It was just a few months ago that Elon Musk could have reasonably been described as the most influential person in America, not just the main character on Twitter but a human daisy cutter slashing his way through the federal government. If you haven’t been paying attention to tech news, you might have missed the fact that Musk seems to be facing some rather hard times, even as he continues to insist that everything is going great and he will ascend to even greater heights before you know it.

Here’s what’s going on with him lately:

-

Musk is engaged in an ongoing feud with acting NASA administrator Sean Duffy over delays in SpaceX’s work for future NASA missions, which naturally Musk has made as personal and angry as possible.

-

Tesla’s profits dropped 37% in the third quarter of the year despite a bump in vehicle sales as consumers rushed to beat the expiration of EV tax credits.

-

In response to the end of the credits, Tesla unveiled slightly cheaper and slightly crappier versions of its Model Y and Model 3. Other than the spectacular failure of the Cybertruck, it hasn’t released a new model in years, which doesn’t exactly position it as a company on the bleeding edge of innovation.

-

Tesla’s robotaxi rollout in Austin has been underwhelming; only about 30 of the taxis are in operation, and they still have drivers in the front seat for safety. Musk says that by year’s end they will be fully autonomous, but his predictions have a way of not coming true. In any case, Tesla is way behind Waymo in this sector, suggesting that the robotaxi project will never amount to anything like what Musk has said it would.

-

Tesla recently rolled out “Mad Max” mode in its self-driving features, which will engage in rapid acceleration and swerving between lanes. Sounds like a great idea that couldn’t possibly have any negative consequences! Naturally, safety regulators are concerned.

-

Musk is trying to get Tesla shareholders to approve what would be a $1 trillion pay package, though it is highly unlikely that it will ever amount to that much, since it depends on outlandish production and sales targets.

There are still plenty of Musk fanboys out there, convinced that he is a genius of historic proportions who can do anything he sets his mind to. On the other hand, there are people who have seen his X feed and know that while he has some considerable talents, he’s also an insecure, erratic, hateful, bigoted, juvenile little man-baby who isn’t nearly as smart as he thinks he is, especially when he ventures outside his areas of actual expertise. Which is exactly what we saw when he rampaged through the government, saved almost no money for all the damage he did, and then ran away from the wreckage he had created.

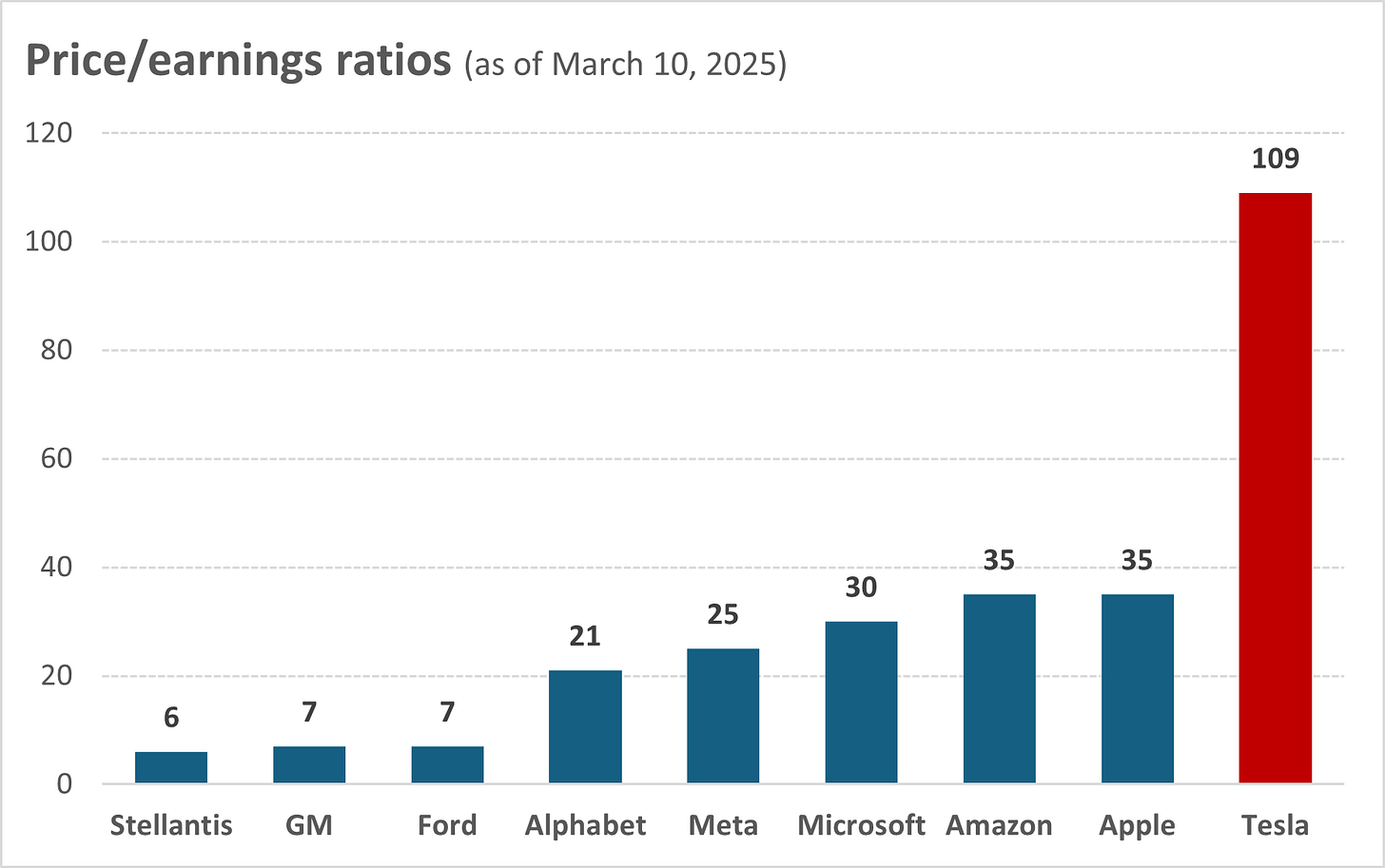

Back in March I wrote a post about the DOGE-driven backlash against Tesla and argued that it is basically a meme stock. To illustrate, I made a chart comparing Tesla’s price/earnings ratio to that of its peers in both the auto and tech industries. The P/E ratio compares a company’s stock price to the amount of money it’s actually making; while it isn’t a perfect measure of whether a stock is overvalued, it can be quite suggestive. If a company has a huge P/E ratio, it can mean that while it isn’t making much money now, investors foresee that it will eventually become hugely profitable. Or it can mean that the stock is just overhyped. But Tesla does make money; it’s not like it’s a brand-new company with an untested product that might just go big if everything works out. For its P/E ratio to be justified, it would have to mean that in the future its profits will rise exponentially.

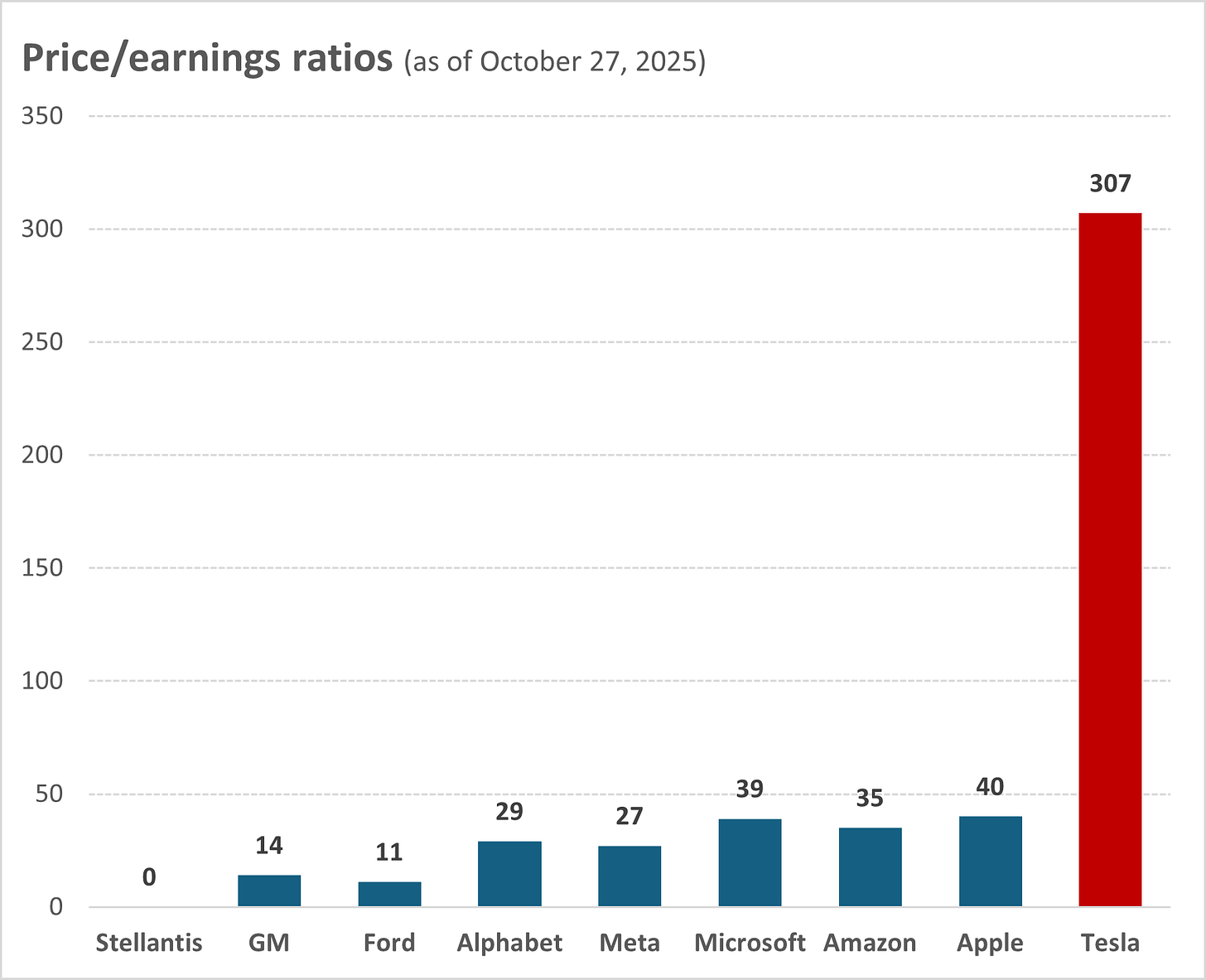

But now it’s even more dramatic:

I couldn’t really make the second graph to the same scale because it would have gotten too big, but Tesla’s P/E ratio has almost tripled. Sure, it goes up and down on a day-to-day basis, but it remains clearer than ever that Tesla is a meme stock. Its price – and therefore Musk’s wealth – is based not on real value but on hype, and investors’ faith in Musk to produce spectacular future profits.

But how is Tesla going to do that? It’s hard to know where the EV market will be in 10 years, but it’s almost impossible to believe that Tesla will ever regain the dominant position it once had. There are simply too many high-quality competitors, both in the U.S. and abroad, and the company seems to have pretty much stopped innovating.

But Musk has the answer: robots! Specifically, Tesla’s Optimus humanoid robot, which is still essentially in the experimental stage. Despite the fact that there are a thousand robot companies out there, Musk talks as though before long just about everyone on Earth will have an Optimus and there will be no meaningful competition, at which point Tesla will be making trillions of dollars and all humanity’s problems will be solved. I am not exaggerating:

He’s said that Optimus will upend the job market and free humanity from the drudgery of work. (“Working will be optional, like growing your own vegetables, instead of buying them from the store,” he posted this week.) Elsewhere on the investor call Wednesday, he said that Tesla’s robots would “actually create a world where there is no poverty, where everyone has access to the finest medical care.”

Optimus, he added, “will be an incredible surgeon, and imagine if everyone had access to an incredible surgeon.” For Tesla, Optimus will be “an infinite money glitch,” Musk said, arguing that everyone will want a humanoid robot who can do their work for them.

There’s a glitch alright, but it appears to be located in Elon Musk’s brain. Even in an industry that runs on absurd predictions of the glorious future to come, this is positively deranged.

Perhaps Musk will mount a dramatic comeback and surprise us all. Perhaps his AI company, xAI, will emerge as the dominant force in that sector (assuming there’s a universal demand for a chatbot that is being shaped according to Musk’s anti-woke ideology and at one point started calling itself MechaHitler). And he is still the richest man in the world (current estimated net worth: $428 billion), thought is mostly based on the insane price of Tesla shares. Nevertheless, it isn’t hard to imagine that Musk has begun what could be a dramatic fall.

Thank you for reading The Cross Section. This site has no paywall, so I depend on the generosity of readers to sustain the work I present here. If you find what you read valuable and would like it to continue, consider becoming a paid subscriber.