Investors are also looking ahead to this week’s inflation data

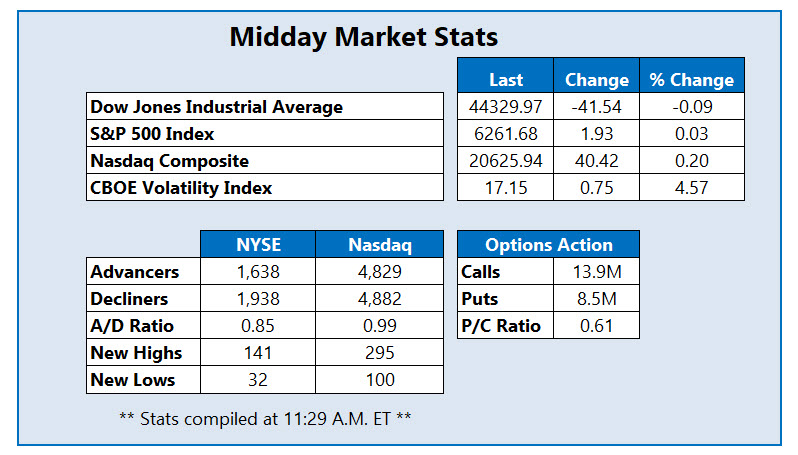

The Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are trading near or just below breakeven, while the Nasdaq Composite (IXIC) is inching higher this afternoon. Traders are mulling over President Trump’s threats of 30% tariffs on the European Union (EU) and Mexico, slated to go into effect on Aug. 1. Wall Street is looking ahead to the release of inflation readings this week as well as the start of a fresh earnings season, with big bank reports on deck.

Continue reading for more on today’s market, including:

- Electric vehicle (EV) stock could face sales pressure.

- Call traders blast Kenvue stock after C-suite shakeup.

- Plus, natural gas stock surges; ADSK drops out of acquisition; and Waters’ merger.

EQT Corp (NYSE:EQT) stock is seeing unusual options activity today, with 40,000 calls and 6,023 puts traded so far — 5 times the volume typically seen at this point. The most active contract is the July 58 call. The security was last seen up 4.8% to trade at $58, rising alongside natural gas peers amid forecasts of hotter weather over the coming weeks and higher flows of gas to liquefied natural gas (LNG) export plants. EQT added 25.9% over the last 12 months, and just bounced off a familiar floor at $54 back above the 20-day moving average.

Waters Corp (NYSE:WAT) is the worst stock on the SPX today, last seen down 11.1% to trade at $313.66. Today’s tumble comes after the company agreed to merge with rival Becton, Dickinson and Company’s (BDX) biosciences and diagnostic solutions unit for $17.5 billion. WAT is pacing for its worst day since April 2019, and is down 15% so far this year.