U.S. stock index futures edged higher on Friday, recovering slightly from the previous session’s losses as investors awaited Federal Reserve Chair Jerome Powell’s address at the Jackson Hole Symposium for clues on the interest-rate path.

At the Wyoming research conference last year, Powell had promised to lower rates and support the job market when the unemployment rate started to rise, while in 2022, he underscored the Fed’s inflation-fighting rigor.

“Balancing the risks between a weakening labor market but without commensurate easing in wage growth and inflation will likely feature prominently in Powell’s Jackson Hole speech today,” Geoff Yu, EMEA macro strategist at BNY said in a note.

Powell’s comments, expected at 10 a.m. ET, could play a pivotal role in shaping the rate-cut expectations for September.

Traders now see a 71.3% chance of a 25-basis-point rate cut next month, down from a 85.4% chance a week ago, according to the CME FedWatch Tool.

Markets had initially ramped up the bets following a weak payrolls report at the start of August and after consumer price data showed limited upward pressure from tariffs.

Other Fed officials speaking on Thursday appeared not to be less keen on the idea of a rate reduction next month.

Earnings reports from big-box retailers earlier this week offered a mixed picture as investors sought fresh signals on the broader health of the American consumer amid ongoing tariff pressures.

Retail bellwether Walmart WMT reflected the concerns, with the CEO stating that tariff costs were increasing each week. Target TGT and Home Depot

HD were the other key names in focus.

Against this backdrop, all three main U.S. stock indexes are set for weekly losses, with the S&P 500 SPX and the Nasdaq

IXIC on pace for their worst weekly showing of the month.

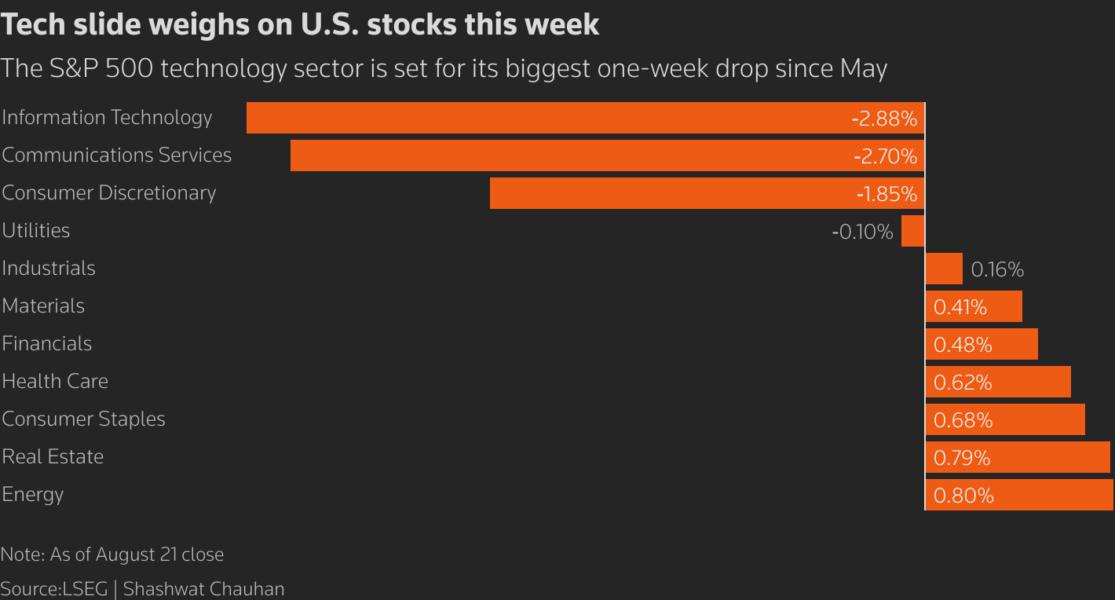

The S&P 500 took its string of losses to a fifth straight day on Thursday. A broad-based selloff in heavyweight technology stocks has kept U.S. equities pressured this week.

Information technology S5INFT is the week’s worst hit sub-sector, while energy

SPN and real estate

S5REAS are on track for mild weekly gains.

At 07:10 a.m. ET, Dow E-minis (YMcv1) rose 150 points, or 0.33%, S&P 500 E-minis ES1! gained 16.75 points, or 0.26%, and Nasdaq 100 E-minis

NQ1! added 54.5 points, or 0.23%.

Among top movers, Nvidia NVDA slipped 1% in premarket trading after reports the chipmaker has asked Foxconn

2317 to suspend work on the H20 AI chip, the most advanced product the company is permitted to sell to China.

Google-parent Alphabet GOOG gained 1.1% after reports the company has struck a six-year cloud computing deal with Meta Platforms

META worth more than $10 billion. Meta shares last rose 0.2%.

Intuit INTU fell 5.7% after the TurboTax-maker forecast first-quarter revenue growth below analysts’ estimates due to sluggish performance at its Mailchimp marketing platform.

Workday WDAY shed 5.3% after the human resources software provider provided an in-line outlook for the current quarter.