Even in an age of instant communication and live financial data, investors have had to wait days to take ownership of the stocks they purchased or to receive payment for the stocks they sold. No longer. Since May 28, US stock trades have “settled” in one day rather than two. Global banks, brokers and investors were forced to review all of their post-trade technologies and procedures to ensure they were ready for the new pace of stock trading. The change has posed a special challenge to investors outside the US because global currency trading — as well as many local stock markets — still typically settle on a two-day standard.

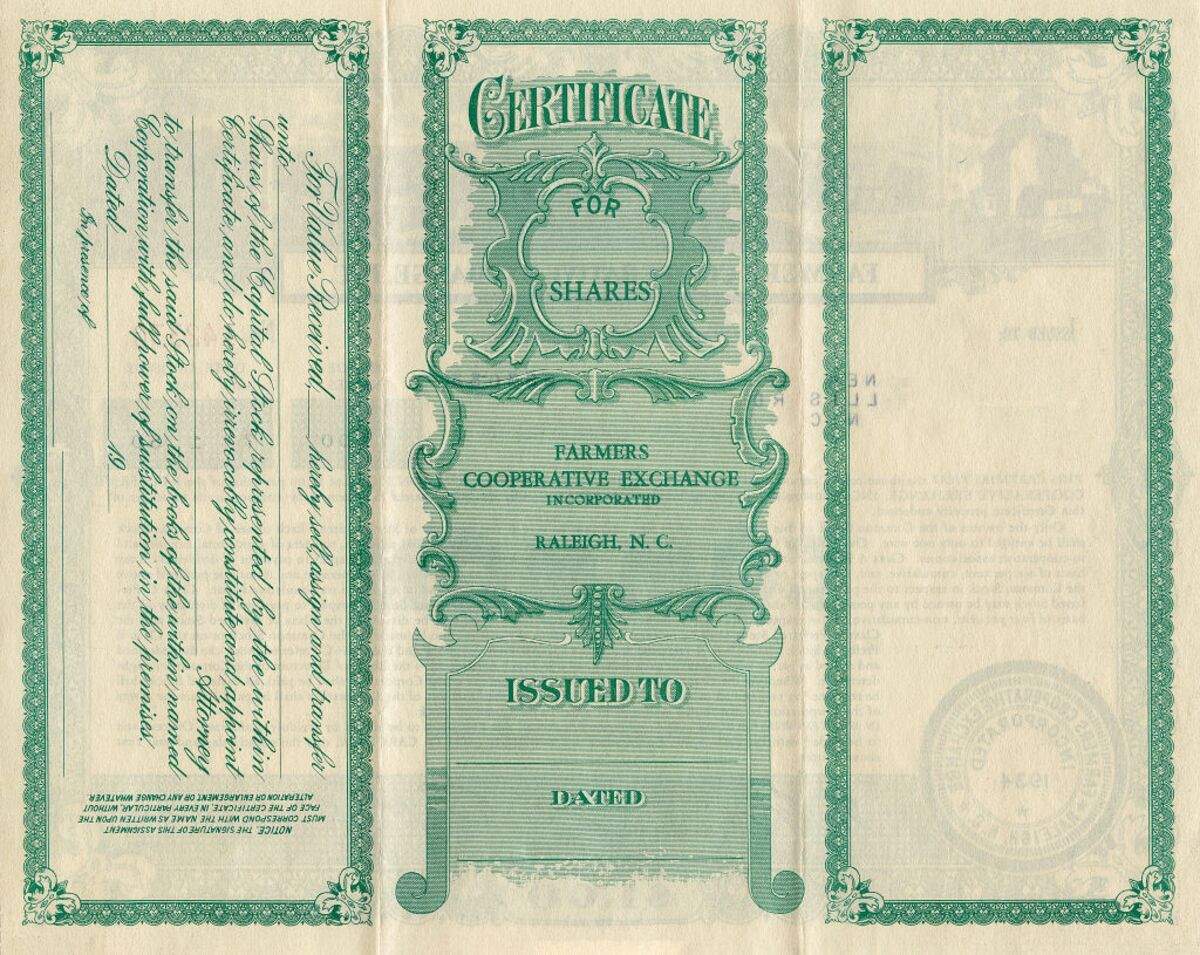

Stock trades before the computer age involved the physical exchange of stock certificates, which often took five days or more. That became a problem in the late 1960s as the stock market finally climbed its way back to its 1929 peak. As public participation in the stock market increased, trading volume skyrocketed to 12 million shares a day in 1970 from 3 million a day in 1960. With the industry’s growth prospects threatened by a “paperwork crisis,” the New York Stock Exchange created a central clearinghouse that would hold the millions of certificates owned by its member firms. That set the stage for transactions to become computer-automated.