The formal sale process only got started at the beginning of this month, with banking companies JPMorgan Chase and BDT & MSD facilitating the bidding on the Celtics’ behalf.

It is too early to know what shape the interest shown by Hale and Bezos will take.

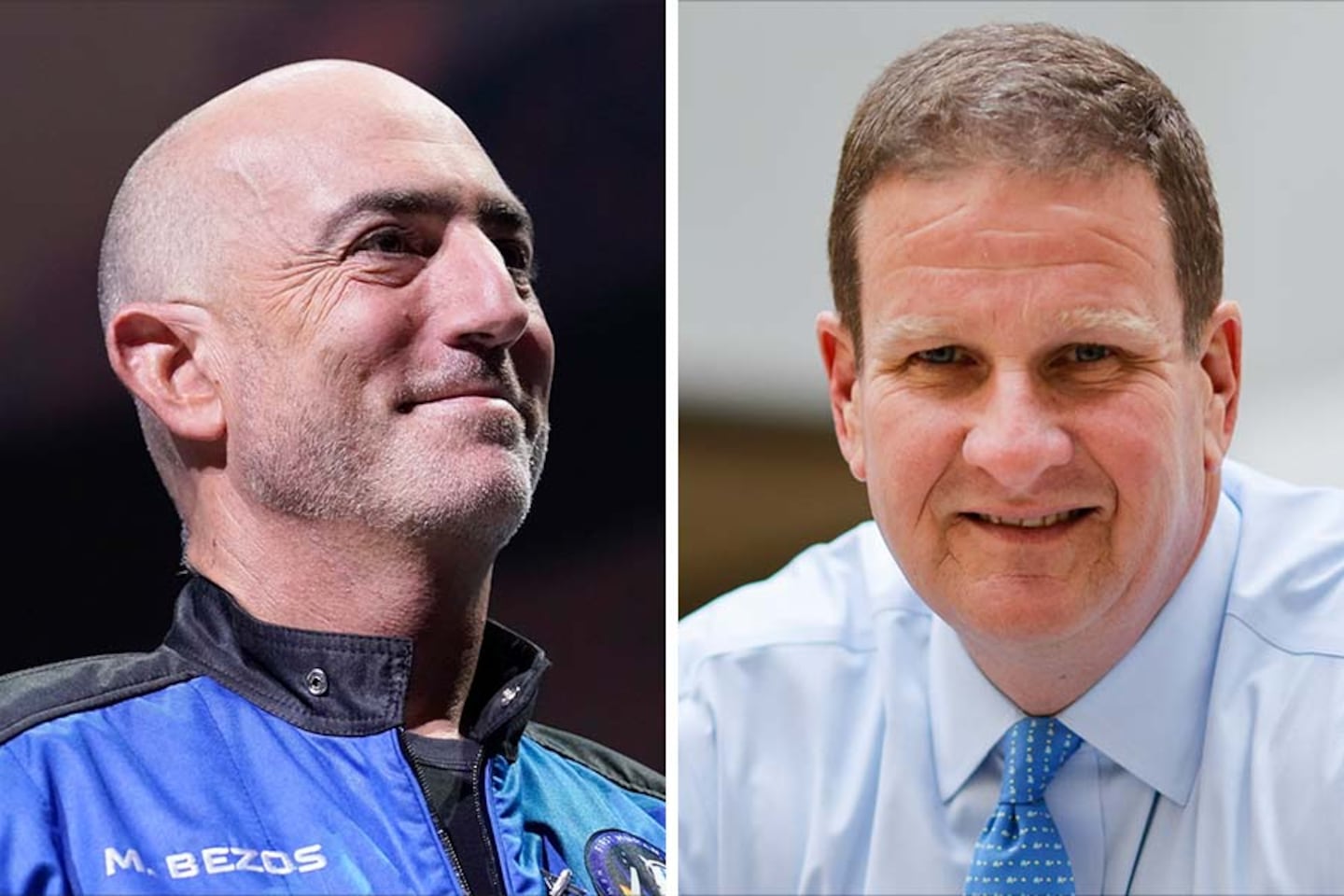

Hale is keeping his options open on whether to bid as a lead owner or continue as a limited partner. He said he has looked at the club’s financials via a book prepared for bidders by the two banks.

“I’m hanging around the hoop, and carefully observing what happens and taking advantage of all opportunities,” said Hale, referencing a basketball strategy for being in the right place at the right time.

The Celtics announced Hale as a new investor in the ownership group in 2012. Hale said he has increased his shares in the team several times after other owners sold their stakes over the years.

“It is a very, very valuable asset and a lot of fun,” said Hale, who rode on a duck boat with Celtics star Jrue Holiday during the championship parade in June.

Hale has the means to be a lead investor. His wildly successful Quincy telecommunications company has earned him a place on Forbes magazine’s list with a net worth of $5.8 billion.

Hale said he has been invited to join other bids but declined to name names.

Whether or not the initial interest from Mark Bezos extends beyond kicking the tires as a controlling or limited partner remains to be seen as well. Bezos did not immediately respond to requests for comment from the Globe.

The Grousbeck family, which is selling the team for estate planning purposes, hopes to sell 51 percent of all shares by early next year, with the remainder of the shares slated to sell in 2028.

Since the team announced its intent to sell July 1, Steve Pagliuca, a managing partner of the Celtics and co-governor, has been the sole candidate to go public with his interest to buy the team, issuing his statement just hours after the “For Sale” sign went up.

“I hope to be part of the Celtics moving forward and will be a proud participant in the bidding process that has been announced today,” Pagliuca’s statement read in part.

Irv Grousbeck and his son Wyc Grousbeck, along with Pagliuca and other partners, formed Boston Basketball Partners LLC and bought the Celtics for $360 million in 2002.

Asked this week about his interest in being part of an ownership bid, Robert Epstein, another managing partner and part-owner of the Celtics, declined to comment.

Estimates on an eventual purchase price vary widely, but between $5.5 billion and more than $6 billion is the most commonly cited range.

Both Sportico and Forbes rank the Celtics the fourth-most valuable NBA team, with Sportico’s valuation at $5.12 billion, and Forbes, as of last October, pegging them at $4.7 billion.

A Northampton native, Hale founded Granite Telecommunications in 2002 and built it into a corporate juggernaut generating $1.8 billion in annual revenues with more than 2,200 employees and about 17,000 clients including Walmart and CVS.

Hale, the CEO of Granite, and his wife Karen are also prominent philanthropists, giving away more than $400 million to fund everything from cancer research to college scholarships.

The Hales enjoy giving their money away in unconventional ways. After delivering a commencement speech at UMass-Boston in 2023, Hale gave two envelopes with $500 in each of them to every graduate, one envelope for the graduate, the other for the graduate to give to a charity.

Hale also has spent a lot of time on the court as a basketball coach for all three of his children’s teams.

Mark Bezos is the younger brother of Jeff Bezos, whose net worth now sits at about $205.4 billion, with Amazon’s market capitalization at $1.97 trillion. According to news reports, Mark Bezos held a $100,000 stake in Amazon in 1996, a year before it went public. The brothers are close, with Mark joining Jeff on his Blue Origin rocket ship that reached the edge of space in July of 2021.

Bezos has a background in marketing and communications. He co-founded HighPost Capital, which according to its website is a “control buyout and late-stage growth private equity platform, investing into the sports, media, health & wellness, leisure and lifestyle sectors.” The website also states that HighPost “benefits from the backing of the Bezos family.”

Michael Silverman can be reached at michael.silverman@globe.com. Shirley Leung is a Business columnist. She can be reached at shirley.leung@globe.com.