A look at the day ahead in European and global markets from Ankur Banerjee

Sign up here.

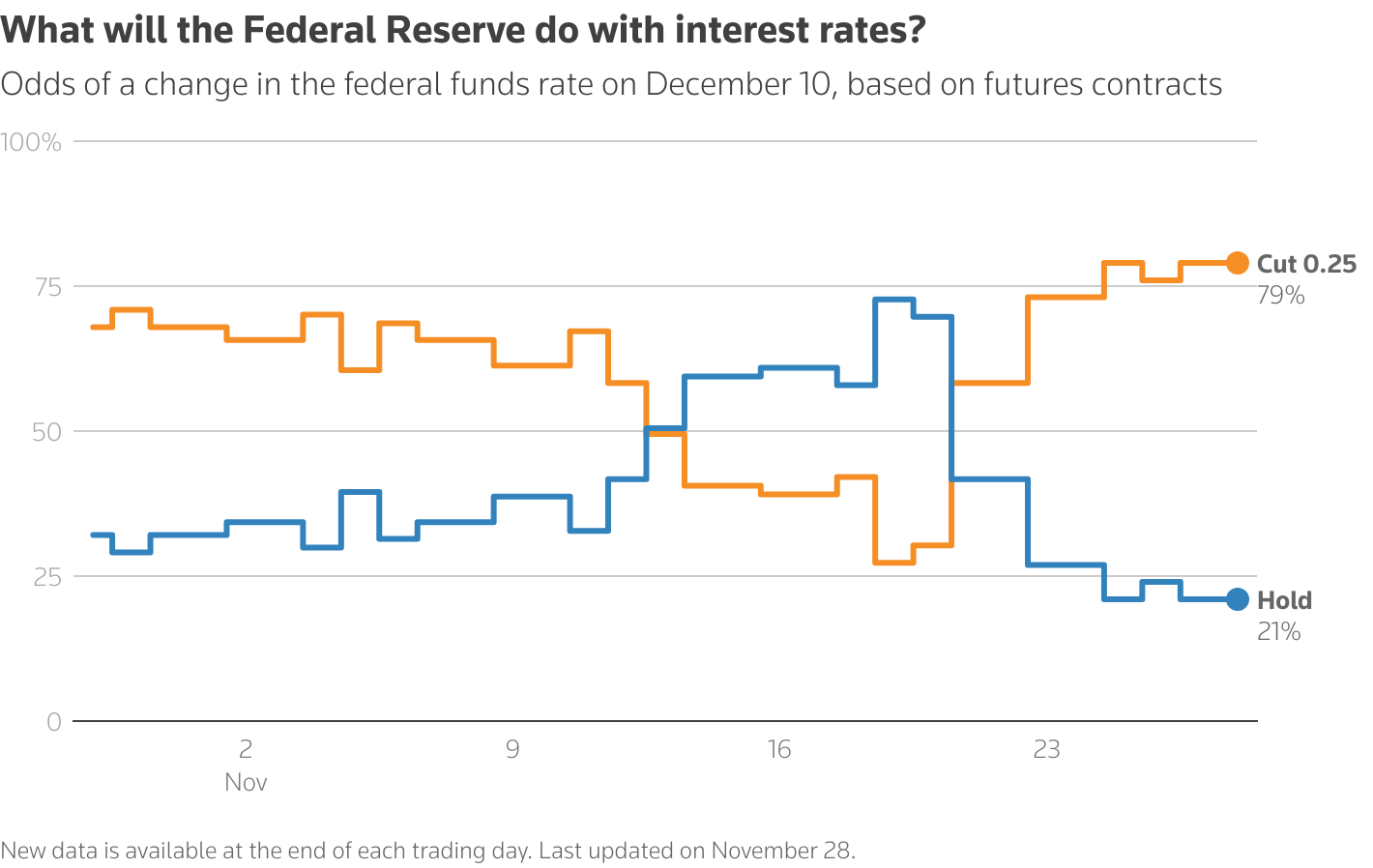

It comes just as investors contend with the prospect of an interest rate cut from the U.S. Federal Reserve next week after dovish comments from a series of policymakers. Fed Chair Jerome Powell is due to speak later in the day and his comments will be picked apart by traders to gauge the near-term rates path.

The contrasting moves from the BOJ and the Fed have provided some relief to the yen, which has been loitering near 10-month lows leading to intervention worries. The currency strengthened 0.5% to 155.41 per U.S. dollar on Monday.

Analysts, though, are quick to point out that the yen weakness may not completely end soon as even with policy normalisation in Japan there will still be a wide gap between the U.S. and Japan rates.

While the spread between U.S. and Japanese 10-year bond yields is tightest since April 2022 at 219 basis points, U.S. yields remain significantly higher than Japanese yields. Back in April 2022, though, the yen was trading around 123 to the dollar.

Meanwhile, after a strong end to November, risk aversion has taken hold at the start of the month as investors look ahead to a slew of economic data across the globe, with European manufacturing data taking centre stage.

Key developments that could influence markets on Monday:

Economic data: November PMI data for Germany, France, UK and euro zone

By Ankur Banerjee in Singapore; Editing by Muralikumar Anantharaman

Our Standards: The Thomson Reuters Trust Principles.