(Bloomberg) — Faced with a moribund share sale outlook and emboldened by their growing recognition on the global stage, some Chinese biotechnology companies have found a new way to cash in on their innovative therapies.

Most Read from Bloomberg

They’re partnering with American venture capitalists to create new, US-based startups built around promising drug compounds, ensuring that they get a healthy payoff should those therapies succeed. The approach is also allowing them to side-step geopolitical tensions that hang over Chinese drug companies’ entry into Western markets.

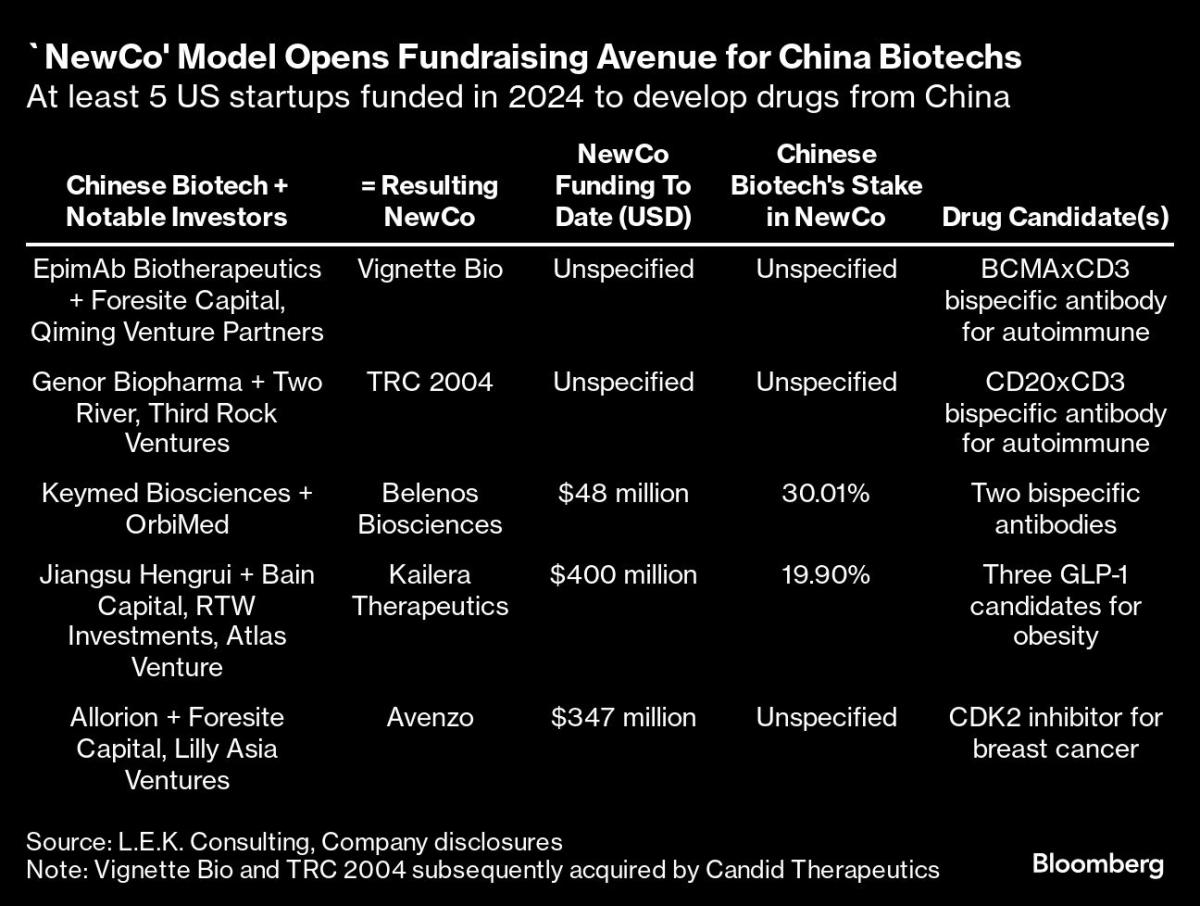

The route, commonly referred to as a NewCo arrangement, has led to at least five new US-based companies so far in 2024, compared to only two in existence before this year, according to consultancy L.E.K. Consulting.

“This is one of the most active discussions with biopharmas in China and also with venture capitalists and entrepreneurs,” said Helen Chen, a greater China managing partner and healthcare co-head of L.E.K. Consulting based in Shanghai. “With the eye-opening deals that had been announced, even those who weren’t thinking about this previously may now be approached by those putting together the deals.”

The new model springs from a desperate funding environment for Chinese biotechs, which ironically are struggling to find fresh liquidity just as they’re starting to break through in potential treatments for everything from asthma to weight loss. Although the Hong Kong stock exchange’s 2018 reforms briefly sparked a rally for pre-revenue biotechs, dismal stock performances have since diminished investor interest and essentially shut the window for initial public offerings.

The NewCo approach offers these companies an alternative path to funding, instead of just directly licensing assets to large Western pharmaceutical companies — another popular route for going overseas but one that can limit their involvement in their drugs’ development and exposure to future rewards.

The experience of Jiangsu Hengrui Pharmaceuticals Co., one of China’s largest drugmakers, shows the evolving nature of dealmaking. The company, which sold ex-China rights of its asthma drug in 2023 to then newly created Aiolos Bio Inc. for $25 million upfront, missed out on a payday when GSK Plc subsequently acquired Aiolos for as much as $1.4 billion.

Wiser from that experience, Hengrui made sure it retained a nearly 20% stake when a new company, called Kailera Therapeutics, was created this year around several of its GLP-1 weight-loss drug candidates. Hengrui also got $110 million in upfront fees for licensing the compounds to Kailera, which launched with $400 million in funding from Bain Capital, RTW Investments LP and others.

For overseas investors, the NewCo model opens up a creative way to capitalize on science coming out of China, while allowing the Chinese firms to leverage their Western partners’ expertise and networks required to speed up clinical studies and engage in deal talks.

“If pharma is finding compelling assets to bring into their pipelines, then obviously you could do the same thing, but build new companies around them,” said Roderick Wong, chief investment officer at RTW. The Hengrui deal was competitive with “multiple players,” he added.

Building a global biotech business and taking it public in China “is not really a practical thing for 99 out of 100 companies right now,” Wong said.

NewCo spinout deals, which tend to carry more sophisticated structures than traditional licensing deals, are not new to the broader biopharma world. The likes of Pfizer Inc. and AstraZeneca Plc have reaped handsome payouts when startups seeded with assets from their pipelines subsequently went public or got sold. To some observers, NewCo deals in China signal the maturing of its biotech industry, where companies saddled with competitive assets are able to drive a hard bargain.

Marquee life science investors have been involved in such deals, including OrbiMed Advisors, Third Rock Ventures LLC, Qiming Venture Partners and Foresite Capital. In a sign of increasing investor appetite, two recently-formed, venture-backed companies that had separately licensed drugs from Chinese companies were quickly acquired by Candid Therapeutics Inc., which launched in September with a $370 million funding round.

“We think this trend reflects China companies’ willingness to become actively involved with global clinical development and their confidence about their assets’ overseas potential,” Linda Shu, head of China Healthcare Research at HSBC Holdings Plc, told Bloomberg.

In some cases, pharma and VC firms would bid on the same assets, leading to a faster deal process, said Wei Peng, a biotech investor who has facilitated multiple global collaborations. There are also instances of NewCos picking up early stage drug candidates passed over by multinational pharma companies, with the hopes of selling them later once the assets are further along.

“It’s a win-win situation for everybody,” Peng said.

Still, the path to returns may not always turn out to be lucrative like the GSK-Aiolos deal, caution industry watchers. Ultimately, the actual value for Chinese biotechs will hinge on the quality of the clinical data they generate in global trials.

“How long will this last will depend on whether we see good exits in a year or two, and then how good the Chinese assets continue to be,” said Chen of L.E.K.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.