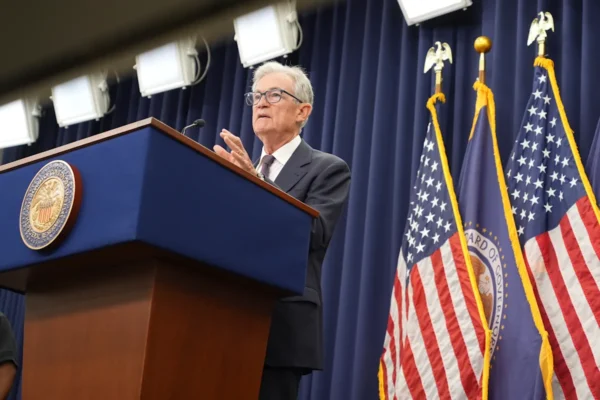

Wall Street cheers bad news on jobs, sending stocks higher and betting that a soft labor market will force Powell’s hand in December

Stocks rose on Wall Street Wednesday as more U.S. companies turn in their latest quarterly reports and several economic updates shed some light on the U.S. economy. The S&P 500 rose 0.5%. The Dow Jones Industrial Average rose 62 points, or 0.1%, as of 11:35 a.m. Eastern time. The Nasdaq composite rose 0.8%. The gains…