As Prime Minister Sanae Takaichi’s recent comments further strain Japan–China relations, rumors are now swirling that Tokyo has tightened controls on photoresist exports crucial for wafer production—stoking new fears over China’s chip output, according to the Commercial Times.

Commercial Times notes Japan controls over 70% of the global photoresist market—and a staggering 95% of high-end EUV resists. Meanwhile, China’s photoresist industry, starting two decades late, still struggled: in 2022, less than 5% of high-end resists were locally produced, as per anue.

Commercial Times further explains that China could meet only about 5% of its own demand for KrF DUV resists used in 110–180 nm chip manufacturing. And when it comes to ArF DUV resists—needed for 7–65 nm production—China is almost entirely dependent on Japanese suppliers, the report adds.

Companies Potentially Involved

Several Japanese companies have been linked to alleged export curbs to China. Commercial Times reports that Shin-Etsu Chemical and Tokyo Ohka, which together control about 80% of the global market, have paused ArF photoresist shipments to certain Chinese fabs. However, industry sources cited by te report also suggest the rumors may have started when Shin-Etsu, facing limited KrF capacity, restricted supplies to smaller Chinese fabs—sparking speculation even though Tokyo has issued no official export ban.

Asia Times reports that around mid-November, unverified claims on Chinese social media suggested Canon, Nikon, and Mitsubishi Chemical had stopped photoresist shipments. However, the claims are dubious: Canon and Nikon actually make lithography machines and parts, while Mitsubishi Chemical supplies only Lithomax, a raw material for photoresists, the report notes.

If true, the rumors could hit hard. Commercial Times notes that high-end photoresists last only three to six months, making stockpiling nearly impossible. Without steady supplies, China’s major foundries could cut output—or even halt production entirely. In 2021, a temporary Shin-Etsu pause reportedly slashed SMIC’s efficiency by around 20%.

China’s Countermeasures

In anticipation of potential sanctions, China has been moving to shore up its photoresist capabilities. Asia Times reports that while imports will still lead, the country aims to produce 40% of its own resists by 2026—up from a localization rate of around 10% in 2024, according to Anue. The report adds that Kehua has developed KrF resists for 45nm chips, and a Peking University team has improved resist stability, gradually extending use from 28nm toward more advanced nodes.

Meanwhile, Commercial Times reports that Beijing rolled out its first EUV photoresist testing standard in October to set a clearer technical framework. The government is also steering the second phase of the national semiconductor fund to prioritize photoresists and other key materials, while pushing domestic wafer fabs to favor qualified local suppliers, the report adds.

Read more

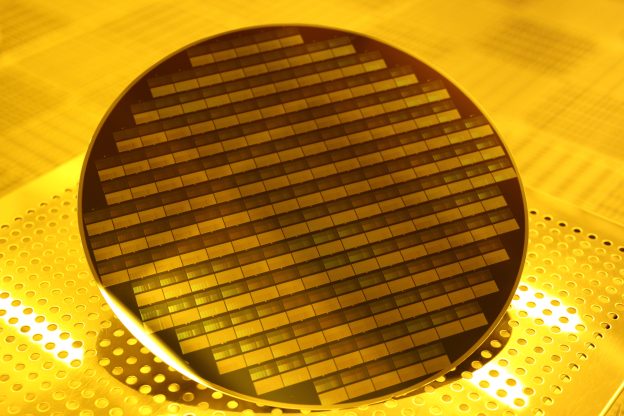

(Photo credit: Shin-Etsu Chemical)

Please note that this article cites information from Commercial Times, anue, and Asia Times.

![[News] Japan Rumored to Curb Photoresist Exports as China Targets 40% Self-Sufficiency by 2026](https://news.charm-retirement.com/wp-content/uploads/2025/12/Shin-Etsu-Chemical-624x416.jpg)