(Bloomberg) — Investors are once again preparing for big earnings-day stock moves, paying up to speculate in a market that’s faltering after it reached a record high.

Options on S&P 500 Index members imply an average 4.7% fluctuation following corporate results, data compiled by Bloomberg show. That’s close to the level in July, when the anticipated move was the highest for the start of a reporting season since 2022, using JPMorgan Chase & Co.’s release date as the kickoff.

Most Read from Bloomberg

The increase in options prices underscores some of the challenges facing investors trading stocks that have been grinding higher, outside of rare plunges like Friday’s 2.7% drop after President Donald Trump threatened higher tariffs on China. It was a reminder of the simmering concerns over the US government shutdown, the impact on corporate earnings from Trump’s economic policies and trade fights, and a potential bubble forming in artificial intelligence stocks.

“There is a lot of volatility being priced in at a single stock level,” said Mandy Xu, head of derivatives market intelligence at Cboe Global Markets Inc. The rally “has really been led by the high-flying AI and tech names, where more and more questions are being raised about valuation, about the forward earnings outlook. This earnings season is going to be very pivotal as to whether that theme continues to dominate.”

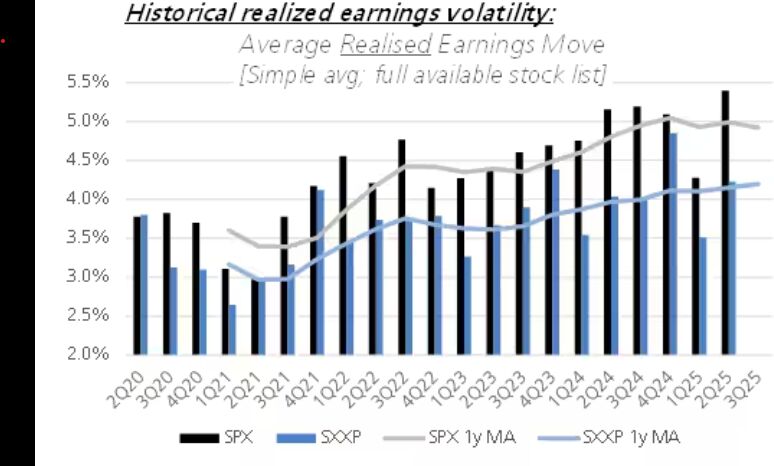

Strategists at UBS Group AG said that actual stock fluctuations after earnings hit a peak in the US last quarter and have been trending higher since 2021 — in Europe too. At Citigroup Inc., they pointed out the extremely low stock correlations, with both realized and implied volatilities near the lowest levels in at least a decade.

“The government shutdown means we’re in a macro catalyst vacuum, and positioning was stretched, at least based on single-stock options,” Vishal Vivek, an equity and derivatives trading strategist at the US bank, wrote in an email. “All of this sets us up for an interesting latter half of October/early November,” he added, citing earnings from mega-caps, an AI conference for developers and the releases of some economic reports.

“Investors continue to expect stock-specific stories to drive volatility in the near term, but unlike last quarter, option prices have ticked higher in anticipation of that volatility,” the Citigroup strategists wrote in a note last week.