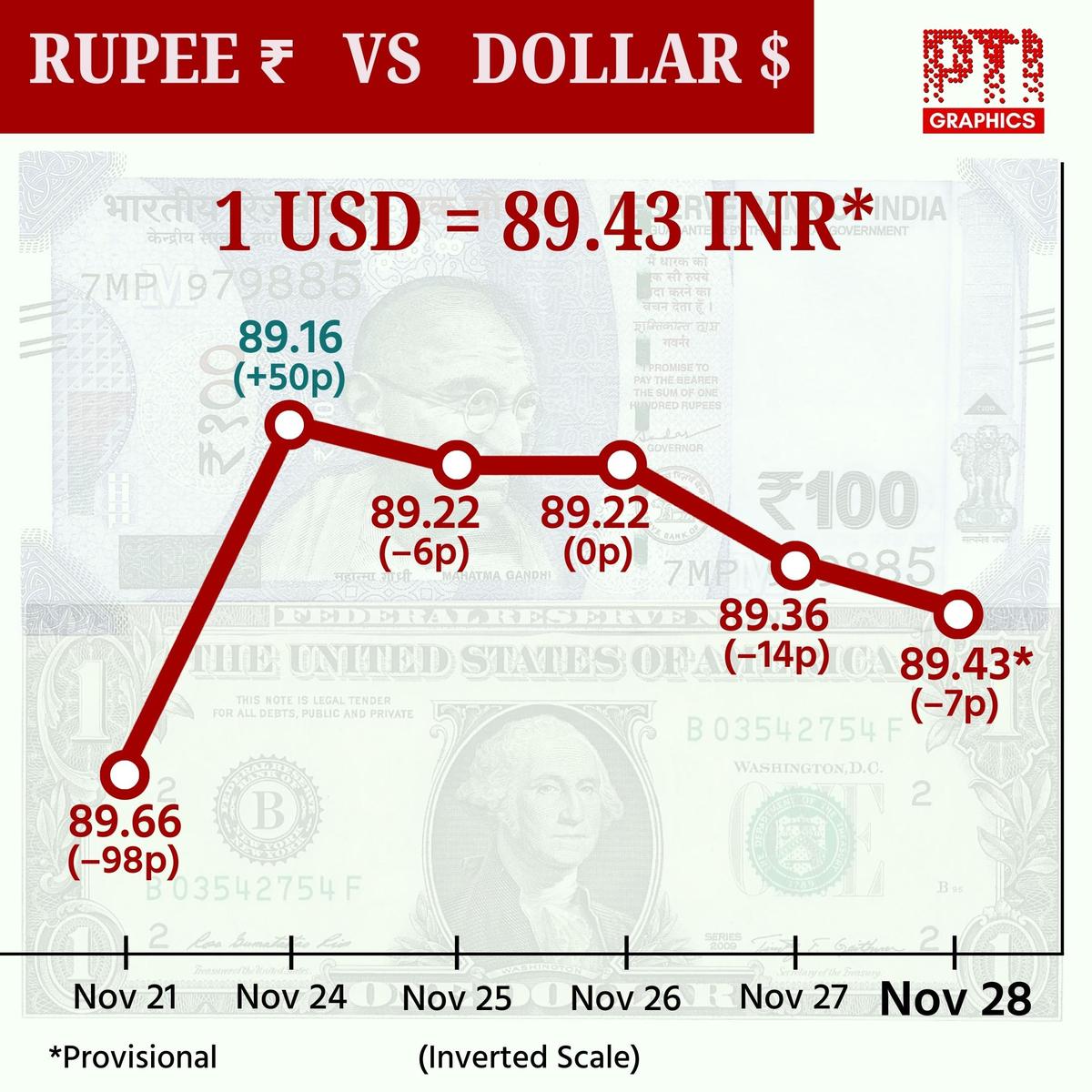

On November 21, the rupee plunged 98 paise to close at its lifetime low of 89.66 against the U.S. dollar. File

| Photo Credit: Reuters

The rupee depreciated by 34 paise to an all-time low of 89.79 (provisional) against the U.S. dollar in intraday trade on Monday (December 1, 2025), tracking a negative trend in domestic equities and persistent foreign fund outflows.

Forex traders said a strong greenback and a rise in international crude oil prices also weighed down the Indian currency.

Moreover, significant dollar demand by importers exerted persistent downward pressure on the local currency.

At the interbank foreign exchange market, the rupee opened at 89.45, then lost its ground and fell to a record low of 89.79 (provisional) against the U.S. dollar in intraday trade, registering a fall of 34 paise over its previous close.

On Friday (November 28), the rupee dropped nine paise to settle at 89.45 against the U.S. dollar.

On November 21, the rupee plunged 98 paise to close at its lifetime low of 89.66 against the U.S. dollar.

“The rupee has been under pressure as there has been heavy buying by FPIs taking out money, outflows happening as stakes were sold in various companies due to high valuations, oil buying, gold buying and repayments by corporates and central government,” Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP, said.

Mr. Bhansali further noted that trade tensions with the U.S. continue, with expectations of a settlement towards the end of the year.

On November 28, Commerce Secretary Rajesh Agrawal said India is hopeful of reaching a framework trade deal with the U.S. this year itself that should address the tariff issue to the benefit of Indian exporters.

Both countries have been in negotiations for a long time, and the first tranche of a bilateral trade deal was expected by the fall of 2025, but the Trump administration’s imposition of tariffs on Indian exports has created hurdles.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.04% higher at 99.50.

Brent crude, the global oil benchmark, rose 1.96% to $63.60 per barrel in futures trade.

On the domestic equity market front, both benchmark indices, Sensex and Nifty, declined from their record highs by noon. The Sensex was trading 122.58 points or 0.14% lower at 85,584.09, while Nifty was down 46.35 points or 0.18% to 26,156.60.

Foreign institutional investors sold equities worth ₹3,795.72 crore on a net basis on Friday (November 28), according to exchange data.

Published – December 01, 2025 10:42 am IST