(Bloomberg) — HSBC Holdings Plc is kicking off a fresh round of job cuts at its investment bank as new Chief Executive Officer Georges Elhedery continues his overhaul of Europe’s biggest lender, according to people familiar with the matter.

Most Read from Bloomberg

The latest phase of cuts will start in Asia, but will ultimately affect employees globally, said the people, who asked not to be identified discussing private matters. It’s not clear how many people will be affected by the moves.

Some cuts are already underway in the firm’s markets division but wider layoffs across the investment bank will begin as early as Monday, the people said. The dismissals will be staggered over several weeks and months, one of the people said. Staff will be let go based on performance as well as to remove duplication of jobs or to simplify operations, the person said.

“As announced on October 2024, HSBC is focused on increasing leadership and market share in the areas where it has a clear competitive advantage and where it has the greatest opportunities to grow,” an HSBC spokesperson said in an emailed response to Bloomberg inquiry.

Elhedery is seeking to reduce costs with a restructuring that has so far included combining the commercial banking division with its global banking and markets unit and pulling out of some underwriting and advisory businesses in Europe and the Americas.

Since taking charge in September, Elhedery has already cut the size of his own group executive committee by about a third. Reductions to senior staffers were expected to affect a little over 40% of the company’s top 175 managers, Bloomberg reported in December. The bank has said it expects to complete the moves by June.

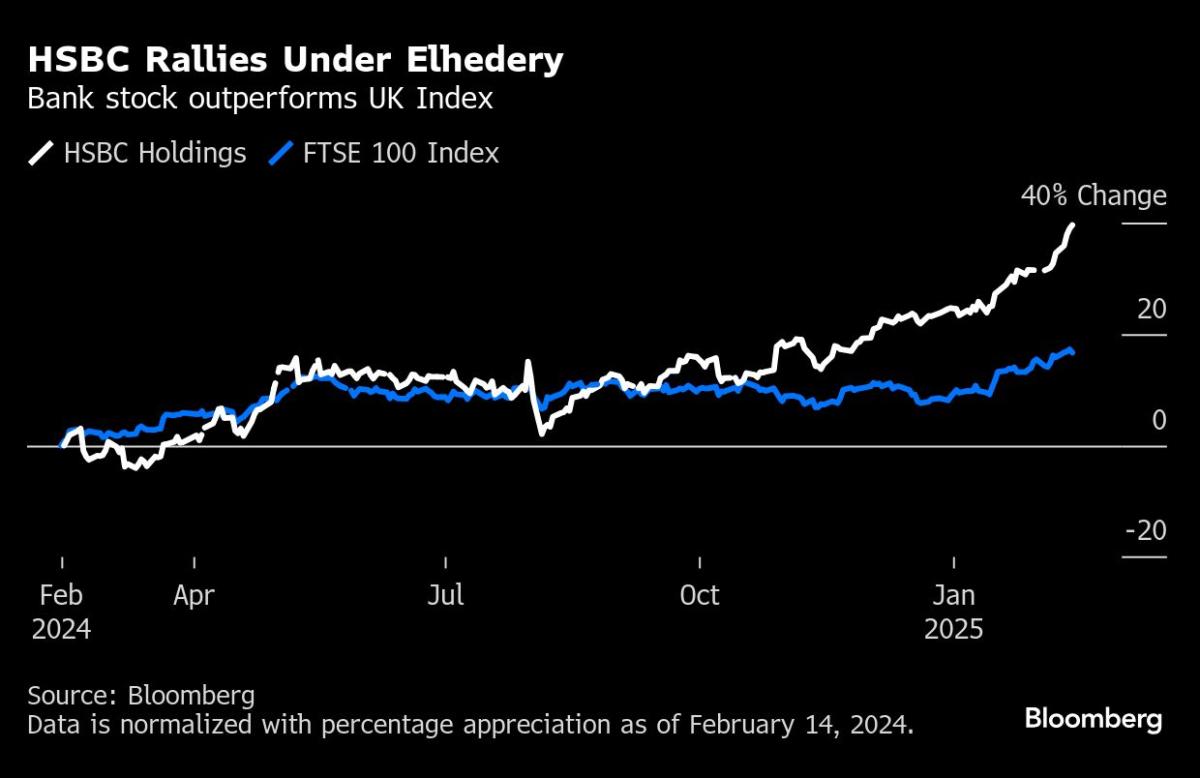

HSBC has said it will provide more clarity on the scale of the restructuring when it reports its full-year results on Feb. 19. The bank is forecast by analysts to post pre-tax profit of $31.7 billion for 2024, a 4.6% increase from the previous year. The stock rose 0.5% on Thursday morning in Hong Kong trading to around a seven-year high.

Townhall

The UK bank’s abrupt retrenchment from equity underwriting and advisory services outside its core markets of Asia and the Middle East has rattled dealmakers in Asia over the past several weeks.

HSBC bankers have been sending a flurry of resumes to headhunters and rivals, people familiar with the matter said. They are concerned that HSBC may lose some businesses such as cross-border M&A advisory from Asia to Europe and the US, and it would be difficult to get a lead role on US listings of Chinese companies.