The quantum computing startup has outperformed the broader market in 2025, but its rise has left it trading at a hefty premium.

Throughout 2025, some of the biggest gainers within the tech landscape were quantum computing stocks. Specifically, pure plays such as IonQ and Rigetti Computing have both outperformed the S&P 500 this year.

But with a 256% gain this year, D-Wave Quantum (QBTS 5.06%) was the top-performing quantum computing stock — handily trouncing the broader market and each of the “Magnificent Seven.”

But can D-Wave keep up the momentum in 2026?

Image source: Getty Images.

What does D-Wave Quantum do?

The classical computers and digital devices we are all familiar with store and process data using binary bits that code every piece of data as either 0s or 1s. Quantum computers, by contrast, use qubits (quantum bits). Through a property known as superposition, these qubits can have values that are not simple 0s or 1s, but probability amplitudes. And by processing using qubits, these machines can solve some unusual classes of problems that are beyond the capacity of even the most powerful conventional supercomputers.

There are numerous approaches to the creation and manipulation of qubits.

For example, IonQ is designing trapped ion systems, which make qubits by suspending individual charged atoms in electromagnetic fields and using lasers to cool them down to temperatures just above absolute zero. Rigetti uses superconducting qubits, which are created by cooling electrical circuits in chips to near absolute zero.

D-Wave, by contrast, is pursuing a technology called quantum annealing. Its systems don’t process algorithms in the traditional sense — analyzing individual steps until a solution is found. Instead, annealers use qubits as individual puzzle pieces within a broader picture.

D-Wave’s machines gradually analyze each possible arrangement of this body of qubits until they find an optimal or near-optimal configuration that corresponds to the specific problem at hand. As such, its technology will not be suitable for as broad a range of potential uses as other quantum computing types. But annealing systems could be extremely useful in optimization-oriented tasks in areas like logistics, manufacturing, route planning, and inventory management.

Does D-Wave Quantum’s valuation make sense?

As of this writing, D-Wave boasts a market capitalization of $10.5 billion and trades at an extremely lofty price-to-sales (P/S) ratio of 363.

QBTS PS Ratio data by YCharts.

Over the last year, D-Wave has generated $24 million in revenue while posting nearly $400 million in net losses. On one hand, it’s encouraging that D-Wave has identified some practical applications for its technology. However, as its losses continue to widen, the unit economics surrounding D-Wave’s business don’t look too compelling.

Today’s Change

(-5.06%) $-1.47

Current Price

$27.65

Key Data Points

Market Cap

$10B

Day’s Range

$26.94 – $29.68

52wk Range

$3.74 – $46.75

Volume

13M

Avg Vol

48M

Gross Margin

82.82%

Counterintuitively, despite D-Wave’s limited revenue traction and accelerating net losses, the market has responded by giving it meaningful valuation expansions.

In other words, the company’s potential liquidity issues and its inconsistent sales base — which has little in the way of long-run visibility — have been met with a high degree of enthusiasm from investors. This doesn’t make much sense to me.

Where will D-Wave stock be at the end of 2026?

The deep disconnect between D-Wave’s underlying business and its valuation suggests to me that the stock has become a favorite within the day-trading and retail-investor communities. Said differently, D-Wave is trading based on headlines and narratives. The company is often framed as a next-generation disrupter in the AI market — but it’s far from guaranteed that it will be.

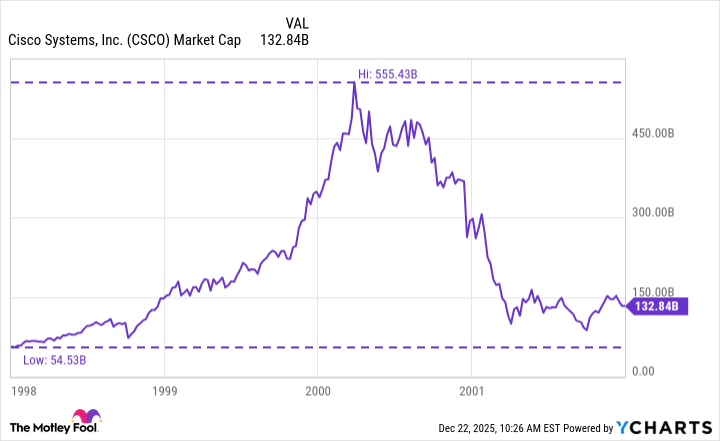

These themes echo what investors witnessed during the dot-com bubble in the late 1990s. One of the biggest stock losers of that early internet era was Cisco, which saw its market value decline by almost 80% after that period’s irrational exuberance evaporated and the bubble burst.

CSCO Market Cap data by YCharts.

In 2026, I think more investors are going to start viewing the euphoria fueling quantum computing stocks as a bubble. Should D-Wave follow a similar trajectory to that of early-2000s Cisco, by this time next year, it could have lost nearly three-quarters of its value and be hovering at around $7 per share (compared to about $31 per share today).

While history doesn’t precisely repeat itself, I think there is a good chance D-Wave stock could plummet during 2026. For this reason, I think investors are best off sitting on the sidelines and avoiding the risk of becoming bag holders.