, I think Nvidia will outperform the market again in 2026. And with the stock down by more than 10% from its recent high, this could be a perfect time to buy shares.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 1, 2025

Keithen Drury has positions in Alphabet, Broadcom, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Meta Platforms, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.