There are numerous budgeting apps available, and I have tried several. I have tried the ones that promise to do all the work for you, and even the super basic spreadsheet-style apps, but none have clicked for me. The problem with many of these apps is that they are difficult to figure out. Some were too restrictive or complicated, and it didn’t take long before I gave up using them. Moreover, the thought of having all my financial details on a company’s cloud server has never been appealing. So when I learnt about the Actual Budget, it felt like a breath of fresh air. It’s quite different. Think of it as a financial GPS that keeps you on track. It’s a tool that allows you to control your finances easily.

That said, let me show what convinced me; perhaps you may be inclined to try it.

3

Continuous Budget Management

Import Feature on Actual Budget

Before I knew the Actual Budget app, YNAB was my usual budgeting tool. While it’s a pretty decent app, I wasn’t entirely convinced by it, especially because it’s a subscription-based service, which was a downside for me. I don’t like to continuously subscribe to a service. While a one-time payment for a tool is cool, a free tool that gets the job done without a steep learning curve is preferable. When I came across the Actual Budget app, I realized it was a free tool; however, what I found even more impressive was that it allowed me to import my previous budget from YNAB to the Actual Budget app.

When I arrived at the “Let’s get started” page, I saw an option to import my budget. I grabbed the opportunity, which allowed me to import from the YNAB app. So, instead of creating my budget from scratch, all I need to do is import my budget from YNAB. I also do not need to worry if I’ve mistakenly introduced an error into my newly created budget; the import feature makes things easy. For someone like me with years of data in another system, this has made room for a cross-platform budget management that suits my needs. I’ve encountered situations where I needed to import .csv files into Actual Budget, and the process was seamless.

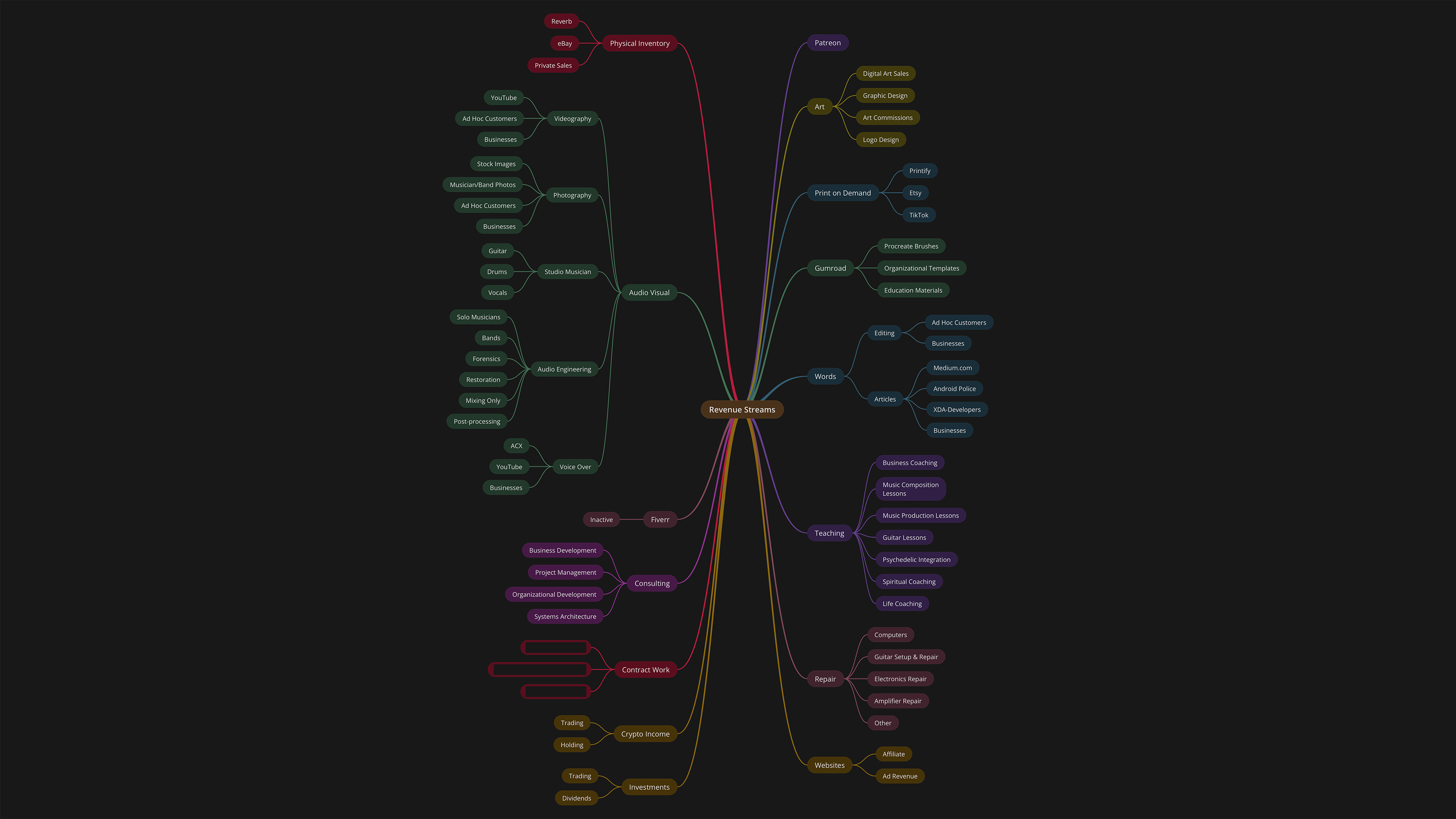

Related

7 mind mapping apps I tested for business and personal use

Your brain works a certain way—so your mind mapping tool should match it

2

Detailed Reports

Actual Budget provides insights and clarity.

It’s easy to spend, but tracking where every dollar goes can be challenging. Honestly, that’s why we budget. So you can see how you spent your money. With the Actual Budget, this becomes easier and more effective. The app not only breaks down spending by category but also provides detailed reports that show your spending trends over a specified period. These reports are easy to understand. With this, you can easily note how much you spent on any category of items in the previous month compared to the present month. Additionally, you will be able to identify where your expenses are consistently increasing, and with this knowledge, you can adjust your spending habits and boost your savings.

Aside from its standard reports, it offers a custom report engine. As a result, you have the freedom to create your report to address a particular category you may want to zoom in on. Let’s say vacation spending. You can design a custom report that shows the amount you plan to spend versus what you actually spent, spanning several months.

Related

I replaced all productivity tools with Microsoft Loop for a month and here’s how it went

My month-long Microsoft Loop experiment was an eye-opener

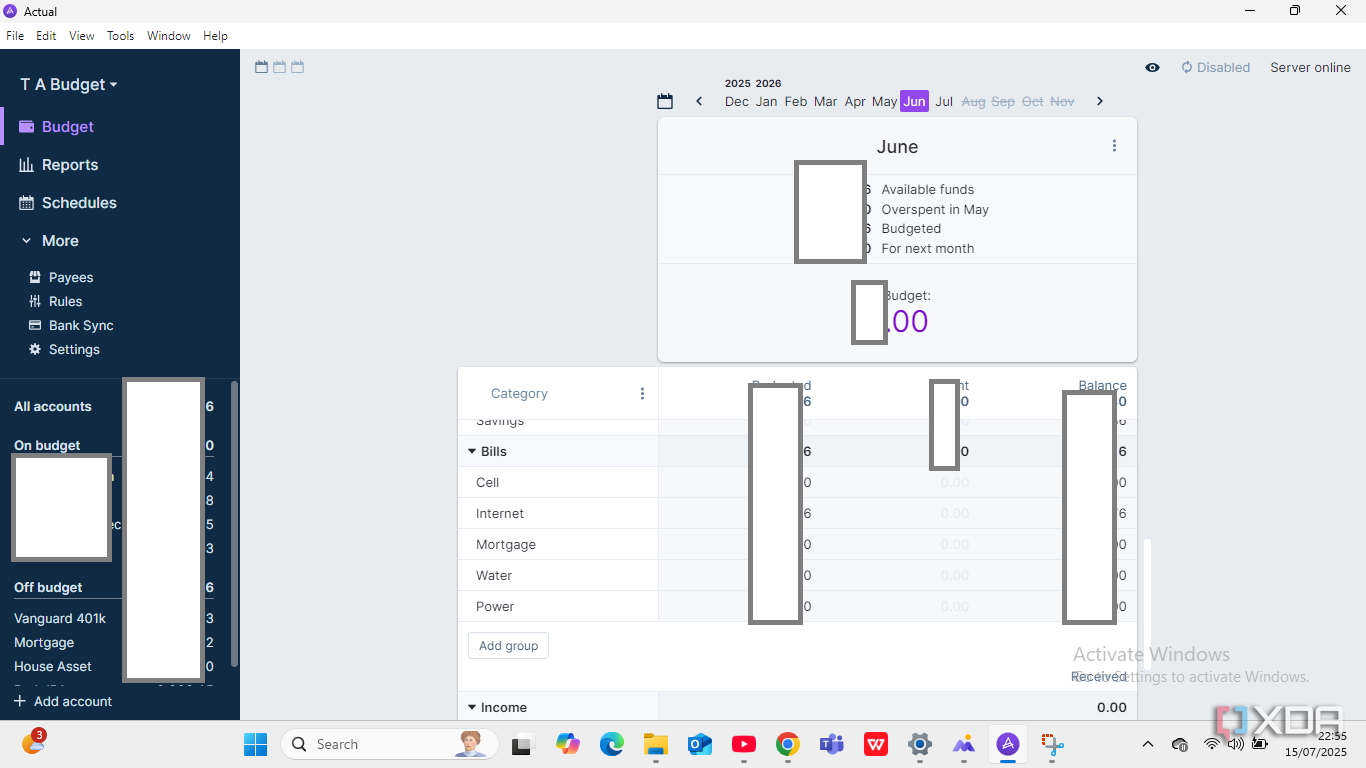

1

Smart Spending

Control your spending habits with Actual Budget.

You have likely kept money in envelopes and earmarked it for a particular purpose to avoid spending it on other activities. The simple logic behind this is that once the money in the envelope finishes, that activity should pause until your next paycheck. The budgeting app offers this approach to money management in a digital form. With the app, you can create different categories of virtual envelopes of items and assign funds to them. It could be for clothing, restaurants, entertainment, vacations, water, or internet bills. As you spend, the app deducts the expenses from the corresponding category or envelope. As a result, you know the amount you have left or whether you have exceeded the budget for that activity.

So, if you’re out with your friends and a discussion arises about making a purchase or spending on a service, the Actual Budget app comes in handy. With the app, you can quickly check your financial state in entertainment or any other appropriate category and immediately determine whether you can afford such spending. This can help you immediately control impulsive spending habits and, in the long run, either reduce or increase funds allocated to any category of items in the subsequent months.

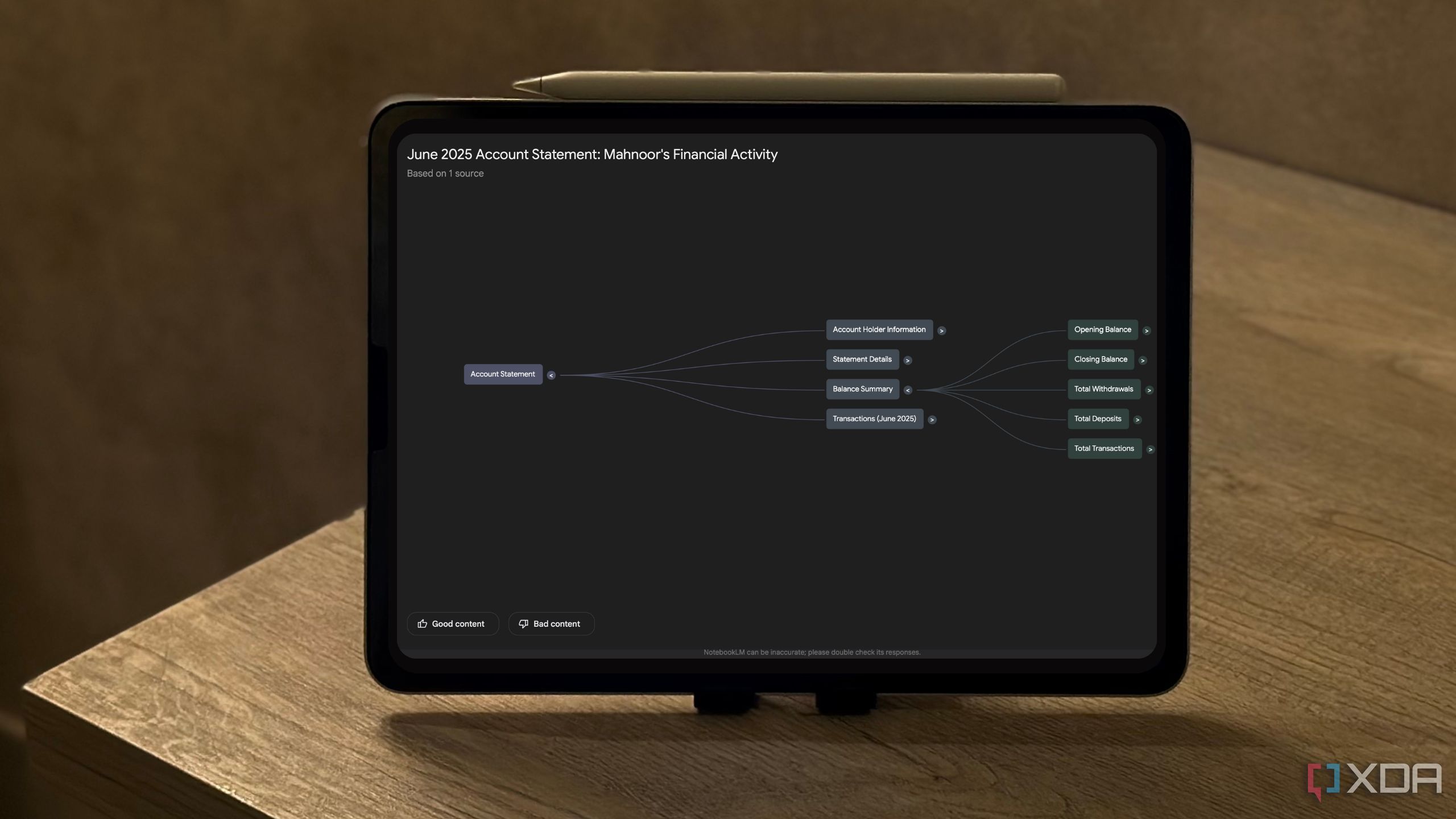

Related

I used NotebookLM to track my finances, and it’s actually kind of brilliant

Letting NotebookLM peek at my wallet was oddly worth it.

Budget with privacy in mind

Budgeting apps make our lives easier. They not only help us understand our financial limitations but also enable us to plan properly for rainy days. Honestly, some of these apps offer interesting plans that suit your budgeting needs. However, what comes first for me is privacy. In an era where growing concerns about data collection and processing exist, there is a need for an app that allows you to control important details about your life. Details about your finances are important. With Actual Budget, you don’t get an app that allows you to easily arrange your financial affairs, but you are also assured that your data is secure.

Related

7 reasons to convert your Excel spreadsheets into web apps

Unlock a whole new level of data management and efficiency