What’s going on here?

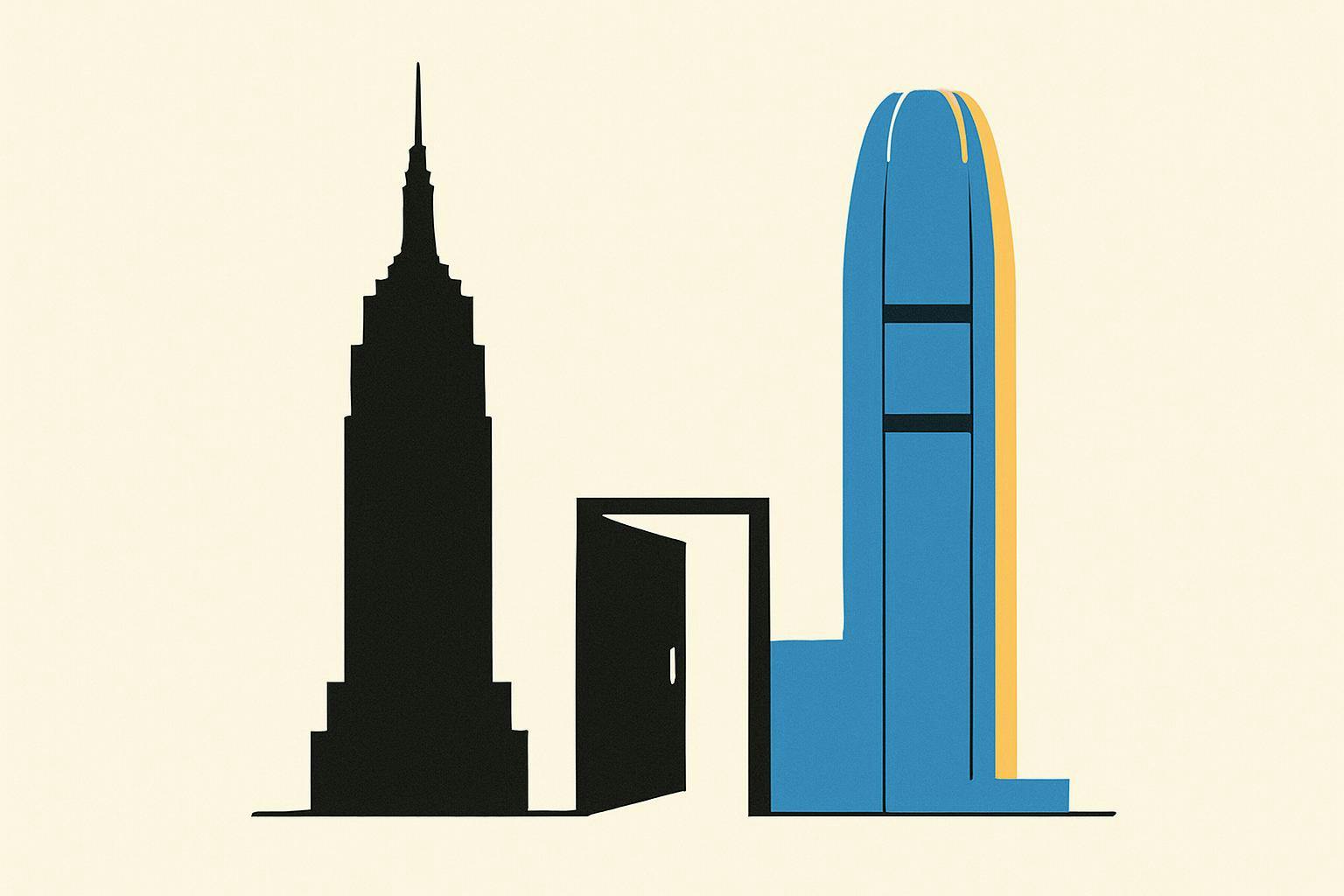

Hong Kong is ready to roll out the red carpet for Chinese companies delisting from US exchanges, as trade tensions prompt a strategic shift.

What does this mean?

The prospect of delisting around 286 Chinese companies from American exchanges is creating a ‘golden opportunity’ for Hong Kong’s financial market. Deloitte China’s CEO has already charted a course to embrace these firms, detailing four strategic measures to strengthen Hong Kong as a financial hub. The move comes amid ongoing trade disputes, with companies like Geely’s electric vehicle arm, Zeekr, looking to shift away from US markets. This repositioning not only aims to enhance Hong Kong’s allure as an IPO destination but also seeks to energize its financial ecosystem by accommodating firms that might soon find themselves without a US listing.

Why should I care?

For markets: Hong Kong’s new wave of opportunities.

Hong Kong’s push to attract Chinese companies delisting from the US could significantly reshape its market landscape. This influx might not only increase the region’s financial security but also create fresh investment opportunities. Investors should keep an eye on which sectors might gain momentum, especially as more firms shift to Hong Kong.

The bigger picture: Shifting tides in global finance.

The potential relocation of these firms to Hong Kong underscores a larger trend: global financial dynamics are evolving as geopolitical tensions rise. With this shift, the balance of economic power could see a subtle, yet significant, west-to-east transition, impacting international trade and investment strategies.