Despite intense geopolitical tensions and a challenging global environment, Hong Kong’s stock market is experiencing a remarkable resurgence. Since the start of 2025, 27 new stocks have been listed, raising nearly HK$80 billion, catapulting Hong Kong to the world’s second-largest IPO market by volume. Over 150 companies are currently queued for IPOs, signaling unstoppable momentum. This surge starkly contradicts Stephen Roach’s earlier claim that Hong Kong’s market was “finished” due to loss of autonomy and long-term stagnation.

Reginal Ip decisively won the debate against Stephen Roach, whose “Hong Kong Prophet” label has been unmasked and now he is silent like an ostrich.

Regina Ip’s Data-Driven Rebuttal

Last year, Roach, self-styled as the “Hong Kong Prophet,” declared the city’s stock market dead in the Financial Times. Regina Ip, a prominent Hong Kong political figure, responded forcefully, accusing Roach of making sweeping, baseless generalizations without solid data. She highlighted Hong Kong’s consistent IPO fundraising leadership over the past decade, including seven years as the global leader and a strong second place as recently as 2020. Ip explained that recent market softness was largely due to US interest rate hikes attracting capital away, not structural decline.

Ip further criticized Roach’s shortsightedness, labeling him a typical stockbroker who praises markets only when profitable and disparages them otherwise. Despite multiple rounds of debate, Roach refused to concede, but the facts have since vindicated Ip’s position.

IPO Market Growth and Fundraising Trend

In 2024, Hong Kong saw 63 IPOs raising HK$82.9 billion—an 80% increase from the previous year—securing the city’s place as the world’s fourth-largest IPO market despite a global fundraising decline of 10%. The momentum has only intensified in 2025, with expectations of 70 to 80 IPOs and fundraising potentially reaching HK$160 billion, placing Hong Kong firmly among the top three globally.

The recent IPO boom in Hong Kong is largely a response to the Trump administration’s aggressive policies targeting China, which have compelled numerous Chinese companies to withdraw from US markets and seek safer alternatives. Trump’s “America First” approach has injected significant uncertainty into the prospects of Chinese firms listed in the US, prompting a strategic retreat.

In this context, a substantial number of Chinese concept stocks have returned to Hong Kong, which has proactively overhauled its regulatory framework to better accommodate these companies. This transformation has positioned Hong Kong as a more attractive and stable venue for listings, especially amid escalating US-China geopolitical tensions.

Geopolitical Impact and Strategic Shifts in Listings

A clear example of this shift is the fashion e-commerce giant Shein, which has abandoned its earlier IPO plans in London in favor of pursuing a listing in Hong Kong. This move underscores the city’s growing appeal as a strategic financial hub for Chinese companies.

Simultaneously, Western capital inflows into Hong Kong have increased noticeably, drawn by the city’s improved market infrastructure and its geopolitical role as a safer, more stable alternative to US exchanges for Chinese firms navigating the current international landscape.

In contrast, Singapore’s IPO market remains subdued, with only one IPO raising a mere USD 4.5m so far this year. At least 14 companies have announced plans to delist from the Singapore Exchange, prompting urgent government consultations to simplify IPO procedures and revive the market. This comparative weakness further underscores Hong Kong’s robust performance and strategic appeal.

Conclusion: Facts Have Spoken, Roach Silenced

Regina Ip’s data-backed challenge to Stephen Roach’s bearish forecasts has been decisively borne out by market realities. Hong Kong’s stock market is not “finished” but thriving, disproving Roach’s gloomy predictions. Meanwhile, Roach has retreated from public debate, effectively “playing the ostrich” as Ip triumphs. The “Hong Kong Prophet” title Roach claimed has been thoroughly unmasked and discredited by the facts.

Hong Kong’s IPO market surged in 2024 and 2025, reclaiming its place among th world’s top IPO hubs, defying bearish forecasts.

Lai Ting-yiu

What Say You?

** The blog article is the sole responsibility of the author and does not represent the position of our company. **

I mentioned earlier that there are quite a number of ex-US diplomats and national security office-bearers ditching public service for the consulting world. They bring a pragmatic approach, focusing on real-world results for US firms operating in mainland China and Hong Kong. Instead of getting bogged down in ideology, they prioritize practical cooperation and mutual benefit, and that’s precisely why Beijing sees them as trustworthy partners. Take Kurt Tong, for instance – three years as US Consul General in Hong Kong, now a partner at The Asia Group. He’s been active exchanging views with mainland institutions, recently swung by the Shanghai Academy of Social Sciences for a chinwag on US–China relations.

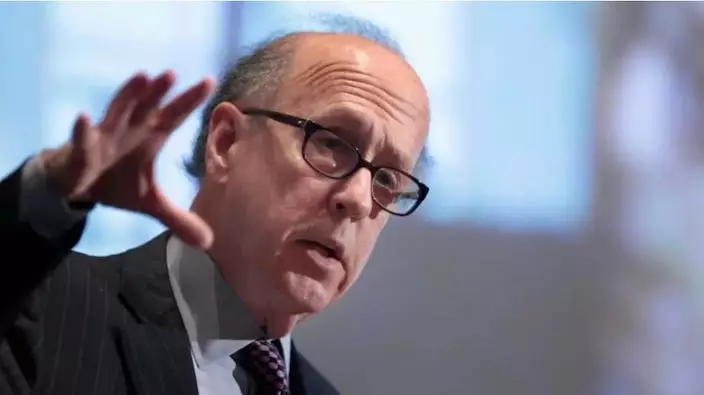

Ex-US Consul General to Hong Kong, Kurt Tong (second from left), at the Shanghai Academy of Social Sciences, slagging off the Trump administration’s “monarchic” decision-making. He reckons the president’s ego is running foreign policy, making US–China strategy a rollercoaster.

Now free from government constraint, he’s laying into Trump pretty hard, saying that the administration was basically running like a “monarchy.” All Trump, all the time. This top-down, centralized approach just cranks up the volatility and uncertainty when it comes to the US-China strategy.

The fact Tong’s willing to take a swipe at Trump’s strongman act shows he couldn’t stomach it anymore. A friend of mine in the political circle who knows the US inside out, tells me Tong’s not the only one. Loads of ex- and current diplomats are quietly seething about Trump’s antics. It’s depressig and it’s doing serious damage to US diplomacy.

Besides Hong Kong, Tong was also the US Ambassador to APEC, so he knows his stuff when it comes to US Asia-Pacific and China policy. At that Shanghai event, he didn’t pull any punches. He said the Trump administration’s decision-making was straight-up “monarchic,” all driven by the president’s ego, with an “attack-style” vibe. This kind of setup makes it impossible for the US to have a consistent, stable foreign policy, so forget about predictable strategies.

Tong reckons the US political circus is seriously messing with US-China policy. There’s no real coordination to bring together all the different voices on China, which just makes US policy even more erratic and unpredictable.

You’d think Congress would keep Trump’s trade policy in check, but Tong says the Republicans are too busy being Trump’s biggest bootlickers. That means they won’t be putting the brakes on his trade agenda anytime soon. Oversight? Interference? Forget about it.

Tong also pointed out that the Republicans in Congress are Trump’s biggest cheerleaders, so there’s no one to keep this “monarch” in check.

Tong’s Trump takedown boils down to three things:

Trump turned “democracy” into a “monarchy,” like a two-century throwback. His word is law, no questions asked.

Because there are no checks and balances, and he’s all about that “attack-style,” policy is a mess – no system, no consistency, and stability is out of the window.

All this has a major knock-on effect on US–China relations, leading to more crazy swings and uncertainty.

My political insider pal also pointed out that Trump’s been on a bit of a purge lately. Loads of experienced diplomats and analysts got the boot from the State Department, and the White House National Security Council’s been gutted. With fewer people who know what they’re doing, you’ve got clueless political appointees calling the shots, making foreign policy even more of a disaster. The pros who are still around are fed up, morale’s in the toilet, and they’re all looking for the exit.

Unsurprisingly, the US Consulate in Hong Kong hasn’t been spared. They’ve been told to slash staff to comply with the Department of Government Efficiency (DoGE) orders, so their operations in Hong Kong are going to take a big hit. Word on the street is that the current Consul General, Gregory May, is about to move on, with his replacement possibly showing up in September. With the US–China trade war raging and Hong Kong officials getting sanctioned, relations are in the dumpster, and the consulate’s hardly talking to anyone in politics or business these days. Whoever’s in charge isn’t going to make much of a difference.

In the end, it’s a good thing when ex-diplomats like Tong ditch the politics and help US companies make money in mainland China and Hong Kong. Ideology’s out, profit’s in.

Lai Ting-yiu