Key Points

-

Nuclear energy is becoming increasingly important for powering next-generation data centers.

-

Big tech has signed a number of purchase agreements with nuclear power suppliers.

-

Oklo is among the biggest gainers in the nuclear energy opportunity.

- 10 stocks we like better than Oklo ›

Artificial intelligence (AI) stocks are by far the hottest theme in the capital markets. As is often the case with megatrends, tangential opportunities are beginning to emerge — bringing curiosity to anything that even touches AI.

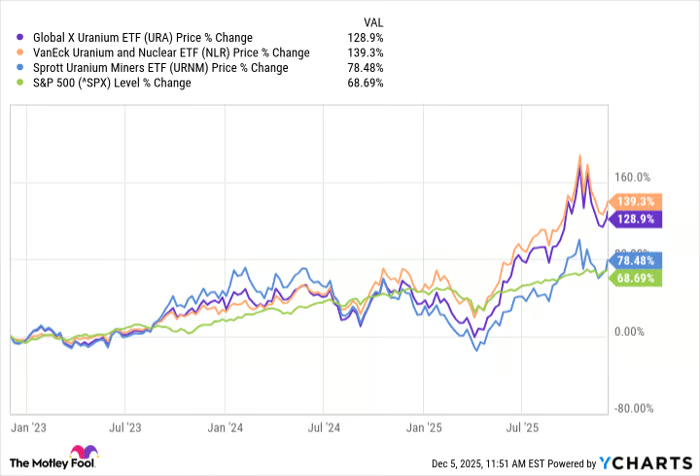

One of the adjacent AI opportunities that has received its share of attention is nuclear energy. While nuclear power is becoming increasingly critical for next-generation data centers, investor appetite in this area of the energy sector may be overextended. Throughout the AI revolution, shares of nuclear energy ETFs have consistently outperformed the S&P 500 (SNPINDEX: ^GSPC).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Let’s explore the catalysts fueling nuclear energy stocks and understand how these businesses are playing a central role in the AI infrastructure era. From there, I’ll dig into why I am particularly bearish on Oklo (NYSE: OKLO) stock heading into 2026.

Why is nuclear energy important for AI?

Given the pace at which big tech is developing generative AI applications, it shouldn’t come as a surprise that data centers consume a lot of electricity.

According to the Department of Energy (DOE), data centers accounted for roughly 4% of U.S. electricity in 2023. However, the DOE expects this figure to potentially triple by 2028 given the rapid acceleration of AI infrastructure investments.

In an effort to curb rising energy costs, hyperscalers are beginning to turn to alternative power sources. Unlike wind and solar, nuclear is unique because it is low-cost and can run continuously. This brings a level of stability, scalability, and cost predictability that is much needed in the energy space.

Image source: Getty Images.

Could nuclear energy stocks be entering a bubble?

Over the last year, a number of tech titans have inked deals with nuclear energy companies.

- Last September, Microsoft entered into a purchase agreement with Constellation Energy for a 20-year partnership featuring the restart of nuclear reactors on Three Mile Island.

- Back in June, Meta Platforms also partnered with Constellation Energy in its own 20-year deal. As part of the alliance, Meta gains access to the Clinton nuclear facility in Illinois.

- In October, Alphabet signed a deal with NextEra Energy to buy power from its Duane Arnold Energy Center.

- Amazon Web Services (AWS) entered into a power purchase agreement with Talen Energy that features the cloud giant accessing nuclear facilities in Pennsylvania as well as the potential development of its own small modular reactors (SMRs). In addition, AWS is also working with Dominion Energy on a separate SMR initiative.

Shares of nuclear energy stocks have soared thanks to the press surrounding the various deals with big tech. While this momentum may be tempting to follow, smart investors understand that there are more details to unpack.

At the moment, the partnerships with big tech represent nothing more than agreements and future commitments. In other words, these deals are not yet live and many won’t actually power data centers until the latter half of the decade.

In my eyes, the gains in nuclear energy stocks shown above already price in a lot of future optimism. It appears that the nuclear energy movement is largely riding high on a hopeful and potentially promising narrative, rather than concrete business fundamentals. This is similar to how internet stocks initially traded in their early days back in the late 1990s.

Why Oklo stock could plummet in 2026

To be clear, I am not saying that the entire nuclear energy opportunity isn’t worthy of an investment. Rather, investors need to be smart about which companies they choose and why.

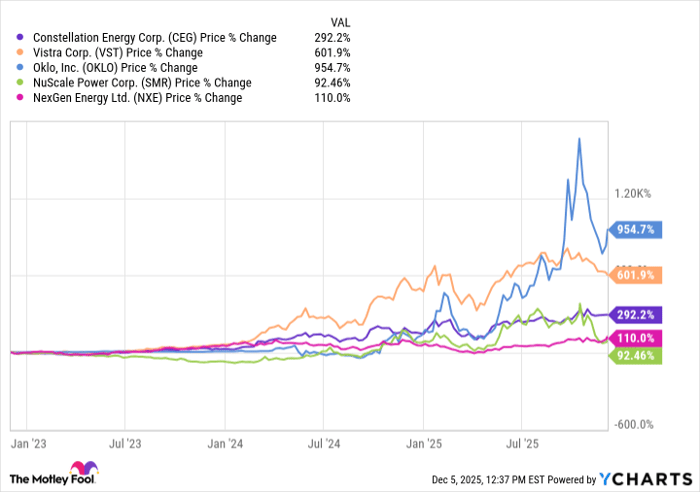

In the section above, Oklo’s 955% share gain is by far the highest among the cohort illustrated in the chart. However, looking at its percentage gain doesn’t reveal much about the company’s underlying valuation.

In order to help determine whether Oklo is becoming a bubble stock requires looking at valuation ratios such as price-to-sales (P/S) and price-to-earnings (P/E). Spoiler alert: We can’t do that because Oklo doesn’t generate revenue, and the company continues to burn cash in an effort to bring its ambitions to life.

I find it hard to justify Oklo’s $16 billion market cap when the company does not yet have a real product or actual paying customers. Instead, Oklo has fetched some interest from government agencies and other enterprises that may, someday, become an actual revenue generator. But for that to happen, the company needs to build, market, commercialize, and monetize its services.

Against this backdrop, I do see nuclear energy becoming a pillar supporting the broader AI infrastructure boom over the next five years. With that said, I think time will tell which companies will actually last and which will crash — as is what happened during the dot-com bubble burst in early 2000.

In 2026, I think investors will witness sharp corrections across a number of nuclear energy stocks — with Oklo being by far the most vulnerable in my opinion.

Should you invest $1,000 in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of December 8, 2025

Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Constellation Energy, Meta Platforms, Microsoft, NextEra Energy, and Nvidia. The Motley Fool recommends Dominion Energy and NuScale Power and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.