How’s the electric vehicle market doing in America so far this year? Well, that depends on what exactly you mean, and who you ask.

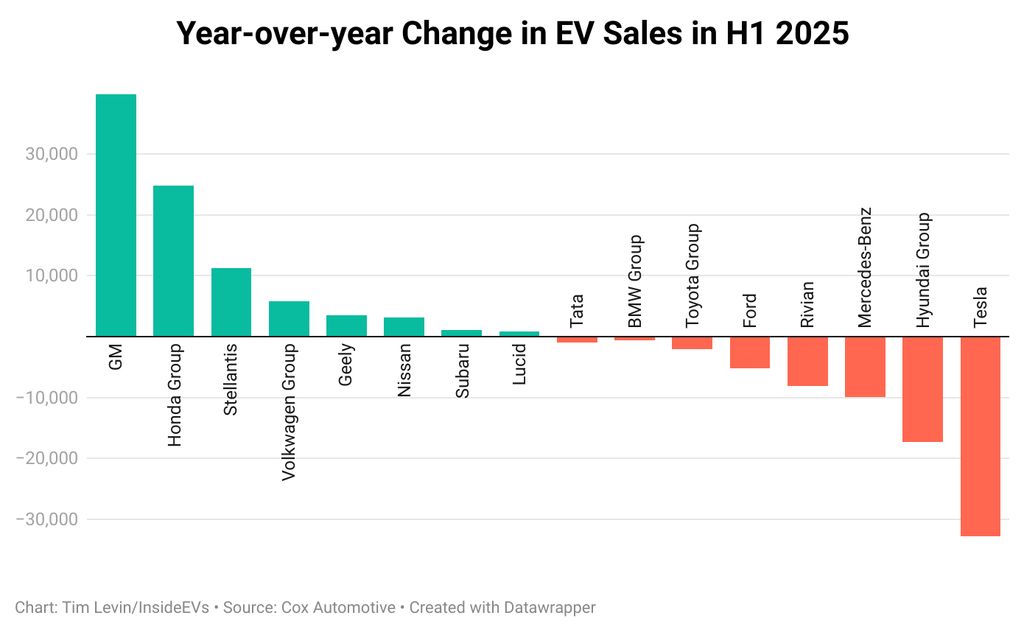

EV sales are up this half—but the most recent quarter isn’t looking so pretty. General Motors? Crushing it. Tesla? I probably don’t even have to say it at this point.

My point is: It’s a mixed bag. The clean car will not shrivel up and die under President Donald Trump, but getting Americans hooked on EVs isn’t proving to be a walk in the park either. And while EV sales generally trended upward for most companies in the past as the market exploded, in 2025 clear winners and losers are emerging.

So let’s break down the first half of EV sales in America, and what they could look like going forward.

What EV Sales Are Like In 2025

I’ll start with the glass-half-full view. EV sales got off to a strong start in the first quarter of this year, growing by more than 10% year-over-year, according to Cox Automotive. From January through June, EV sales rose 1.5% to roughly 607,000 units, a new first-half record.

Get a bit more granular, though, and the picture gets less rosy. In Q2, U.S. EV sales dropped by over 6%, according to Cox, to a little over 310,000 units from an estimated 332,000. That was only the third year-over-year decline on record, the firm said.

There are a lot of factors at play that could be dragging down sales, and some are company-specific. But some headwinds apply across the board, said Stephanie Valdez Streaty, director of industry insights at Cox Automotive.

There’s more work to be done on educating consumers on EVs, she said. There’s a lot of consumer unease around the economy and where prices are headed, especially with tariff bombs dropping left and right. It’s a lot harder to sell EVs to wary, everyday Americans than the tech-obsessed early adopters that lined up for Teslas in years past. Many of those people are leaning into increasingly popular hybrids instead.

Not to mention, EVs are simply a new and volatile market, and there are bound to be big swings as they gain traction.

“We saw really amazing growth in ‘23 to ‘24,” she said. “I think with any new technology, you have to expect that you’re going to have accelerations, decelerations. So I think this is part of it.”

One potentially troubling stat: EV sales fell in Q2 despite the introduction of over a dozen new models over the last 12 months. Those include the Cadillac Optiq, Volvo EX30 and America’s first electric muscle car, the Dodge Charger Daytona.

Average sales per EV model, according to Paren

Photo by: Paren

Of the 59 electric models that were on sale in Q2 2024, 50 experienced a decline in sales in Q2 2025, according to Loren McDonald, who tracks the EV industry as chief analyst at the charging data firm Paren. The average sales volume per EV model on the market has trended downward over the last year, his analysis found.

“As we get more models and the overall sales pie doesn’t grow that much, it means that the individual models are seeing more competition for the same buyers,” McDonald said.

Who’s Up In The EV Market?

The biggest success story so far this year has been General Motors. With a slew of new electric Cadillacs and Chevys on offer, it doubled its EV sales in Q2 and ended the quarter having moved over 78,000 units.

Its real hero was the Chevrolet Equinox EV, which has become a hit thanks to its low (for EVs, at least) $35,000 price point and healthy 319 miles of range. Through the first half of the year, the Equinox EV was the best-selling non-Tesla EV, racking up nearly 28,000 sales.

Photo by: Tim Levin/InsideEVs

Honda and Acura also posted big gains. They were basically non-factors at the beginning of last year and have been burning up the sales charts with the Prologue and ZDX, respectively. Valdez Streaty notes that the biggest winners in Q2, like these cars, probably benefited from hefty manufacturer incentives to boost sales. (In a way, this is another win for GM, since the Prologue and ZDX are built by the Detroit automaker using its platforms.)

Stellantis, parent to Chrysler, Dodge and Jeep, was up by over 11,000 units too. But that’s because it had no EV presence to speak of this time last year. The Charger Daytona and Jeep Wagoneer S just went on sale.

At the Volkswagen Group, strong sales of the new Porsche Macan EV and Audi Q6 E-Tron outweighed weaker sales for other models. And the Nissan Ariya crossover served as a boon to that brand as it awaits the next-generation Leaf.

Who’s Down In The EV Market?

Tesla, far and away the industry leader, saw the biggest drop. It sold 31,000 fewer EVs in the first half than it did during the same period last year, Cox said. What’s more, Tesla still makes up nearly half of America’s EV market, so its troubles (or successes) have an outsized influence on the broader picture.

If you take Tesla out of the equation, EV sales would’ve been up 14% year-to-date, Valdez Streaty said.

The refreshed Tesla Model Y.

Photo by: Tesla

Part of the drop was due to the rollout of the refreshed Model Y, Tesla said, which required factory downtime. But even once that crucial model was ramped up in Q2, the automaker couldn’t match last year’s sales. The Cybertruck, meanwhile, posted a 50% decline in sales year over year in Q2 as that proves to be an extremely niche offering.

It’s clearer than ever that what Tesla needs are new, widely appealing models—and that it needs to play by the same rules that have governed the auto industry for decades. Polling has also shown that Elon Musk’s politics have been repelling potential buyers.

“Like any car company, when you don’t have new products, you’re going to start to see competitors start to eat at that share,” Valdez Streaty said.

Photo by: Kia

The Hyundai Motor Group, which has been a real leader in the EV space, saw a big drop-off, led by Kia.

Kia’s electric sales were down by a whopping 53.5% or nearly 16,000 vehicles in the first half, according to Cox data. Earlier this year, Kia spokesperson attributed its decline to supply disruptions caused by model-year changeovers. The electric Kia EV6 has long been outpaced by its cousin, the Hyundai Ioniq 5; we’ll see if it can pick up more sales on the back half of this year.

“EV sales across the industry are experiencing a transitional phase as the market shifts from early adopters to mainstream buyers,” Hyundai spokesperson Ira Gabriel said. “While Hyundai’s EV sales were essentially flat in the first half of the year (-1%), our overall green vehicle sales, including hybrids and plug-in hybrids, grew 22% in H1 and 9% in Q2, reflecting strong consumer interest in electrified options.”

Gabriel added that Hyundai has no plans to delay EV rollouts or reduce production.” We believe in the future of EVs but also recognize that consumers are at different stages of adoption,” he said, noting that the company has seen success with its mix of powertrain options in America.

Mercedes-Benz saw its EV sales fall off by over 50% in the first half, per Cox, continuing a downward trend. That may be because its jelly-bean-shaped EVs haven’t exactly resonated in the marketplace—something the new CLA and electric G-Wagen could change. The company also said in a statement that new tariffs on imported cars hit its sales in the U.S.

Earlier today, a Mercedes spokesperson confirmed that the automaker would end production of the U.S.-made and U.S.-bound EQ cars, ahead of the end of the tax credits in September.

The new Mercedes-Benz CLA could help turn the brand’s EV sales around.

Photo by: Andrei Nedelea

Ford sold about 5,000 fewer EVs this year, amounting to an 11.8% drop. A spokesperson said that was due to a model-year changeover and a stop-sale on the Mustang Mach-E crossover. Valdez Streaty said it could also be because of Ford’s thin lineup that hasn’t changed in years: the Mach-E, the F-150 Lightning pickup and the commercial E-Transit van.

The Volkswagen brand posted a drop as well. The brand’s head of communications, Mark Gillies, noted to InsideEVs that the ID.4 lost federal EV tax credit eligibility in January and that the ID. Buzz van was hit with a recall. “The consumer uncertainty didn’t help, either,” he wrote in an email.

Rivian sold about 8,000 fewer EVs year-to-date. It lowered its delivery guidance this year due to Trump’s tariffs and the recent Los Angeles wildfires, which hit a key market. It expects its next phase of growth to come from the upcoming, more affordable R2 crossover.

What’s Next For The EV Market?

EV sales are all over the place for a myriad of reasons. Industry watchers in general expect slower growth in America’s EV market throughout the decade due to the Trump administration’s war on climate policies.

With various EV tax credits now set to end after September 30, Valdez Streaty expects a mad dash to buy and lease electric cars in Q3—followed potentially by a “collapse” in Q4. Cox Automotive estimates that EV sales in the U.S. will be flat this year, making up around 8.5% of the car market.

Until, of course, more affordable options appear in the U.S.

“We need vehicles that are affordable that have that price parity with their ICE counterpart,” she said, referring to internal combustion vehicles. “Once we have more options like that, I think that’s going to be the game changer.”

Contact the author: Tim.Levin@InsideEVs.com