The London Metal Exchange has approved its first four licensed warehouse facilities in Hong Kong, it said on Tuesday, but high costs in the territory could curb growth there.

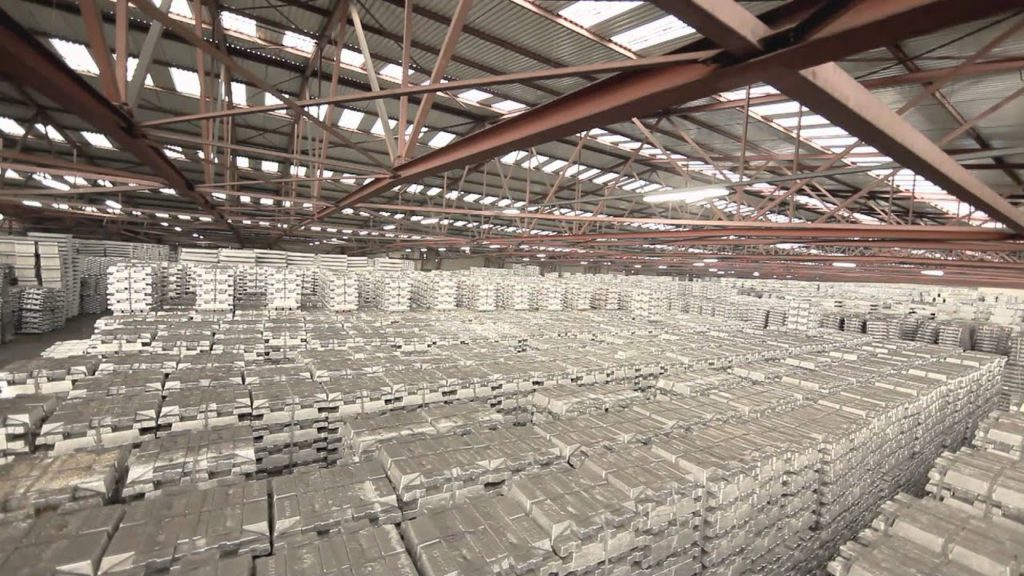

The LME, the world’s oldest and largest forum for industrial metals, hopes new warehouses in Hong Kong will boost access to mainland China, the world’s top consumer of industrial metals.

Approving warehouses in China to store LME traded metal has been a strategic goal since Hong Kong Exchanges and Clearing bought the LME in 2012.

Some LME-registered warehouse firms are, however, sceptical about the commercial appeal of Hong Kong as the costs of real estate in the territory are high and they would have to charge more for their services than in neighbouring locations such as Malaysia and Taiwan.

“We will try it and see what happens,” said a source at one global warehousing company, adding that any metal in Hong Kong storage would quickly be moved by Chinese consumers to the mainland.

Hong Kong is not an area of net metal consumption, which in the past had been a factor for LME warehousing.

The LME approved two warehouses run by GKE Metal Logistics and one each for Henry Diaper & Co and PGS East Asia. Their local partners are China Resources Logistics Ltd, Sinotrans Warehousing Ltd and SF Supply Chain Ltd, respectively.

“Hong Kong is now well-positioned to further develop as a key global metals hub servicing the region, and as a gateway for access to the mainland China market,” LME CEO Matthew Chamberlain said in a statement.

The new Hong Kong storage facilities will be able to start accepting metal on July 15, joining the LME’s existing network of 32 locations, the LME said. The exchange approved Hong Kong as a warehouse delivery point in January.

The maximum amount warehouse companies can charge to store metal is 51 cents per metric ton for copper in South Korea and Singapore, but it will be 61 cents in Hong Kong, according to LME documents.

In an internal presentation more than a year ago, the LME said that warehouse rents would have to be subsidized by the Hong Kong government to make the move commercially viable.

No real subsidies have been agreed, a source at another warehousing firm said, but several firms waiting for the LME to approve the listing of their warehouses in Hong Kong expect the cost for them will be lower than market rates.

(By Eric Onstad, Pratima Desai and Polina Devitt; Editing by Andrew Heavens, David Evans and Emelia Sithole-Matarise)