Published

October 13, 2025

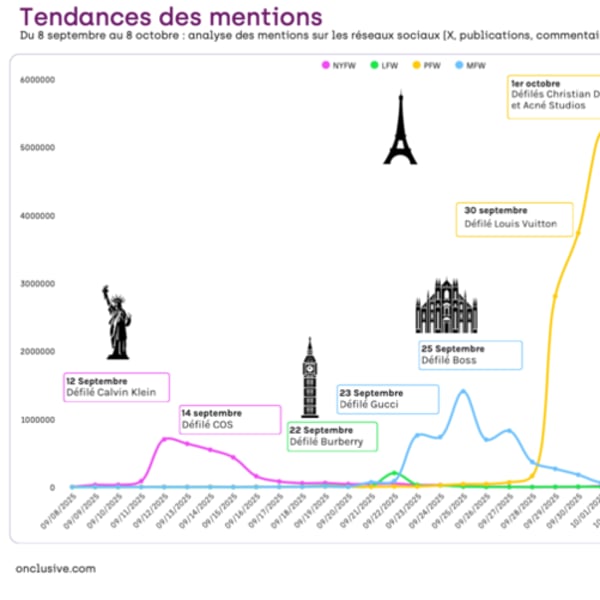

Paris remains the queen of fashion. According to a recent Onclusive analysis of the four major Fashion Weeks (New York, London, Milan, Paris) for the Spring/Summer 2026 season, Paris and its haute couture houses overwhelmingly dominated the media and digital landscape, while other capitals struggled to keep up.

For the recent round of runway shows, Paris Fashion Week (PFW) far outstripped the competition with 25.5 million mentions on social media (including X, posts, comments, and hashtags), well ahead of Milan (5 million), New York (3.8 million), and London (2.7 million). This pattern is seen echoed in traditional media (TV, radio, press, digital), where Paris generated 406.3 million mentions, ahead of New York (38.815 million), Milan (25.824 million), and London (19.792 million).

Paris strengthened by partnerships with Asian celebrities

The ranking of the most-mentioned brands also shows a Parisian triumph. Christian Dior dominated, making up 35.04% of all social mentions analysed, followed by Chanel (11.40%). In total, ten Parisian brands featured in the top 20, accounting for 73.17% of the mentions in this ranking. Louis Vuitton (8.73%), Loewe (6.96%), and Valentino (4.68%) rounded out the top five. This dominance stems from haute couture heritage, strategic partnerships with Asian celebrities, and the historic prestige of Paris.

For London, the verdict was stark: no London brand appears in the top 20 for social mentions. Burberry, the leading British brand, ranks only 27th. The Onclusive study highlights a critical lack of K-pop ambassadors and a stance perceived as overly hesitant, faltering between tradition and modernity.

“The symbolic end of American dominance”

Despite the presence of six prestigious brands in the top 20 (Gucci 8th, Bottega Veneta 10th, Max Mara 11th, BOSS 15th, Prada 19th, Ferrari 20th), their combined performance (11.14%) remains three times lower than that of Dior alone. According to Onclusive, the post-Alessandro Michele era at Gucci, less aggressive celebrity strategies, and weaker engagement for Prada (0.84%, lower than COS at 0.86%) are cited as contributing factors.

Finally, New York’s performance signals “the symbolic end of American dominance in global digital fashion”. Only Calvin Klein Collection (8th, 2.76%) features in the top 10. The study identifies three major weaknesses: the absence of a K-pop/Asian strategy, a historic focus on sportswear that generates less excitement than haute couture, and the exodus of influential American designers to European fashion houses.

This article is an automatic translation.

Click here to read the original article.

Copyright © 2025 FashionNetwork.com All rights reserved.